UBS announced that it plans to acquire Credit Suisse to create a business with more than USD 5 trillion in total invested assets and sustainable value opportunities. It will create a leading Swiss-based global wealth manager with more than USD 3.4 trillion in invested assets combined. UBS will pay 3 billion Swiss francs ($3.23 billion) for 167-year-old Credit Suisse and assume up to $5.4 billion in losses in a deal backed by a massive Swiss guarantee and expected to close by the end of 2023.

Last Thursday, the Swiss National Bank (SNB) made 50 billion francs available to the struggling Credit Suisse. The market, however, remained unimpressed. The bank’s share price fell further and was only 1.86 francs at the close of trading. Pulverized. This meant the bank was worth just one-seventh as much as it was a year ago.

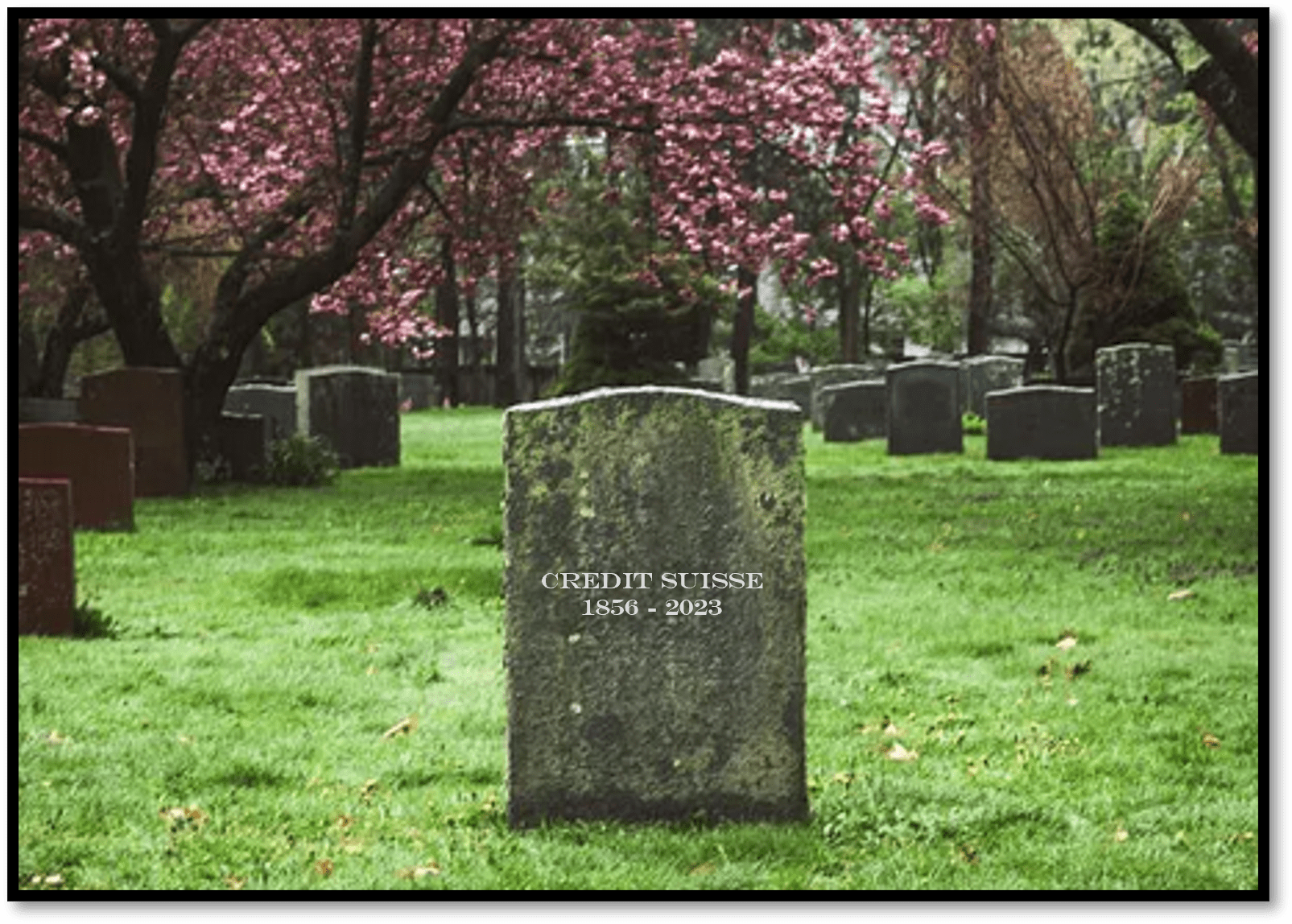

Credit Suisse is an apparent corporate governance failure, writes Gregor Greber on Inside Paradeplatz. With the UBS take-over, shareholders and bondholders were rightly bled dry. Credit Suisse has been in a downward spiral for years, and it was clear that the bank will continue to suffer. Banking is trust! And the trust was gone.

Nevertheless, the Credit Suisse managers were very well paid. The honeypot for top executives always contained between 5 billion (2010) and 3.2 billion Swiss francs (2021) to be distributed among the top people. Bonus payments were lower in the last two years but still considerable. Bonus payments for total failure at the expense of the state and, i.e., the taxpayers. Who will be held accountable for this?

Given the information disclosed so far on the Credit Suisse transaction, one can probably not speak of a market-economy takeover. Rather, this was a bail-out action for which UBS is rewarded with Swiss taxpayers’ money. The shareholders of Credit Suisse, its bond creditors, its employees, the Swiss taxpayers, and, in the long run, the financial industry were harmed. It is a rotten deal. It is doubtful whether this will prevent bank runs.