Dutch Payvision is already having headaches with its involvement in scams in Europe. Israeli Gal Barak, sentenced to 4 years in prison and millions in restitution payments in the Vienna Cybercrime Trials, was a huge Payvision client with his cybercrime organization. But the Dutch high-risk payment processor also has issues in the U.S. and was allegedly a co-conspirator of the U.S. payment processor T1 Payments, Nevada, in a $4M fraud, according to a counterclaim lawsuit filed by MLM Beyond Wealth, Utah, in August 2020. Payvision was quick in denying any responsibilities and above all claimed that the Nevada court has no jurisdiction over Payvision. It claimed that they are “of course” only doing business with European customers. Payvision will get a place of honor in the scam-facilitating payment processors Hall of Fame. Here’s the U.S. story.

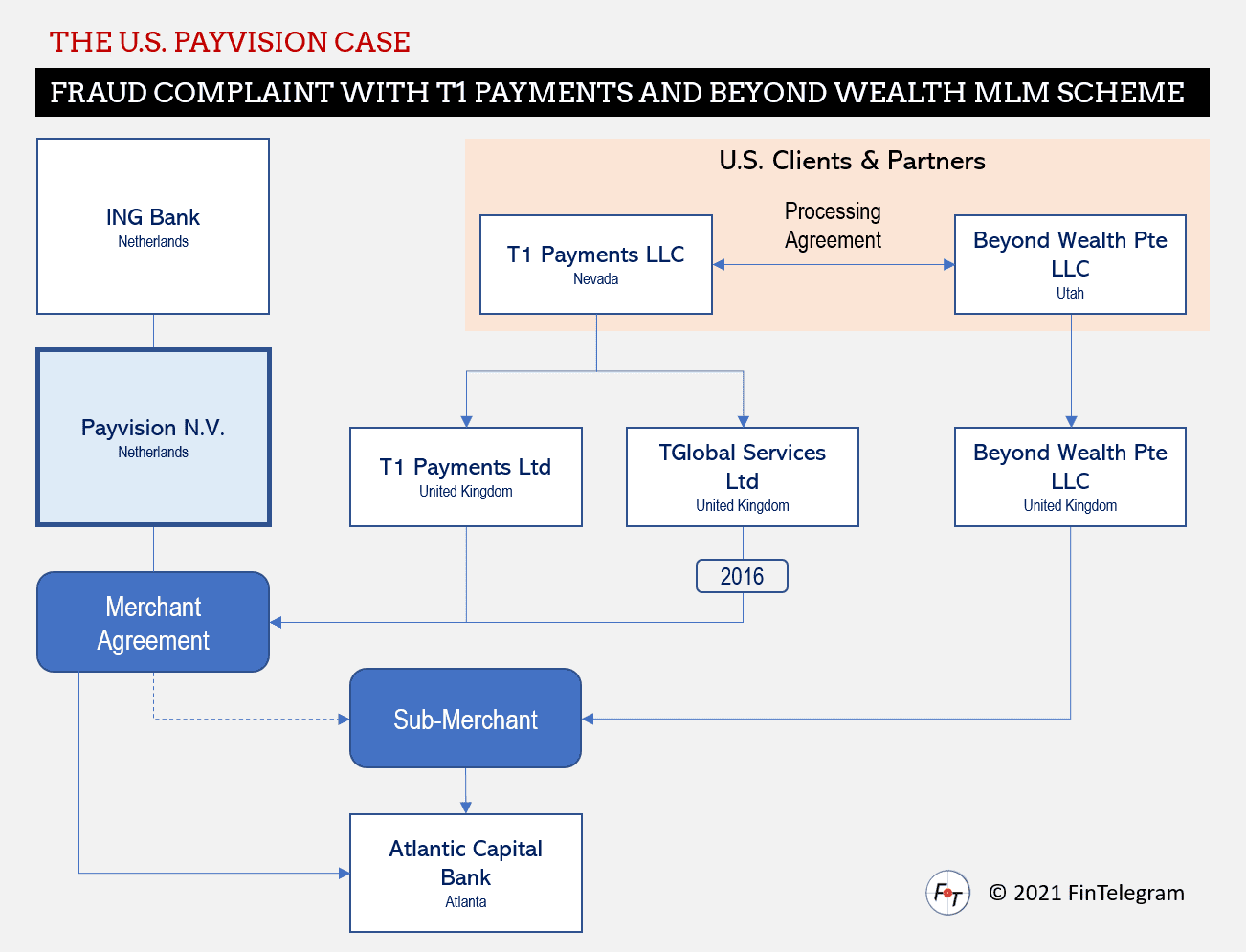

Payvision is not allowed to act as acquirer in the U.S. due to regulatory and card network restrictions. Therefore, T1 Payments LLC established TGlobal Services Ltd in the UK which entered into a merchant agreement with Payvision already in 2015/2016. In addition, T1 Payments told all its US high-risk-merchants to also set up UK shell companies (coveniently T1 Payments offered a corporation building service). The U.S. business thus metamorphized into EU business. Consequently, Payvision was able to do the payment processing for its U.S. merchant (a/k/a payment processor) T1 Payments LLC.

T1 Payments (www.t1payments.com) apparently represented itself as a registered payment facilitator when it entered into a payment processor agreement with the U.S. MLM scheme operator Beyond Wealth Pte LLC, Utah, in May 2020. T1 Payments offered to process the customer payments for the MLM scheme. In reality, however, T1 Payments was not at all registered with any card network as a payment facilitator. Beyond Wealth learned later on that Payvision in Amsterdam actually processed all their business transactions.

Payvision handled all transactions of Beyond Wealth as acquiring company via a sub merchant account for Beyond Wealth under T1 Payments´ master merchant account. There was no agreement signed between Beyond Wealth and Payvision which transferred Beyond Wealth‘s incoming payments to the T1 Payments bank account with the U.S. Atlantic Capital Bank. T1 Payments paid it out to Beyond Wealth´s bank in Utah. At least this was the plan.

A few weeks after entering in the agreement with Beyond Wealth, T1 Payments then did what many high-risk payment processors do – they terminated their high-risk merchant (being all of the sudden surprised about the high-risk of the merchant!), and retained a $4 million balance. Surprisingly, Beyond Wealth wanted to get its money and claimed that T1 Payments and its alleged co-conspirator in the theft, Payvision, have colluded and are fraudsters.

Payvision was very quick in telling the court that they never did and do any business in the United States. After all, you don’t want to stand out in the U.S. if you have regulatory issues back home. The Counterclaim filed by Beyond Wealth included Payvision as a Counterclaim Defendent was filed on August 24, 2020, the worst possible timing.

With the FinCEN leaks it got evident that Payvision had been on the radar of the American money laundering watchdog FinCEN and several American banks for years. The Dutch payment processor may have processed suspicious transactions from customers who could not otherwise access the traditional banking circuit. For years, the company served clients from the porn and gambling industry, two sectors that are often excluded by traditional banks because they are susceptible to fraud. At the same time, employees of other major banks such as Deutsche Bank or Bank of New York Mellon had already warned five years before ING acquired Payvision in 2017. Payvision, of course has troubles to understand all the allegations raised in the FinCEN leaks because “they have never done any business in the United States”.

There are a lot of similarities to the German Wirecard case. Back then the management board of Wirecard kept on pretending that everything is just fine in the group. Their lies are legendary by now. One of the former board member is still on the run and the other big liar is arrested in Munich, Germany.

A more detailed description on the T1 Payments’ lawsuit can be found on the European Fund Recovery Initiative (EFRI) website here.

The approach taken at T1 Payments and Beyond Wealth generally demonstrates Payvision‘s business conduct even after its acquisition by ING in March 2018.