It is once again BridgerPay we discovered as a payment facilitator in one of the countless broker scams. Founded by Israeli FX expert Ran Cohen, the Cyprus-based PayTech Bridger AI Ltd is unregulated and, therefore, apparently feels free to accept scam operators without too many worries. Just recently, Cohen hired Nati Harpaz, a big name, as an additional Executive Director. One would expect legitimacy there. However, BridgerPay has come up more frequently as a payment facilitator of scams regulators warn against. So it facilitates The Forex Premium (www.4xpremium.com) operated by Premium Finance Solutions Ltd.

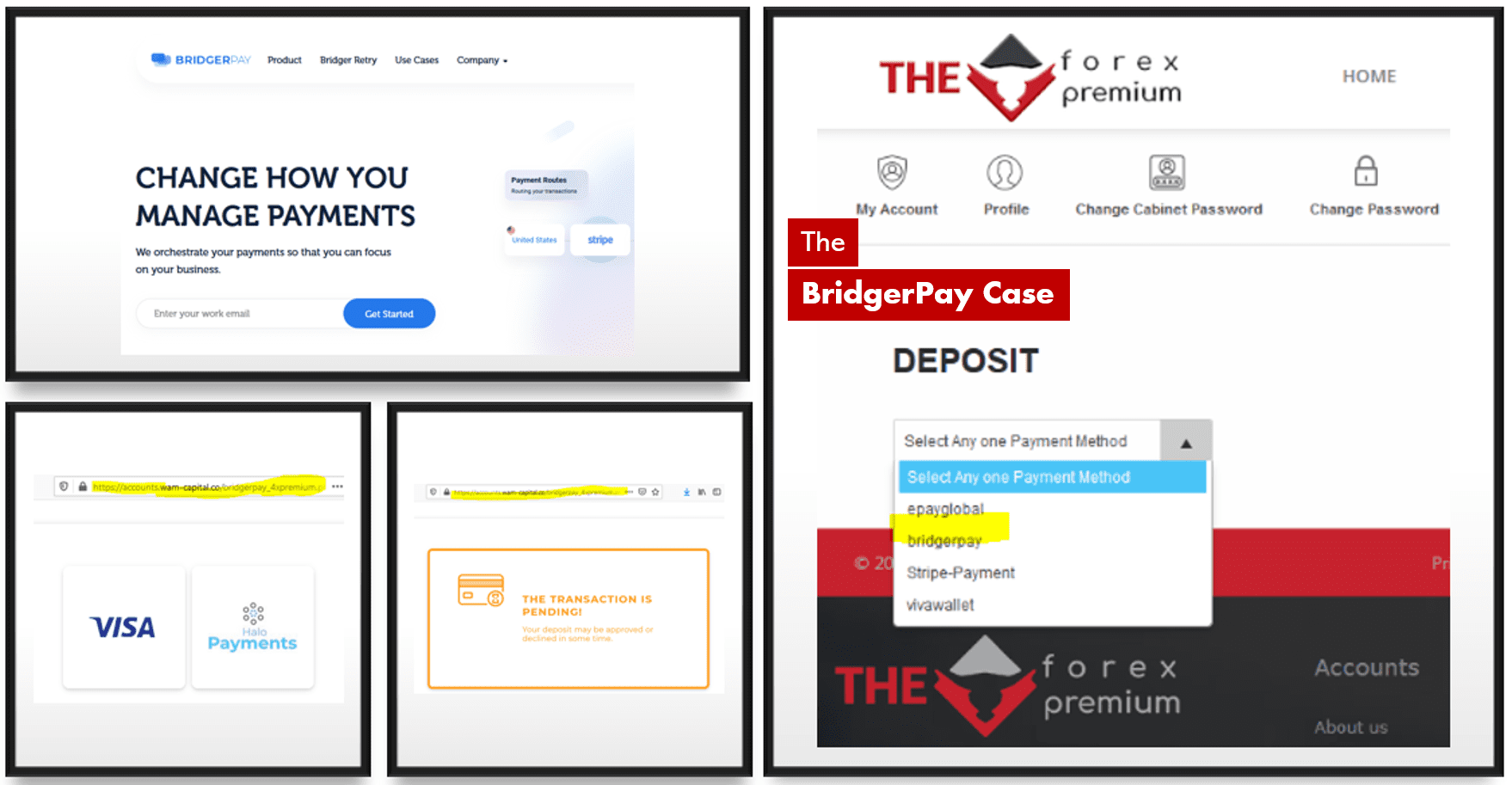

Today, 22 Feb 2021, the Spanish CNMV issued a total of ten investor warnings against various financial services providers. Seven of them were FX brokers and in two of them, we discovered BridgerPay as a payment facilitator – at The Forex Premium and WAM Capital. We have not yet analyzed the warnings issued by the other regulators today. Evidently, BridgerPay has accepted the operators of The Forex Premium and WAM Capital as clients for its “intelligent” payment gateway. The two scams belong together as can be easily seen from the payment screenshots (above). But of course, an “AI” payment gateway does not have to be able to recognize this, does it?

In discussions with Cohen, he rejects any responsibility for the scams of his clients. Well, actually, he denies accepting scam clients in the first place. Regulators prove him wrong on a daily basis.

Cohen argues that BridgerPay would only be the “smart API” provider connecting merchants (apparently including many scammers) with their payment service providers. Thus, BridgerPay would not have to apply KYC/AML and would have no responsibility for its scam customers.

Bullshit. Of course, BridgerPay is to be qualified as a payment processor under the EU directives and, as such, must implement proper AML procedures. Sure, the Central Bank of Cyprus should regulate companies like BridgerPay or Praxis Cashier, but it doesn’t. However, a regulator’s failure to regulate and supervise doesn’t necessarily authorize PayTechs to facilitate scams, which is a criminal offense anyway.

Closing PayTechs like BridgerPay or Praxis Cashier would be a very efficient way to prevent scams and set an example for other payment processors in the EU.