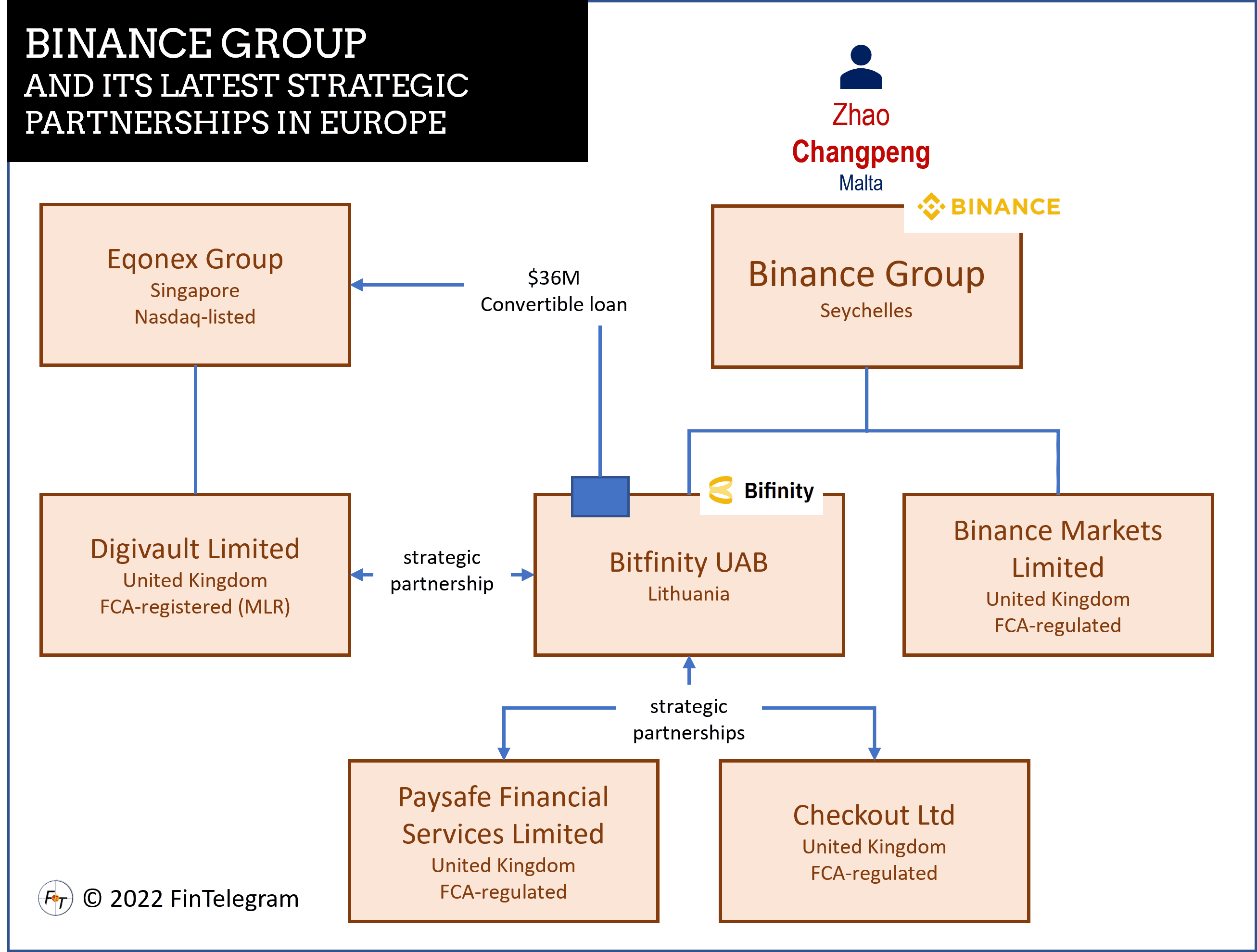

Early this week, the UK Financial Conduct Authority (FCA) said that it would be concerned about the announcement made by the Eqonex Group and the Binance Group confirming that an entity called Bifinity UAB will advance a US$36 million convertible loan to Nasdaq-listed crypto exchange Eqonex. Bifinity has acquired some specific contractual rights over Eqonex Limited through this loan. The Lithuanian Bifinity is the official fiat-to-crypto payments provider for the Binance Group launched on 7 March 2022.

FCA worried about Binance partnerships

Eqonex Limited is the parent company of Digivault Limited, one of the cryptoasset businesses registered by the FCA under the Money Laundering Regulations (MLRs) with the reference number 927958. As a result of the transaction mentioned above, the Binance Group may have become beneficial owners of Digivault.

The FCA said that it did not have powers to assess the fitness and propriety of the new beneficial owners or the change in control before the transaction was completed. However, the regulator previously published its concerns about Binance. The Binance Group includes Binance Markets Limited. The FCA regulates Binance Markets Limited with reference number 688849 for a limited set of activities.

Just recently, the FCA raised concerns about a partnership between Binance and FCA-regulated Paysafe Group. With this partnership, Binance has gained access to the FPS and SEPA payment systems (read the report here).

Binance has very cleverly woven a global spider web of companies spanning regulatory regimes since its inception in 2017. Binance Group has so much money that it recently bought into the US financial magazine Forbes. The partnerships with Eqonex, Paysafe, or Checkout extend this spider web. Binance founder Zhao Changpeng is the 18th richest person on the planet in the Bloomberg Billionaires Index with just under $64 billion.

No effective supervision

Due to requirements imposed by the FCA, Binance Markets Limited is not currently permitted to undertake any regulated activities without the written consent of the FCA. This requirement was put in place because, in the FCA‘s view, Binance Markets cannot be effectively supervised. This is particularly concerning in the context of Binance Markets‘ membership of the global Binance Group, which offers complex and high-risk financial products posing a significant risk to consumers.

The FCA can take steps to suspend or cancel the registration of a cryptoasset business if it is not satisfied the firm or its beneficial owner is fit and proper. It also has powers to suspend or cancel a firm’s cryptoasset registration on a number of grounds, including where a firm has not complied with obligations under the Money Laundering Regulations.

Conclusion

The FCA‘s concerns about Binance Markets Limited remain, the regulators stressed. The FCA statement shows us two points. First, the FCA does not want Binance and distrusts the world’s leading crypto exchange. Second, it clearly shows that national regulators are almost helpless in the face of crypto providers operating globally without borders, and mostly outside the traditional FIAT system. This is especially true for Binance with its web of companies.