Amsterdam-based Payvision and its founder and CEO Rudolf Booker played an important role as payment service providers (PSP) in the gigantic investment scam of Uwe Lenhoff, Gal Barak, and many other binary options and broker scam perpetrators. Until shortly before the shutdown of the scams enforced by police actions in several jurisdictions, Payvision transferred millions to Gal Barak’s GPay Ltd, for example. This company was apparently registered as a merchant with Payvision. Payments of vast broker scams such as XTraderFX, SafeMarkets, CryptoPoint, or Golden Markets were processed via Barak’s GPay Ltd, a UK-registered company with a Bulgarian frontman.

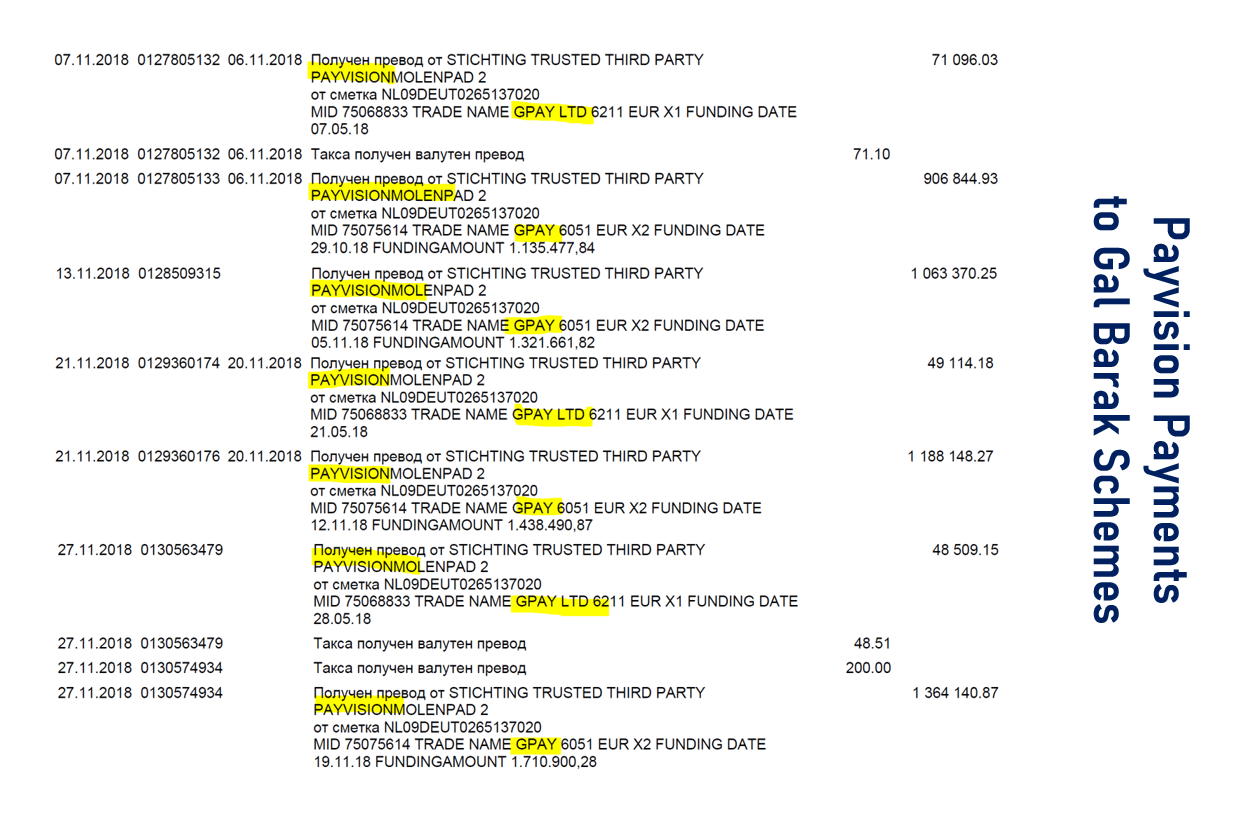

FinTelegram has corresponding bank statements and agreements. In November 2018 alone, shortly before the arrest of Lenhoff and Barak, Payvision transferred more than €4.5 million to the account of GPay Ltd at the Bulgarian Investbank. These transfers were the funds stolen from European retail investors. At that time, a number of investor warnings against GPay had already been issued by various financial market supervisory authorities. Here is the first introductory part of our reports on Payvision‘s role in the broker scams of recent years.

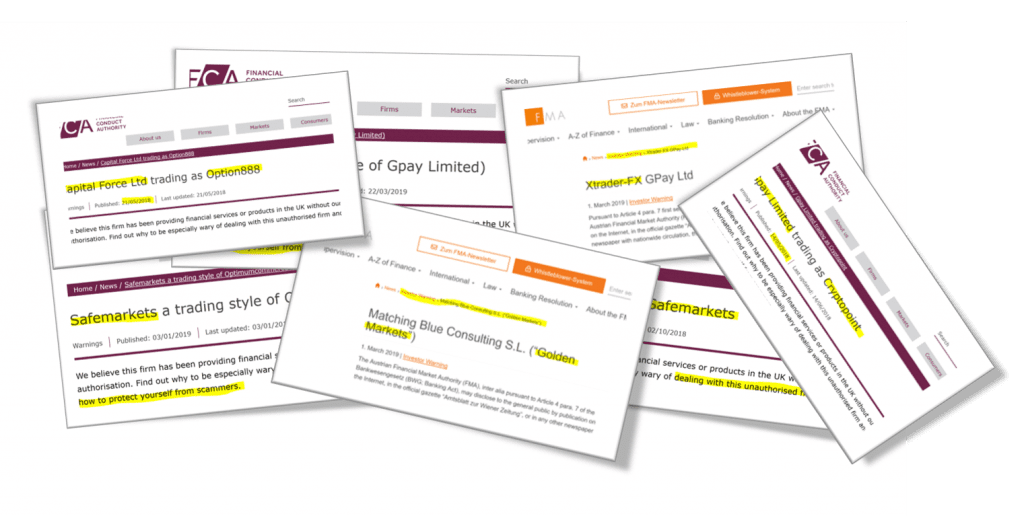

The fact is that since the end of 2017 financial market supervisory authorities have been issuing public warnings against the broker scams of Gal Barak and Uwe Lenhoff. Nevertheless, Payvision has supported the operating companies involved in those scams, such as GPay Ltd.

Uwe Lenhoff is currently in custody in Germany awaiting prosecution and trial.

The 2016 Binary Options Brainstorming at Payvision

FinTelegram’s Payvision story began how many stories begin. With a “once upon a time”. In this case, the publisher of FinTelegram, Werner Boehm, was once invited to Amsterdam in June 2016 by the German online entrepreneur Uwe Lenhoff. That was two years before the FinTelegram launch. At that time Lenhoff wanted to develop a partnership and invited Boehm to the iGaming Super Show 2016 in Amsterdam.

During his stay in Amsterdam, Lenhoff spent half a day at Payvision and discussed “delicate” payment transaction solutions with Payvision staff and a number of operators of binary options schemes for hours on end.

Boehm was present at this meeting because Lenhoff insisted on it. So it came about that Boehm experienced this binary options brainstorming with the fraud industries most aggressive perpetrators and Payvision. Binary options were then presented at the iGaming Super Show as a kind of “investment gaming”. Yes, they were neither illegal nor regulated back then in Europe. Hence scammers enjoyed their life with tons of stolen money. Actually, the binary options’ fraudulent nature was not yet evident back then. Gal Barak was also present in Amsterdam at the time and Boehm was introduced by Lenhoff.

Shortly after this and some other meeting with Lenhoff and his partners, Boehm filed a complaint with the National Crime Agency (NCA) against Lenhoff and his partners. The informational basis for this was his own experience and a due diligence report he let have made on Lenhoff and his Veltyco after this remarkable Payvision meeting. Kill threats by Lenhoff were the result of the complaint. Read more on the reaction of Lenhoff and Booker below.

Payvision Reseller Lenhoff

According to FinTelegram’s records, Uwe Lenhoff, who has since been arrested on suspicion of financial crime, money laundering, and investment fraud, worked as a reseller for Payvision until the end of 2018. In this capacity as a

Allegedly, Lenhoff and Booker met through an Amsterdam real estate investor, who was (is) also one of the major shareholders of Lenhoff’s listed Veltyco Group PLC. This was also directly confirmed to us by this real estate investor. The interesting point here: Lenhoff claims vis-a-vis the police that he would own 4,400 condominiums in Amsterdam through a trustee. Amsterdam and Amsterdam accomplices were undoubtedly of great importance in Lenhoff’s scam schemes.

Tens of thousands of victims and hundreds of millions of damages

According to FinTelegram records, the scams from Lenhoff and Barak alone caused more than 35,000 victims with total damage of over €200 million. Former business partners of Uwe Lenhoff and Gal Barak have provided FinTelegram and the authorities with the relevant documents. Payvision and Booker were involved as payment service providers. These findings are also supported by telephone records which are in the criminal record and were transmitted to us by one of the other suspects.

Phone logs – Collusion to destroy Fintelegram and publisher

End of December 2018, a few weeks before Lenhoff was arrested: Rudolf Booker (LinkedIn profile) phoned his customer and partner Uwe Lenhoff. Above all, Rudolf Booker discussed the problem with FinTelegram reports. It was not the first time. Lenhoff replied that he would like to kill every one of FinTelegram because he would soon go bankrupt because of the reports. Booker asks what else FinTelegram could report about Payvision. Lenhoff says that perhaps Booker’s business on the “grey market” will be reported. Booker replies that he has already canceled a loan. Booker said that he needs to cancel the relationship if FinTelegram cannot be stopped. He asks Lenhoff about possible means to stop the FinTelegram or Boehm.

Lenhoff replies that it is planned to play Boehm into a money-laundering trap in order to attack him or damage his reputation. In particular with the aim of stopping the reporting on FinTelegram. Lenhoff would also talk to Gal Barak about this.

These telephone calls took place after financial market supervisory authorities had warned of the scams from Lenhoff and Barak. Booker and the responsible compliance people at Payvision must have been aware of this. Nevertheless, he wants to take action against FinTelegram. Why? Because all FinTelegram reports were correct?! Maybe Payvision and Booker themselves have been victims of Lenhoff and Barak?

The money-laundering trap

Following the discussion between Booker and Lenhoff, Gal Barak and his business partner Vladimir “Vlad “Smirnov played by the script and started an attempt to bribe the publisher of FinTelegram. They offered him participation in a million project for free! And several hundred thousand Euros upfront. Boehm, however, immediately reported this attempt to the police. That’s also in the files. Anyway, the scheduled meeting with Gal Barak and Vlad Smirnov had already been reported to the police in advance.

No comments by Rudolf Booker and Payvision

FinTelegram has asked Rudolf Booker to comment on Uwe Lenhoff‘s allegations and the telephone logs planning the attack on FinTelegram and Boehm. Booker replied after a few days that he could only make a statement through Payvision’s legal department. We have taken note of that. The legal department, in turn, argued that according to Payvision’s company policy there would be checks and approvals before a statement can be provided. Moreover, they want checks on the FinTelegram editor and, additionally, the approval of the prosecutor. Well, in a nutshell, no comments from Booker or Payvision. But we can report that now evidently Payvision takes KYC checks very seriously when it comes to FinTelegram. Maybe, well, no, for sure, it would have prevented the loss of the life-time savings for thousands victims of those broker scams if Payvision would have done a proper KYC and AML check when onboarding UWE LENHOFF and GAL BARAK`s shabby companies in 2016.