In March 2021, we issued an investor warning against the offshore broker scam Crystal Ball Markets, operated by the offshore entity Crystal Ball Markets LLC. Since March 2021, the supporting payment processors have changed. The offshore broker has no authorization to operate as a Forex, CFD, or Crypto broker in Europe or other jurisdictions. We were contacted by the broker’s Chief Strategy Officer Sasaenia Omilabu, and advised that Crystal Ball Markets would be registered with FINTRAC of Canada as a Money Services Business (FMBS). Here is the update!

Key Data

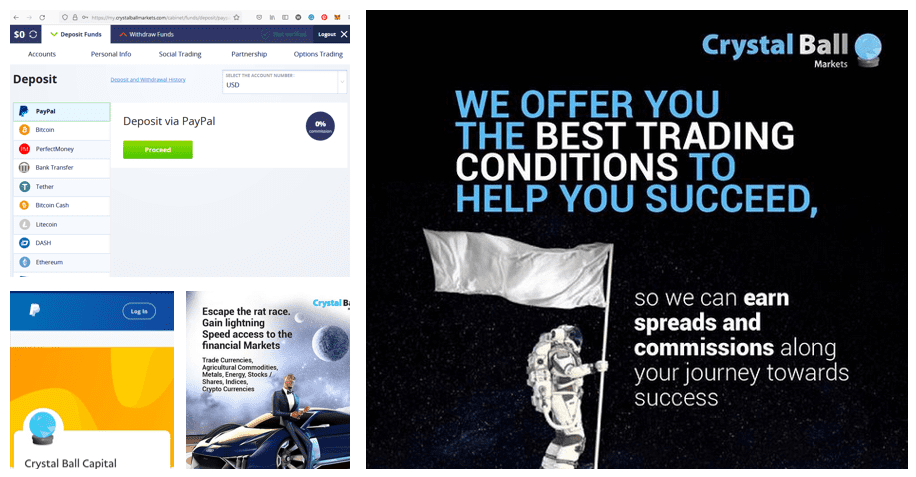

| Trading name | Crystal Ball Markets |

| Business activity | Forex and CFD broker |

| Domain | www.crystalballmarkets.com |

| Social media | LinkedIn, Facebook, Instagram, |

| Legal entity | Crystal Ball Markets LLC |

| Jurisdiction | St. Vincent & The Grenadines Canada, Nigeria |

| Authorization | Registered Money Services Business (MSB) in Canada (FMSB No M21983070) |

| Related individuals | Sasaenia Omilabu (LinkedIn) |

| Contact | +44 1244 94 1257 |

Unauthorized Offshore Broker?

It is true that Crystal Ball Markets has registered as a Money Service Provider (MSB) with Canada’s FINTRAC. In this regard, the offshore broker also made a press release in May 2022, informing that the FINTRAC registration is intended to simplify the business. This is a good approach.

But does the FINTRAC registration entitle Crystal Ball Markets to act as a broker for CFDs, Forex, Commodities or Inidzes? The simple answer is no. To operate as a broker in almost any regulatory regime requires a license or permit. Crystal Ball Markets, to the best of our knowledge, has no such license in any regulatory regime on this planet.

According to the available information, the operators of Crystal Ball Markets are based in Nigeria. Its Chief Strategy Officer, Sasaenia Omilabu, states Geneva, Switzerland as his place of residence on his LinkedIn profile.

Is It A Scam?

Is Crystal Ball Markets a Scam? Not necessarily every unauthorized broker is a scam, but most of them are. In any case, the trader’s risk increases significantly with an unregulated broker. There is no Investor Protection Scheme and no supervision by a regulator. No one knows how the trades are actually executed and the business is conducted. In this respect, we warn again against unregulated brokers like Crystal Ball Markets.

Share Information

If you have any information about Crystal Ball Markets, its operators and facilitators, please let us know through our whistleblower system, Whistle42.