Viceroy Research‘s new short-seller battle against Japan’s Abalance continues. As usual, Fraser Perring and his comrades are using Twitter (#Abalance) as the battleground to create pressure to send Abalance’s stock south. That’s their business model. So far, the success has been manageable. Although the stock plunged nearly 30% after the release of the first report on May 17, 2023, it recovered somewhat and is down just under 25%.

Viceroy Research accuses Abalance that the Japanese solar panel manufacturer is just a front company for Chinese firms. These Chinese companies would partly use forced labor to produce solar panes. The short-sellers also accuse Ablance that its Vietnamese subsidiary VSUN is, in reality, controlled by Chinese owners who siphon off much of the profits.

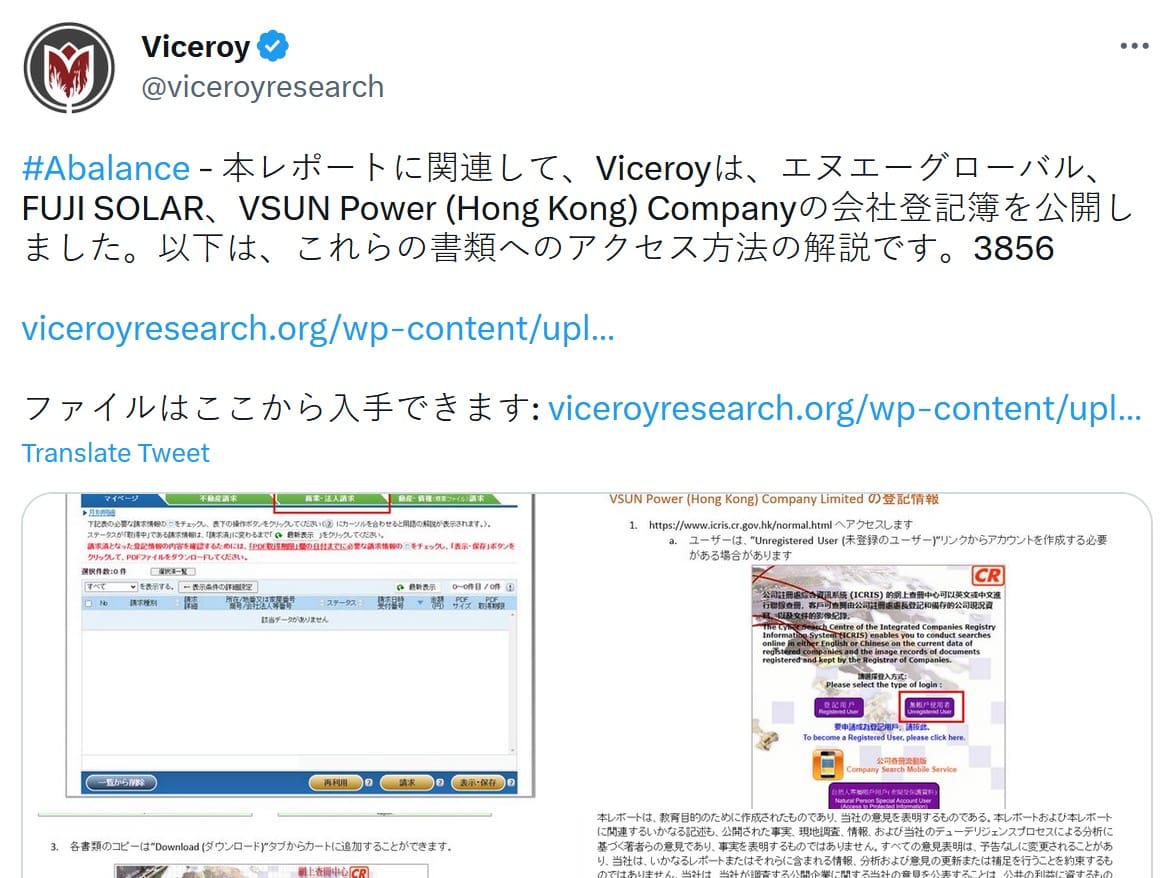

This report will detail the corporate filings our team has pulled from Japan and Hong Kong showing numerous undisclosed related party transactions with Abalance insiders. These transactions take place with dummy shell companies and unconsolidated subsidiaries of VSUN.

Viceroy Research (link)

Japanese Ablance would be used to circumvent existing U.S. trade restrictions, Viceroy argues. The U.S. authorities would be aware of this, and action against Abalance would therefore be expected. The center of this web appears to be Abalance CEO Ryu Junsei, the short-sellers claim.

As proof of its allegations, Viceroy Research today posted the Japanese company’s filings on its website. These are, of course, not readable for non-Japanese comprehension and, therefore, of limited effect.