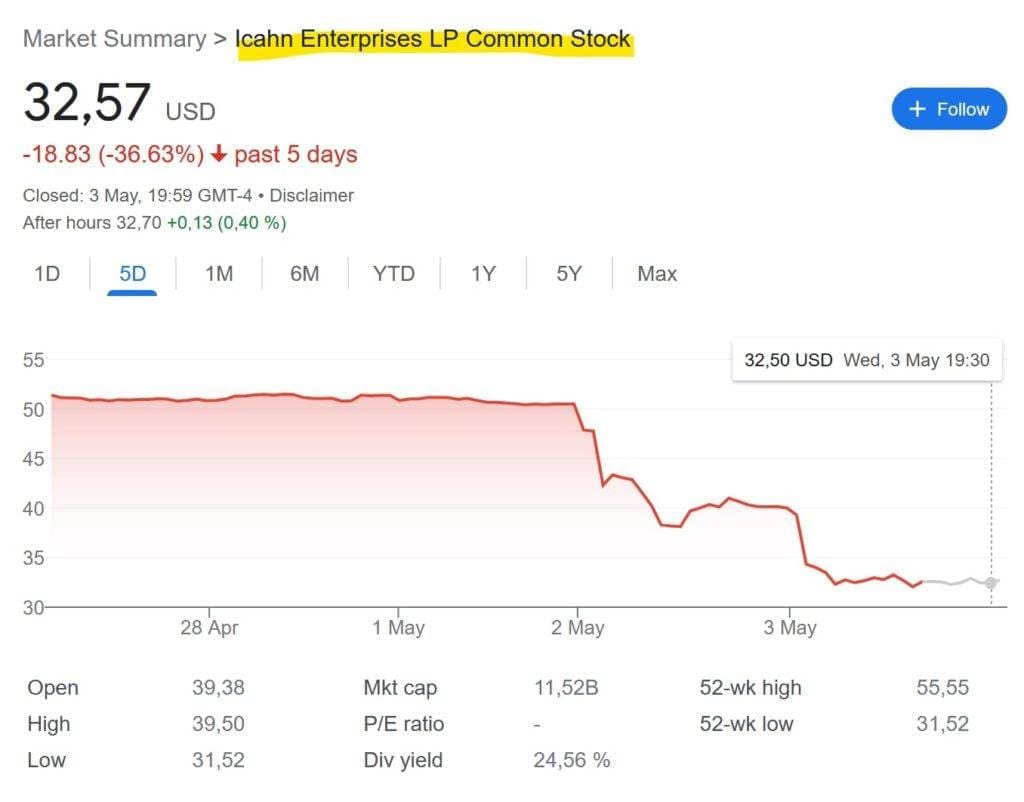

The short-sellers behind Hindenburg Research have struck again and, this time, found a very prominent victim. The target of their revelations is the company of legendary corporate raider and activist investor Carl Icahn. Icahn Enterprises (IEP) is an $18 billion market cap holding company. Icahn and his son Brett own approximately 85% of the company. The company’s shares have lost more than 36% since the Hindenburg revelations.

The Hindenburg report accuses IEP of overvaluing its assets and using a “Ponzi-like” structure to pay dividends.

Icahn has been using money taken in from new investors to pay out dividends to old investors

Hindenburg Research (link)

The report caused IEP shares to plummet, causing Icahn’s net worth to collapse. According to the Bloomberg Billionaires Index, Icahn’s net worth fell by 41% to $14.6 billion in 24 hours.

Carl Icahn responded in an IEP statement, calling Hindenburg‘s report “self-serving” and claiming that it was designed to benefit Hindenburg’s profits at the expense of IEP’s long-term shareholders. Icahn also stated that IEP‘s performance will speak for itself in the long run, as it always has, and that the company stands by its public disclosures.

Hindenburg compared IEP to all 526 U.S.-based closed end funds (CEFs) in Bloomberg’s database. Icahn Enterprises’ premium to NAV was higher than all of the others and more than double the next highest we found.

According to Hindenburg, IEP‘s units are significantly overvalued by over 75%. In addition, IEP trades at a 218% premium to its last reported net asset value (NAV), which is much higher than its comparable peers, such as Dan Loeb‘s Third Point Investors Ltd and Bill Ackman‘s Pershing Square Holdings Ltd, who trade at a discount to their respective NAVs. NAV is an important measure of a fund’s performance, as it calculates the market value of the securities held by the fund.

Hindenburg also argues that the high dividend yield of 15.8% for IEP‘s stock drives the excessive valuation. They accused Icahn of inflating the dividend yield by taking his own dividend in stock instead of cash and pressuring IEP to sell new stock to meet the shareholder payouts.

Icahn has been using money taken in from new investors to pay out dividends to old investors, […] Overall, we think Icahn, a legend of Wall Street, has made a classic mistake of taking on too much leverage in the face of sustained losses: a combination that rarely ends well.

Hindenburg Research (link)