Update 28 March 2021 – Roman Mazur and Krzysztof Kuchta resigned as officers of Epayblock. Please read this update here.

Lithuania is one of those regulatory regimes popular with high-risk payment processors and in the cybercrime scene. Amid the hype of binary options, CFDs, and crypto trading, many FinTech entrepreneurs have picked up e-Money Institution licenses in Lithuania. Like Eyal Nachum with his Bruc Bond and International Fintech. Well, they lost the license and went to Singapore. However, MoneyNetint Group and its GlobalNetInt are still there; regulated! Most recently, Epayblock caught our attention because it is repeatedly involved in broker scams as a payment processor. We would like to know more about Epayblock.

A Polish venture?

We wanted to contact Epayblock via Twitter. Unfortunately, their Twitter account is currently suspended for rule violations. On LinkedIn have found out that Lithuanian Maciej Kazmierczyk (pictured left) has been the CEO of Epayblock since July 2020. Roman Mazur in Warsaw, Poland, acts as COO. Krzysztof Kuchta, also from Warsaw, is the CTO. Two other managers also list Warsaw as their place of work.

The information available to us suggests that Epayblock, regulated by the Bank of Lithuanian with authorization code LB001911, is indeed a Polish project. Fine, that’s the beauty of the European Union and its license passporting.

Money-laundering and SAR

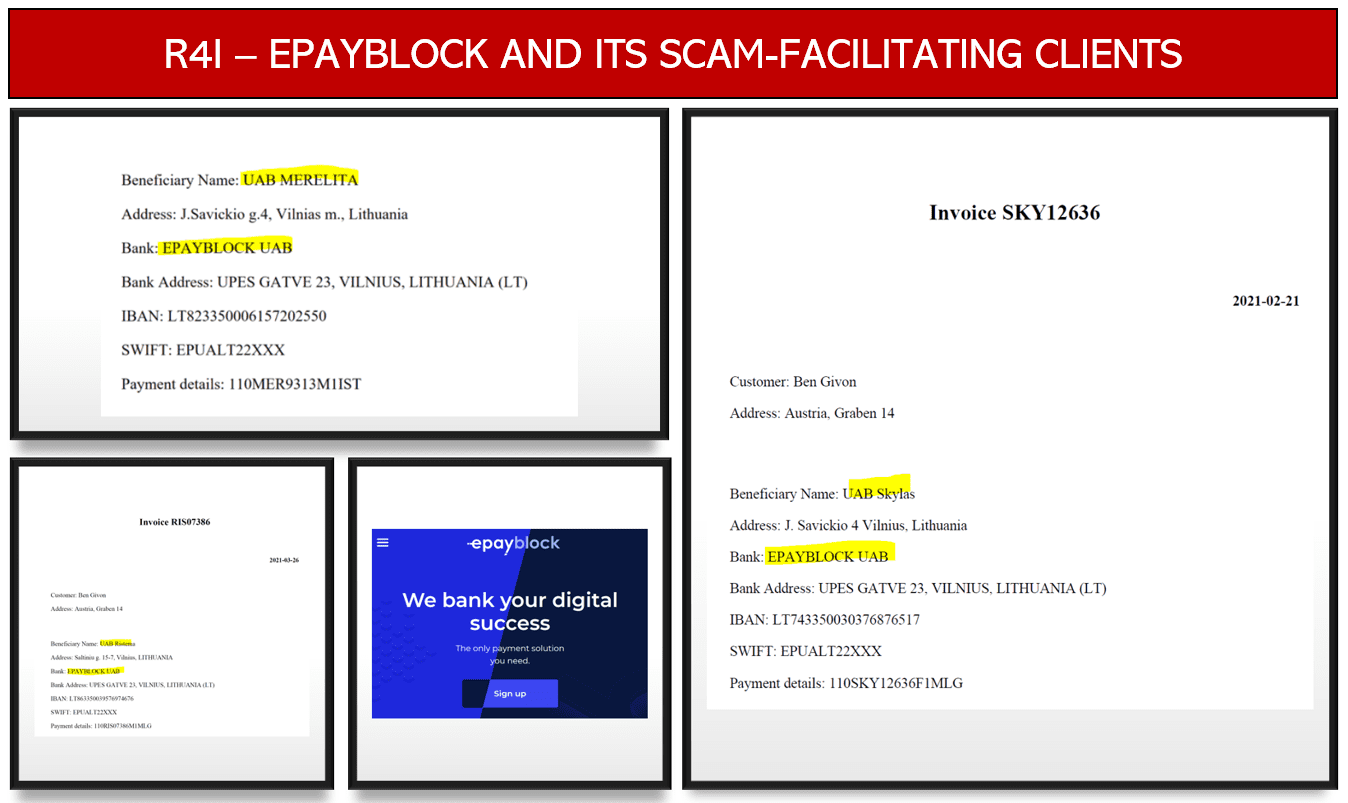

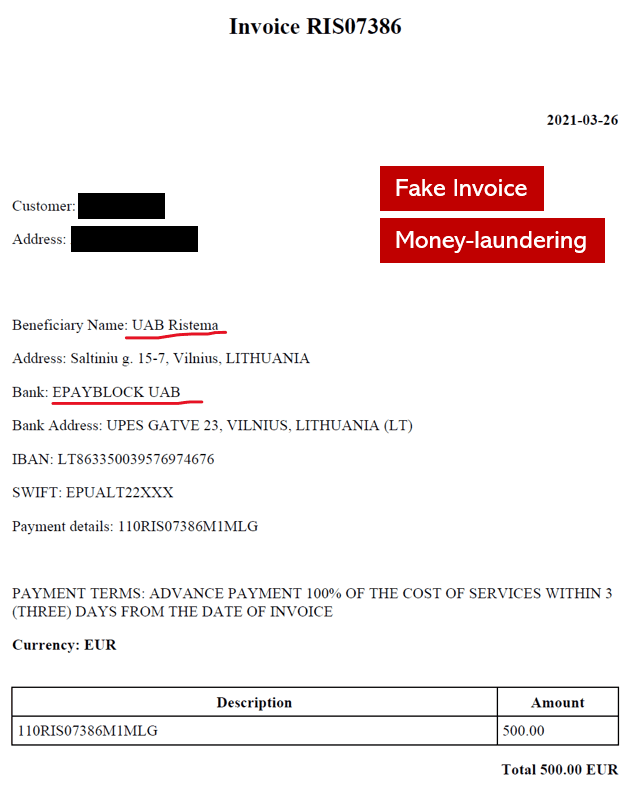

Lastly, we noticed Epayblock because it is the bank account of illegal payment processors and scam-facilitators like Skylas UAB, Merelita UAB, or Ristema UAB. These Lithuanian companies work for broker scams, accept deposits from unsuspecting victims of these scams, and consequently launder these illegal proceeds. For this, these companies’ fake invoices are automatically issued, and customer deposits are disguised as services. This is the typical money laundering approach.

Epayblock apparently has no problem with this or runs a flawed compliance regiment. In any case, Epaybank and its scam-facilitating clients certainly know the identities of the scammers, their legal entities, and their bank accounts. Epayblock is obliged to immediately file a Suspicious Activity Report (SAR) with the relevant regulator.

Share information

We would like to know more about Epayblock, its people, clients, and projects. We would be very grateful for any information.