In March 2021, Ray Akhavan and Ruben Weigand were found guilty of bank fraud in the Eaze scheme that deceived financial institutions in the U.S. into effectuating more than $150 million of credit/debit card purchases of marijuana. They disguised those transactions as purchases of other kinds of goods, such as face creams and dog products. Akhavan and Weigand were sentenced to 30 and 15 months in prison, respectively. Allegedly, ING subsidiary Payvision and its U.S. partner T1 Payments operated a similar scheme between 2016 and 2021.

Miscoding Is Bank Fraud

In the Eaze case, the U.S. court found that manipulation of the so-called Merchant Category Codes (MCC) as well as the country of origin with the purpose of concealing the true location of the merchants as well as the kind kind or products sold qualifies as bank fraud. This is clearly more than “just” money laundering.

Allegations Against Payvision And T1 Payments

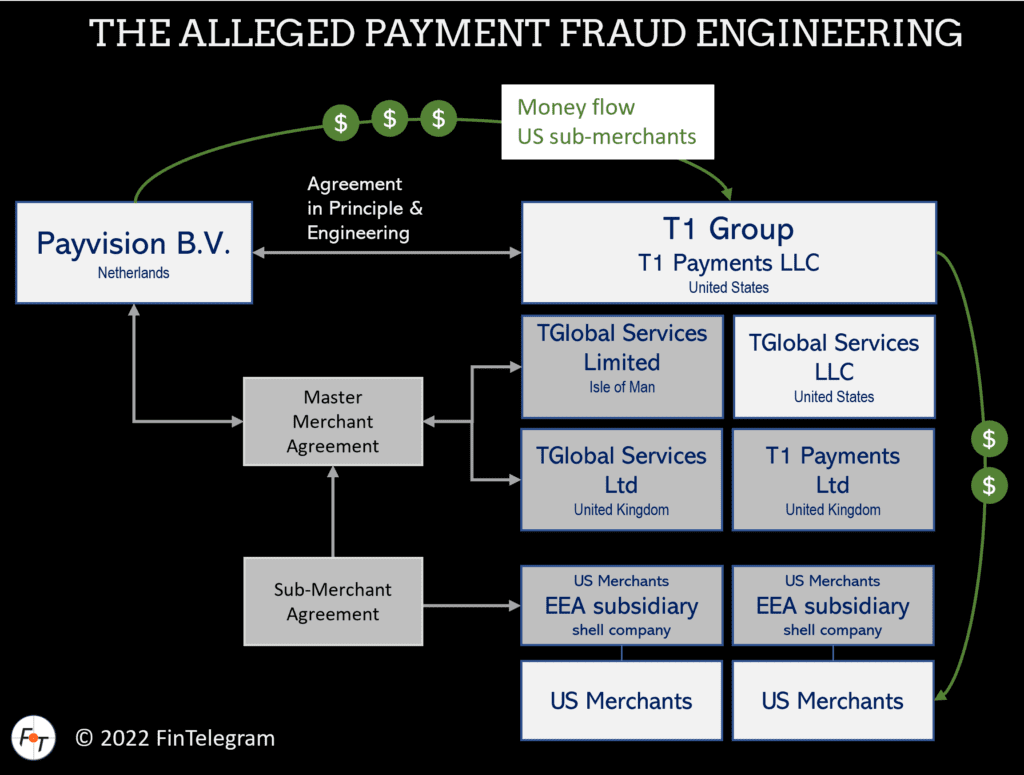

According to a statement of facts established by the European Funds Recovery Initiative (EFRI), ING subsidiary Payvision and its U.S. partner T1 Payments were also involved as payment processors in the U.S. drug scene. Like in the Eaze case, T1 Payments and Payvision are said to have deliberately hidden the true nature of the transactions through MCC manipulations in combination with building overseas aggregators.

Marijuana is listed as a Schedule I drug by the U.S. Food & Drug Administration (FDA) and is, therefore illegal under federal law. Accordingly, U.S. banks and credit card associations (Visa, Mastercard, Discover, American Express, etc.) have firm policies against their cards being used for illegal drug sales. The U.S. DEA has considered labeling Kratom a controlled substance. Like marijuana, the purchase and sale of kratom in the U.S. are prohibited in some states. Kratom is also banned in some European and Asian countries.

Credit card networks do not have drug-related merchant codes. To process payments for marijuana or Kratom, a false merchant code, i.e., a merchant code associated with a different product or product category (very often non-high-risk) – would have to be used. This approach is known as miscoding resp. transaction laundering.

Allegedly, T1 Payments established phony companies in Europe for the U.S. drug merchants with the sole purpose of processing card transactions for the sale of on-demand CBD and Kratom products via its partner Payvision. According to a dispositition delivered by Donald Kasdon/T1 Payments, Payvision instructed him to set up the overseas structure. The ING subsidiary allegedly processed payment transactions for CBD and/or KRATOM products for U.S. merchants from at least 2017 up to and including May 2021.

According to the EFRI statement, T1 payments has facilitated about 90% of the US Kratom businesses with its payment services. Hundreds of KRATOM merchants got onboarded by T1payments and Payvision.

Read more about the U.S. high-risk business of Payvision and T1 Payments here.

Comparable to Ray Akhavan and Ruben Weigand in the Eaze scheme, T1 payments LLC acted as a middleman and merchant between the actual US drug retailers and processed the illicit payments via its partner Payvision. Some of the clients of this scheme were GAIA Ethnobotanicals, Diamond CBD, and Sarah Grauert.

U.S. Court Cases

Some of the drug merchants felt defrauded by T1 Payments and Payvision and sued in the U.S. The following legal claims of drug-related merchants and former clients have been brought against T1 payments and/or Payvision in the U.S.

- First Capital Venture Co. d/b/a Diamond CBD, Ltd., Case No. A-21- 834626-B brought on 14 May 2021 a claim for 0.6 million USD resulting from a payment processing agreement entered into on May 2017 for CBD products and lasting until Mai 2021.

- Sarah Grauert, and by HANNAVAS Enterprises LLC, Delaware, Case No. 2.20-cv-00411-KJD-VCF brought a claim on 27 February 2020 regarding the retention (early termination fee) of 1 million USD resulting from a Payment Processing Agreement for Online Cannabis products stores (http://www.bionicbliss.com) (settled 11

- GAIA Ethnobotanical LLC, Nevada Case 2:22-cv-01046-CDS-NJK brought on 2 July 2022 a legal claim for approximately 0.4 million USD resulting from a Payment Processing agreement for Kratom (drug) products entered on 12 August 2020 and terminated on 28 May 2021.

Payvision has already settled some of the U.S. lawsuit cases without disclosing details. A guarantee has allegedly been drawn against T1 Payments.

The Legacy

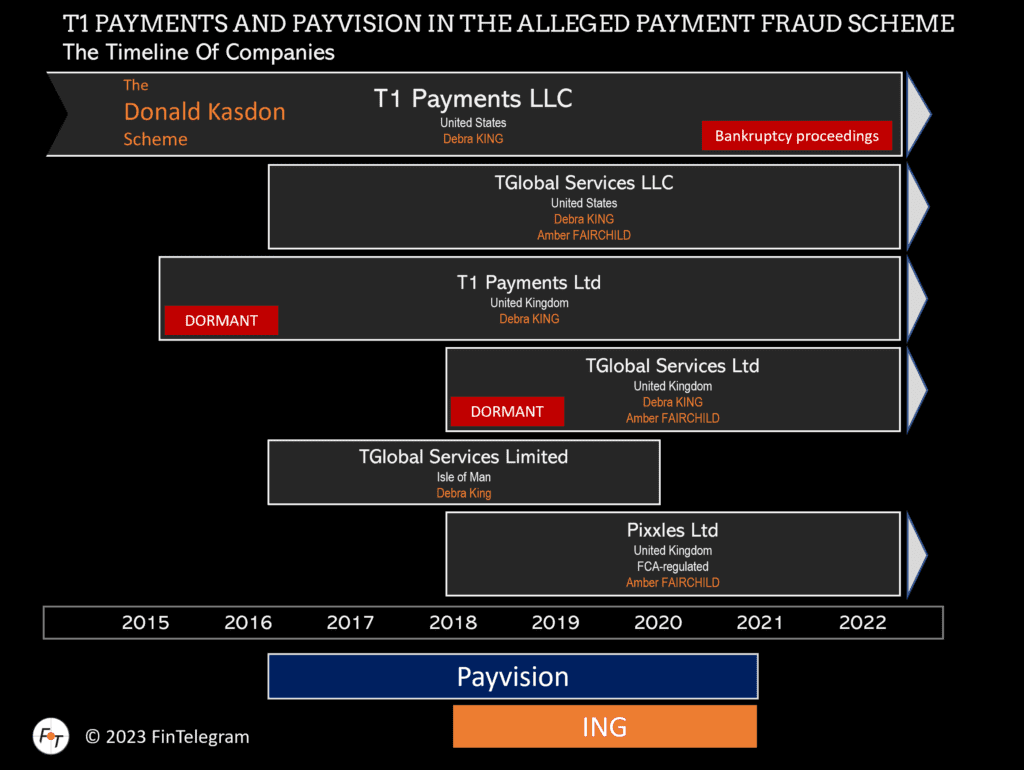

The payment scheme was set up by the CEOs of T1 Payments and Payvision, Donald Kasdon and Rudolf Booker, in 2015. Court documents show that Payvision CEO Rudolf Booker is said to have personally advised his new partner Kasdon on the establishment of European companies.

U.S. dealings with drug merchants continued even after ING acquired Payvision in early 2018. It was not until sometime in 2021 that ING was likely to have run out of steam. Rudolf Booker and his co-founders left Payvision in April 2020. His successor as CEO, Andre Valkenburg, has apparently continued to run the business with T1 Payments until 2021.

Against the background of the U.S. lawsuits, there was massive turmoil between T1 Payments and ING/ Payvision. Donald Kasdon claimed to FinTelegram that ING was, of course, always aware of Payvision‘s U.S. business and its risks. In December 2022, Kasdon initiated Chapter 7 bankruptcy proceedings in the U.S. for his T1 Payments (report here).

Willfull blindness

An audit report submitted by the Dutch Supervisory Authority (DNB) to the management of Payvision on October 8, 2020, stated that an on-site audit carried out had established

o that the company has been in serious breach of the Sanctions Act, the Financial Supervision Act and the Money Laundering and Terrorist Financing Act (Wwft) since at least 2015,

o fraud signals were deliberately ignored and some of its customers were deliberately not screened,

o furthermore, customer checks and compliance with anti-money laundering regulations were systematically neglected.

Whereby explicitly stated in DNB’s report that the company’s violations were still ongoing at the time of filing the report, despite a (alleged) purge by the company’s new top management (meaning Valkenburg and Terpstra).

In accordance with its legal obligation, DNB already filed a criminal complaint with the FIOD (Fiscal Information and Investigation Service) at the beginning of 2021, and in May 2022 a house search took place at Payvision, Amsterdam.

.

Share Information

If you have any information about T1 Payments, Payvision, and their business, please let us know through our whistleblower system, Whistle42.