The FCA-regulated e-money institution MoneyNetInt had its best time during the binary options hype. Most of the binary options scheme providers were Israelis, and, as it turns out, almost all of them were scam schemes. Many of them were clients of MoneyNetInt, such as IC Option, TitanTrade, or the schemes of Uwe Lenhoff and Gal Barak. As of 2017, binary options were banned in most regulatory regimes. Since then, MoneyNetInt‘s business might not be doing so well either, as their latest figures suggest. Here is an update.

Voluntary Restricted Onboarding

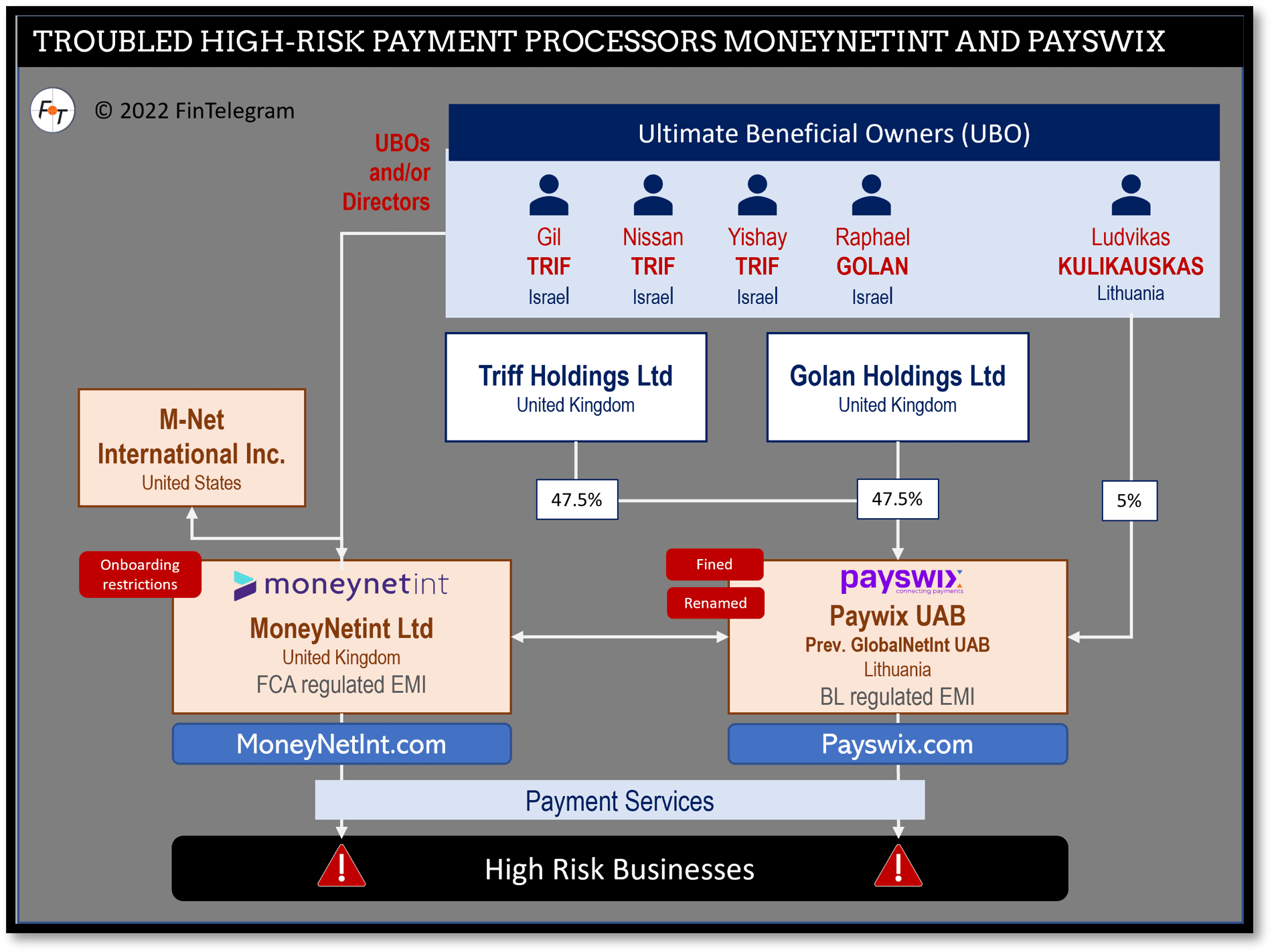

MoneyNetInt evidently had some troublesome communication with the UK Financial Conduct Authority (FCA) in early 2021. Since mid-2021, the website informs that “effective from 1 June 2021, Moneynetint Limited (FRN: 900190) volunteered to: restrict, for a temporary period, the onboarding of all new customers as part of an enhancement process, following dialogue with the Financial Conduct Authority (FCA). Existing customers should not be affected during this temporary period, and all of our services remain intact.“

It could be that the FCA has taken the FinTelegram reports as an opportunity to take a closer look at the e-money institution. With the onboarding restriction in place until today (November 26, 2022), the problems are likely to be structural.

Latest Accounting Data

In 2021, MoneyNetInt changed its accounting period and now closes the year on December 31. Until 2021, October 31 was the balance sheet date. As part of this accounting change, MoneyNetInt has revalued its assets, resulting in a Revaluation Reserve of GBP 3,258,282. As a result, the 2021 balance sheet now shows significantly higher capital than the year before. Details of the revaluation are not explained in the Companies House filing.

The latest filing is also short of an explanation of how approximately GBP 25 million suddenly showed up in the 3-month accounting period between October and December 2021.

The average number of employees in 2021 was 35, the same as in 2020.

There is currently no information on how the year 2022 went for MoneyNetInt.

Similarweb Statistics

Not surprisingly, the onboarding restrictions seem to affect the business. At least from the outside. The Similarweb statistics also show that MoneyNetInt has hardly any substantial websitime being. In the last 28 days (before November 23, 2022), only just under 6,000 people have visited the website. This is not impressive.

The Lithuanian Leaks And Fine

Until at least Q3 2021, the shareholders of FCA-regulated MoneyNetInt, Golan Holdings Ltd and Triff Holdings Ltd, were also the majority shareholders of GlobalNetInt UAB (now Payswix UAB) in Lithuania. While MoneyNetInt had to restrict its onboarding of new clients after discussions with the FCA, this Lithuanian EMI had money laundering problems and was fined €350,000 by the Bank of Lithuania.

FinTelegeram has received leaked data about its clients in the so-called GNI Leaks. Many clients of this Lithuanian e-Money Institution were scammers, illegal gambling operators, and unauthorized crypto financial service providers.

We currently do not know if the shareholder structure of Payswix has changed after the renaming. Lithuanian Liudvikas Kulikauskas still serves as CEO at Payswix.

Key Data

| Trading name | MoneyNetInt |

| Business activity | E-Money Institution |

| Domain | https://moneynetint.com/ |

| Legal entities | MoneyNetInt Ltd Golan Holdings Ltd Triff Holdings Ltd |

| Jurisdiction | United Kingdom |

| Authorization | FCA |

| Related schemes | Payswix (prev. GlobalNetInt) |

| Related individuals | Raphael Golan, UK Leon Isaacs, UK Gil Trif, Israel Nissan Trif, Israel Yishay-Moshe Trif, Israel Ludvikas Kulikauskas, Lithuania (LinkedIn) |

Share Information

We would like to know more about the developments at MoneyNetInt. If you have any information, please share it with us via our whistleblower system, Whistle42.