Wirecard, once a beacon of German fintech innovation, has become synonymous with one of the most convoluted financial scandals to date. The company’s spectacular rise and subsequent fall have left a stain on Germany’s financial reputation and triggered a series of legal battles in Germany and Singapore, aiming to unravel the depths of the alleged fraud and hold those responsible accountable. Wirecard is a stain on the German financial sector and its regulator, BaFin.

The German Proceedings: A Complex Web of Accusations

The trial underway in Munich is pivotal, focusing on former executives, including Markus Braun, Oliver Bellenhaus, and Stephan von Erffa. They face serious allegations of commercial gang fraud, breach of trust, market manipulation, and accounting manipulation, with potential prison sentences looming if convicted. This trial, set against the backdrop of Stadelheim prison’s high-security courtroom, is symbolic of the gravity of the case.

A notable absentee from the proceedings is Jan Marsalek, Wirecard’s COO, who remains elusive after fleeing over three years ago.

Marsalek, considered Braun’s number two, fled and is on Europol’s most wanted list for suspected commercial gang fraud. After more than three years in hiding, Jan Marsalek has communicated with the Landgericht München I (Munich Regional Court) through his defense attorney. While the content of his letter remains undisclosed, it is known that Marsalek did not directly address the specific charges against him.

However, he did mention the third-party partner business of the insolvent payment service provider Wirecard, implying that it did exist.

Singapore’s Spotlight on Document Falsification

Parallel to the German trial, Singapore is also holding trials related to document falsification connected to the missing millions in escrow accounts. Two men linked to the collapse of German payments firm Wirecard are currently on trial in Singapore.

- Singaporean Rajaratnam Shanmugaratnam,a/k/a R Shan, 57, and

- Briton James Henry O’Sullivan, 48,

They face charges of falsifying documents related to the funds held in escrow accounts. They denied the charges and pleaded not guilty.

In June 2023, two other former Wirecard Asia employees were sentenced to jail after they pleaded guilty, including criminal breach of trust.

- James Aga Wardhana was jailed for 21 months.

- Chai Ai Lim received a 10-month term.

In October 2023, the Singapore national See Lee Wee, 30, was sentenced to 10 weeks in jail after admitting she had worked with her then superiors to commit criminal breach of trust. She worked at Wirecard Asia and allegedly acted on instructions from Edo Kurniawan and Chai Ai Lim.

Kurniawan, who left Singapore on Oct 10, 2018, before investigations into him started, is still at large. An Interpol red notice has been issued against him, requesting law enforcement units worldwide to locate and provisionally arrest him pending extradition.

Civil Litigations and the Quest for Compensation

The unfolding civil trials in Munich against Wirecard’s top management, led by insolvency administrator Michael Jaffé, seek substantial damages for alleged breaches of duty. These proceedings underscore the broader financial implications of the scandal and the quest for compensation for those affected.

On Feb 22, 2024, the civil trial against the four members of Wirecard’s top management, consisting of former CEO Markus Braun, CFO Alexander von Knoop, Chief Product Officer Susanne Steidl, and former Supervisory Board member Stefan Klestil, started at the Regional Court in Munich.

The trial is considered one of the most complex civil proceedings in Germany. Insolvency administrator Michael Jaffé is claiming damages of €140 million for loans the defendants allegedly granted to the Singapore subsidiary Ocap in breach of their duties. Jaffé argues that neither the Management Board nor the Supervisory Board should have approved the granting of the loan, especially as even Wirecard Bank had raised objections due to a lack of collateral.

Markus Braun has not appeared in court but is being represented by his lawyers, which is possible in the civil proceedings in contrast to the ongoing criminal proceedings. According to the regional court, a decision on the damages claimed is to be announced on September 5.

Braun’s private investment company insolvent

Almost simultaneously with the start of the civil proceedings, it became known that Markus Braun‘s private investment company is insolvent. The Limburg Local Court imposed a general prohibition on the disposal of MB Beteiligungsgesellschaft and appointed Carsten Koch from the Weilburg-based law firm Westhelle & Partner as provisional insolvency administrator.

MB Beteiligungsgesellschaft is part of the legal dispute surrounding Braun. Wirecard funds that flowed to the subsidiary Ocap are said to have ended up at Braun’s investment company, in some cases via detours, reports the Handelsblatt.

A Torrent of Lawsuits Against EY

The influx of lawsuits against EY, Wirecard’s former auditor, reflects growing discontent among investors and stakeholders. The allegations that EY failed to identify and report suspicious transactions for over a decade underline the perceived shortcomings in oversight and the demand for accountability.

Unanswered Questions and FinTelegram’s Investigative Insights

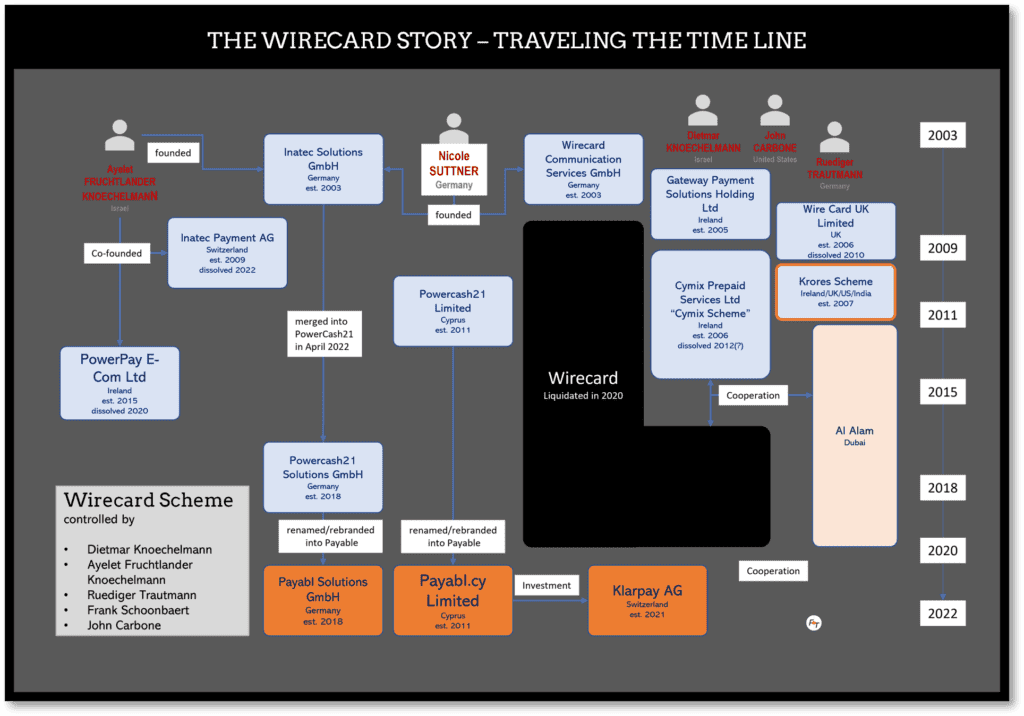

FinTelegram, a platform dedicated to investigative journalism, has conducted an in-depth examination of the complexities surrounding the Wirecard scandal, paying particular attention to the roles of Dietmar Knoechelmann, Ruediger Trautmann, and their affiliations with high-risk financial operations. This legal analysis outlines the key elements unearthed by FinTelegram and their implications for understanding the full scope of the Wirecard case.

Read the FinTelegram reports on Wirecard here.

The Krores Connection

In 2007, the former Wirecard top executive Dietmar Knoechelmann and Ruediger Trautmann co-founded Krores, a prepaid card provider based in Dublin, Ireland, which, according to FinTelegram’s findings, was integrally linked to the Wirecard ecosystem and exhibited operational similarities. The extent of Krores‘ involvement in the Wirecard affair is under scrutiny, with its precise role in the broader scheme yet to be fully determined.

Involvement with High-Risk Payment Processors

Significantly, Knoechelmann and Trautmann played pivotal roles in the ascendancy of Wirecard, engaging with high-risk payment processors such as PowerCash21 (subsequently rebranded as Payabl). These entities, operating in a manner akin to Wirecard, have raised substantial concerns regarding their contribution to the overarching fraudulent activities.

Allegations of Money Laundering

A particularly damning complaint lodged in 2010 accused Wirecard of facilitating money laundering activities amounting to billions, suggesting that the company’s operational model was predicated on the processing of illegal transactions yielding high profits. This accusation remains a central point of interest for legal investigators.

Critical Perspective on the Investigation Period

A critical observation made by FinTelegram pertains to the investigative focus of German public prosecutors, which primarily concentrated on activities from 2016 onwards, thereby overlooking crucial events and decisions occurring in the years prior. FinTelegram posits that pivotal actions leading to Wirecard‘s eventual downfall and subsequent legal actions took place between 2007 and 2016, particularly in Ireland. The oversight of this period, according to FinTelegram, significantly hampers a comprehensive understanding and resolution of the Wirecard scandal.

In light of FinTelegram’s investigative findings, it is evident that a thorough legal examination of the Wirecard scandal necessitates a broader temporal scope, encompassing the company’s entire operational history. This approach is crucial for unveiling the intricate web of relationships and activities that underpin Wirecard‘s fraudulent practices and for ensuring accountability and justice in one of the most significant financial scandals of recent times.