On July 6, 2022, crypto broker Voyager Digital filed for Chapter 11 Bankruptcy. With more than 3.5 million app users and over $5.9 billion in crypto assets under management, Voyager was one of the top crypto brokers and started to lend its customers’ deposits to borrowers in exchange for high returns. This lending program was then the beginning of the end after the collapse of the largest debtor – crypto hedge fund Three Arrow Capital (3AC). Below are excerpts of Voyager CEO Stephen Ehrlich‘s Chapter 11 declaration. This should be read to better understand the Crypto Winter.

[Start Declaration]

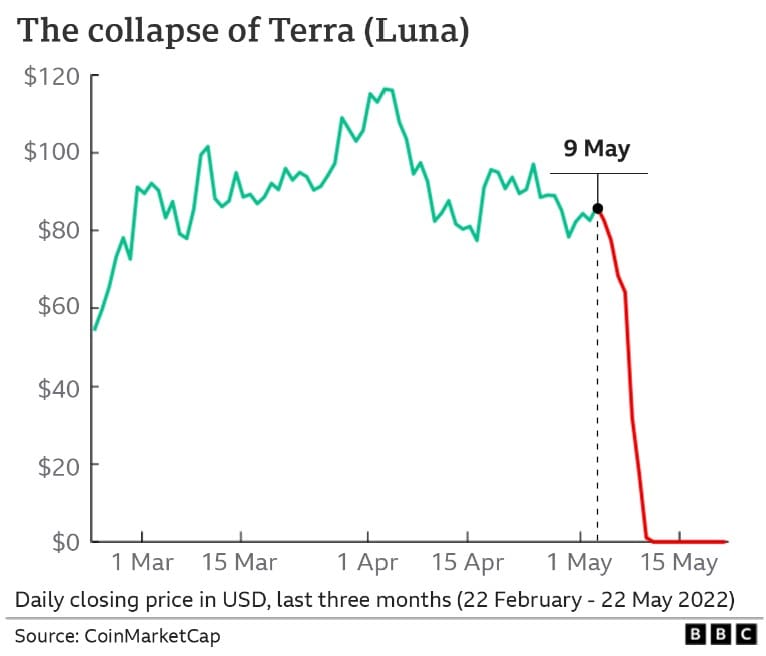

45. Terra is an open-source blockchain protocol created by Terraform Labs. Similar to the Ethereum blockchain (which issues Ether for use on its platform), Terra issued Luna, a cryptocurrency that was used to execute transactions on the Terra blockchain. In early May 2022, Luna traded at approximately $86 and had a market capitalization of approximately $14 billion.

46. Terra also issued TerraUSD (“UST”), an algorithmic stablecoin. Historically, UST traded at $1.6 UST maintained its “peg” to Luna via an arbitrage mechanism. If UST traded above $1, arbitrageurs bought $1 worth of Luna for $1 and exchanged Luna for one UST worth more than a dollar, netting the difference as profit. If UST traded below $1, arbitrageurs bought one UST for less than a dollar and exchanged it for $1 worth of Luna, netting the difference as profit. These arbitrage trades push the price of UST back to $1, and were intended to keep the two tokens equally scarce and limit oversupply or undersupply of the two tokens. To incentivize traders to burn Luna to create UST, Terra allowed owners of UST to stake their UST in exchange for a 19.5% yield (payable in UST).

47. On May 7, 2022, $2 billion of UST was unstaked and immediately sold. The sale moved UST’s price down to $0.91. UST holders, already sensitive to price movements due to the sell-off in cryptocurrencies generally, saw UST “de-peg” and rushed to unstake and sell their coins. Terra’s arbitrage trade was designed to address this type of situation but was not designed to address a situation of this magnitude. Though traders moved quickly to burn Luna and “arbitrage” the price of UST, traders realized that only $100 million of UST could be burned for Luna each day. Due to high trading volume, $100 million of UST was insufficient to “re-peg” UST to $1. Massive selling pressure led to a downward spiral or, as known in traditional finance, a “death spiral.” Traders redeemed UST for Luna and sold their Luna, leading to a significant decrease in the price of Luna. Traders attempted to “re-peg” Luna to UST by burning UST to create Luna, which in turn created an oversupply of Luna that further exacerbated its price decline. Terra allegedly sold $2.2 billion of its Bitcoin reserves to enter the Luna/Terra arbitrage efforts and re-peg the tokens but was unsuccessful. The price of Luna fell from $82.55 to $0.000001 in one week.

49. The Terra/Luna blockchain protocol was widely viewed as a project with significant promise—Luna had attracted significant interest from institutional investors and retail investors alike. The Luna collapse erased over $18 billion of value and contributed to further selloffs in the cryptocurrency sector.

b. Three Arrows Capital

50. The collapse of Luna had a significant effect on the cryptocurrency industry. Many cryptocurrency-focused hedge funds and other cryptocurrency companies owned Luna and incurred losses on their position after they sold. Some participants were unable to sell their Luna under staking agreements or other lock-up agreements—such participants were forced to incur up to a 99% loss on their investment if they were prohibited from selling their Luna.

51. In early June 2022, it was reported that 3AC may have incurred significant losses due to Luna’s collapse. On June 15, one of 3AC’s founders stated that the fund incurred significant losses on account of its staked Luna position and had hired legal and financial advisors to explore potential liquidity solutions. On June 27, 2022, 3AC was ordered by a court in the British Virgin Islands to commence liquidation proceedings.

52. The Company’s management team is familiar with market volatility, having navigated the Company through the COVID Crash and through their collective experience in the finance industry. As Voyager is a brokerage services provider that is not directly dependent on the price of Bitcoin or any other cryptocurrency for revenue, Voyager has limited exposure to an industry-wide selloff.

53. But to provide customers with a yield on the assets they store with Voyager, Voyager loans out a portion of its cryptocurrency reserves to third parties. Voyager customers expressly acknowledge that Voyager may loan the customer’s deposited assets (which are pooled with all other retail investors’ deposited assets) to third parties when they agree to the Voyager customer agreement, a requirement to deposit assets on Voyager’s platform. Loans are typically made in the form of cryptocurrency to, among other things, facilitate the counterparty’s transactions or provide the counterparty with additional liquidity of a specific type of token.

54. The Company has entered into a number of third party loans. Between March 2021 and March 2022, the Company entered into 125 third party loans with 9 different counterparties, lending out cryptocurrency with an aggregate market value of $5.15 billion.

55. In March 2022, the Company entered into a master loan agreement with 3AC (the “3AC Loan”). Pursuant to the 3AC Loan, the Company agreed to lend 15,250 Bitcoins and 350 million USDC to 3AC. The 3AC Loan was callable at any time by the Company. 3AC fully drew down on the 15,250 Bitcoins and 350 million USDC.

56. After the Luna crash in 2022, the Company began to assess 3AC’s downside exposure and the likelihood of repayment under the 3AC Loan. The Company made an initial request for a repayment by 3AC of $25 million of USDC by June 24, 2022, and subsequently requested repayment of the entire outstanding balance of Bitcoin and USDC by June 27, 2022. 3AC did not repay either requested amount. Accordingly, on June 27, 2022, Voyager issued a notice of default to 3AC for failure to make the required payments under the 3AC Loan.

C. The Alameda Loan and the Prepetition Marketing Process

57. Once it became clear that 3AC had significant exposure to the Luna crash, Voyager’s management team immediately engaged in efforts to identify sources of potential liquidity to stabilize the Company’s business and ensure that the Company remained adequately capitalized.

58. The Alameda Loan Facility provided the Company with $200 million cash and USDC and 15,000 Bitcoin subject to certain restrictions. The Company could draw on the facility in either U.S. dollars or Bitcoin, providing the Company with capital to fund its business and cryptocurrency to facilitate trade execution if necessary. The Alameda Loan Facility also communicated to the market at large that Voyager had significant cash on hand and support from one of the industry’s key players.

59. The Alameda Loan Facility, however, was only a partial solution to the Company’s liquidity issues. General market pessimism due to significant declines in cryptocurrency prices, coupled with concerns about the 3AC Loan, contributed to an influx of customer withdrawals. The Company’s management team understood that the Company would likely need to pursue a strategic transaction and/or seek additional sources of liquidity. Accordingly, the Company engaged Kirkland as legal counsel, Moelis as investment banker, Teneo Strategy LLC (“Teneo”) as a strategic advisor, and Consello MB LLC (“Consello”) as a strategic advisor in June 2022 to advise on potential transactions.

60. In late June 2022, the Company, with the assistance of Moelis, commenced a comprehensive, dual-track marketing process to solicit investor appetite in either (a) a sale of the Debtors’ entire business to either a financial sponsor or a strategic company in the cryptocurrency industry and (b) a capital raise whereby a third party (individually or as part of a consortium) would provide a capital infusion into the Debtors’ business enterprise.8 I understand that Moelis reached out to 60 potential financial and strategic partners across the globe, including domestic and international strategic cryptocurrency-related businesses and private equity and other investment firms that currently have cryptocurrency-related investments and/or historical experience investing in the cryptocurrency industry. Ultimately, I understand that 22 parties entered into confidentiality agreements with the Debtors. I understand that Moelis provided these parties with a copy of Voyager’s investor presentation and access to a virtual data room with comprehensive information regarding Voyager’s business operations and financial position. I understand that the virtual data room was robust and was supplemented throughout the marketing process and ultimately contained thousands of pages. I, and other members of the Voyager management team, attended virtual diligence sessions with Moelis and several interested parties.

61. I understand that the marketing process yielded one proposal for an out-of-court financing. The Company determined that the proposal was not actionable, however, as the conditions precedent to the proposal and the pro forma capital structure contemplated thereunder were not achievable. I understand that no other counterparty was willing to participate in an out-of-court transaction on the timeline required. However, I understand that several parties indicated interest in participating in a potential in-court transaction. Accordingly, Voyager and its advisors continued to discuss potential transactions and provide diligence to third parties on potential in-court and out-of-court restructuring transactions.

D. Gates.

62. On June 13, 2022, Celsius Network, a cryptocurrency lender with over $11 billion of assets under management, announced that it was raising the “gates” on account activity, pausing all account withdrawals and transfers due to what it referred to as “extreme market conditions.”

Celsius’ announcement triggered a further pulldown in the cryptocurrency markets; Bitcoin slid over 30% in the ensuing days as investors on other platforms began to liquidate their positions. Voyager saw a significant uptick in customer withdrawals—some of which Voyager does not believe are legitimate—putting additional strain on the Company’s business and risking the Company’s ability to serve customers who remained on its platform.

63. On June 23, 2022, Voyager reduced its daily withdrawal maximum from $25,000 to $10,000 per user per day. Putting a cap on withdrawals was necessary to ensure that the Company could effectuate trades for customers on its platform who elected to keep their cryptocurrency assets with Voyager, as well as stabilize the Company’s business while it engaged in discussions with potential third-party sponsors. Ultimately, the initial withdrawal limits maximized the Company’s ability to continue to provide brokerage services to its customers.

64. Voyager hoped that lower withdrawal limits would allow the Company to stabilize its business. However, as the cryptocurrency markets continued to trend down, the Company realized that further steps were required to preserve customer investments, avoid irreparable damage to the Debtors’ business, and ensure that its trading platform operated smoothly for all customers. Accordingly, on July 1, 2022, the Company froze all withdrawals and trading activity on its platform.

65. Though the Company continued to rigorously diligence all potential restructuring transactions, it became clear that a potential strategic transaction would only emerge after the Company petitioned for chapter 11 relief. Accordingly, the Company began to analyze a potential in-court timeline and finalize its contingency preparations process. The Company engaged BRG as restructuring advisor to assist the Company with its contingency planning efforts.