The Australian Securities and Investments Commission (ASIC) has filed a lawsuit against taken fintech iSignthis (ISX) and its Managing Director, John Karantzis, to court. The regulator filed a lawsuit last week alleging iSignthis and Karantzis had breached its disclosure obligations and misled shareholders regarding some high-paying contracts signed during the first half of 2018. Behind the ASIC proceedings are 2018 contracts and revenues related to some 336.7 million performance shares for the ISX management. ISX used to be part of the Israeli Network of Binary Options Supervillains of Yossi Herzog.

The nice million dollar treat

Evidently, John Karantzis (LinkedIn profile) and his fellow ISX managers wanted to treat themselves to a $500 million bonus share package back in 2018. In 2019, the stock exchange supervisory authority ASX investigated ISX and its binary options network and started to take action against it (see this ASX Query Letter published in Nov 2019). In fact, the current ASIC lawsuit appears to be based on the results of the ASX findings. Legal proceedings have been pending between ASX and ISX over this investigation and its conclusions since 2019. Trading in the ISX share has been suspended on the ASX.

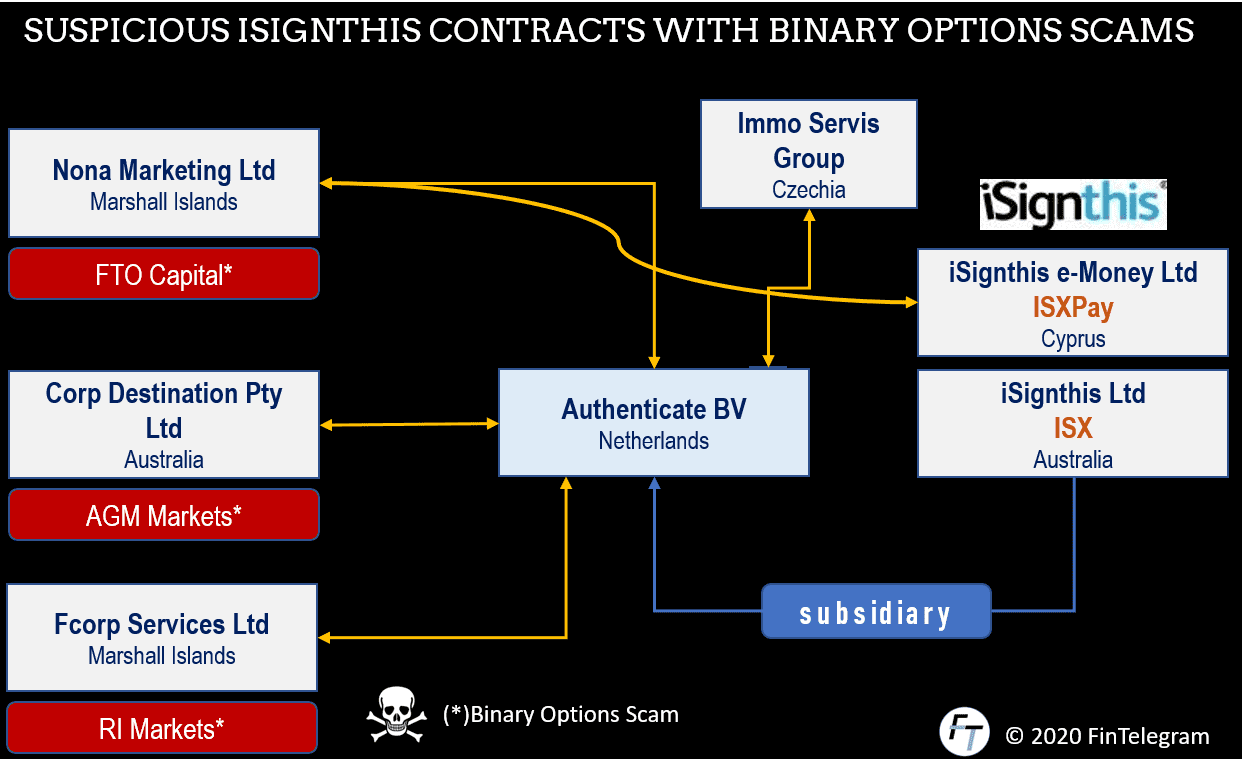

ASIC is alleging that iSignthis misled the market regarding three key contracts that enabled the company to reach its performance milestones. The contracts in question are connected to the binary options industry with Corp Destination Pty Ltd, Fcorp Services Ltd, and IMMO Servis Group s.r.o. iSignthis booked some $3 million in non-recurring revenue from these contracts in the final six months of 2018 before the performance deadline was up. ASIC is alleging that ISX failed to disclose these contracts’ nature appropriately and made misleading representations about the revenue from the deals.

The money-laundering issue with Visa

In addition to the performance share issue, ASIC alleges that iSignthis failed to disclose that VISA had terminated its relationship with iSignthis and iSignthis e-Money Ltd because the company had no appropriate anti-money laundering (AML) and risk programs in place. Thus, the ISX transaction monitoring system had failed to identify unusual transactional behavior. VISA argued that the relationship was off because iSignthis presented an excessive level of risk.

Joe Aston of the Financial Review describes John Karantzis‘ behavior as the “Wirecard Game” of manipulated balance sheets and cash flows. In fact, there are already many battlegrounds around ISX with regulators, authorities, media, and Visa. Somehow, Karantzis’ arrogant statements actually resemble those of former Wirecard CEO Markus Braun.

The Yossi Herzog Connection

The Israeli forex veteran Yossi Herzog – a most wanted person of the U.S. prosecutors – is also connected to iSignthis. Well, not really a surprise to FinTelegram readers, right? According to the U.S. prosecutors and the CFTC, Herzog and his buddy, Kobi Cohen is the villains behind the Yukum binary options scam.

Yossi Herzog and Kobi Cohen were identified as the beneficial owners of the Australian AGM Markets Pty Ltd. This company originally received a broker license from ASIC, the Australian Financial Markets Authority. Under the AGM license umbrella, the Australian Corp Destination Pty Ltd, with ich now part of the ASIC lawsuit, operated broker scam schemes. The scam sites Oinvest and Global.iTrader were operated via this Corp Destination. Two Israelis acted as front men for the Corp Destination in Australia.

Research of Australian ASX uncovered that ISX generated revenues from binary options scam operators via their European subsidiaries Authenticate BV in the Netherlands and iSignthis e-Money Ltd in Cyprus. ISX recorded revenues of $526,525 in the June quarter of 2018 which derived from a contract with Corp Destination Pty Ltd. The subsidiary in the Netherlands was also instrumental in the conclusion of other interesting contracts such as those with Nona Marketing Ltd, Marshall Islands, another binary options scam operator from which ISX generated $252,500 revenues in April 2018 alone. Nona Marketing is associated with broker scams such as FTO Capital (see FCA investor warning). Fcorp Services Ltd, Marshall Islands, used to be the operator of the binary options scam RI Markets.

In a statement to Finance Magnates, John Karantzis said that iSignthis is considering its “position and the allegations regarding the Company’s alleged deficiencies in disclosures.” “We already note a number of factual issues in the ASIC statement of claim,” he added. “As this is a civil case, we will of course respond via our defence and respect the court process.”