Introduction to the GreyMountain Management Case

The case involving GreyMountain Management (GMM), entwined with the notorious Wirecard scandal, represents a critical episode in the landscape of binary options fraud and the early fintech period. This matter delineates a convoluted international endeavor characterized by deceptive binary options schemes and intricate financial transaction manipulations. We observe ongoing regulatory and legal scrutiny, notably from the U.S. Commodity Futures Trading Commission (CFTC) and Canadian authorities, against GMM‘s operations and its directors, underscoring the complexity and breadth of this fraud.

Examination of the Dublin-Based Fraud Operation

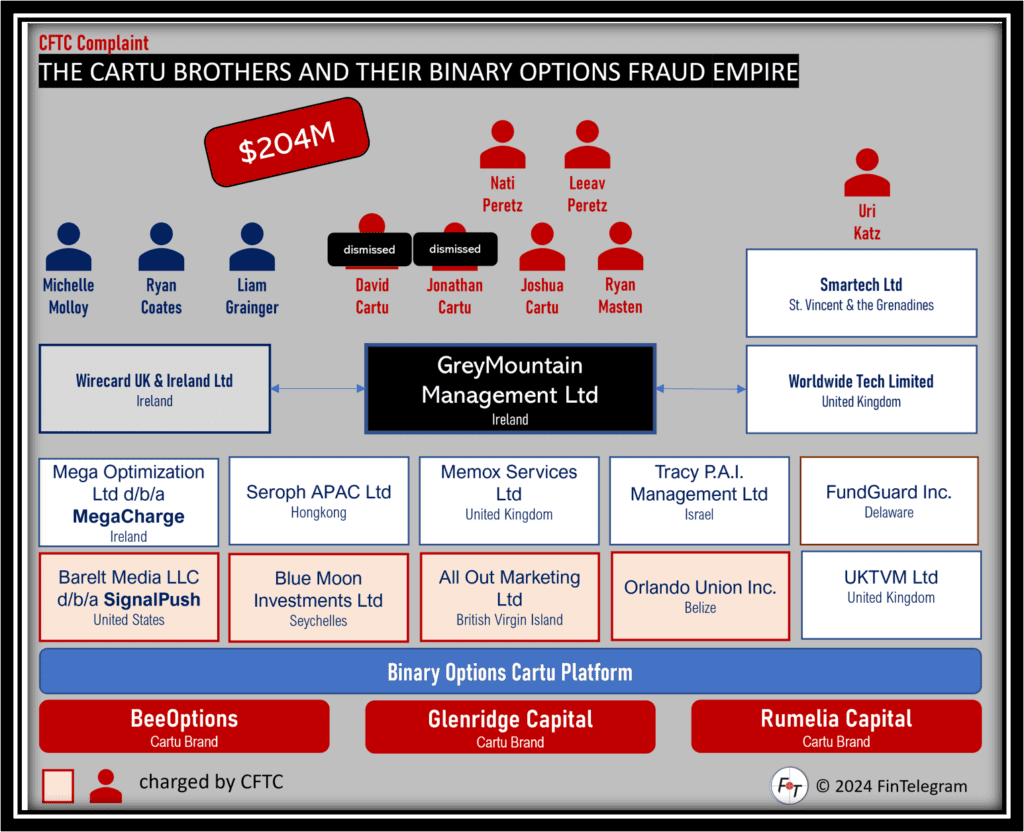

At the heart of this investigation lies the Dublin-based entity GreyMountain Management (GMM), orchestrated by the Cartu brothers David Cartu, Joshua Cartu, and Jonathan Cartu. This binary options fraud scheme’s linkage with the defunct German fintech entity, Wirecard, which collapsed in June 2020, is particularly alarming. This alliance facilitated a sprawling network that spanned several nations, engaging in fraudulent binary options activities and convoluted financial transactions aimed at concealing the movement of illicit proceeds.

Regulatory Actions and Legal Proceedings

The severity of GMM‘s fraudulent activities has prompted substantial regulatory interventions. The CFTC’s fraud complaint in September 2020 resulted in the imposition of monetary sanctions against the legal entities and individuals behind GMM in March 2024. This punitive measure highlights the significant efforts by regulatory bodies to dismantle such advanced fraudulent frameworks. Additionally, whistleblower awards connected to the GMM scheme have been announced, illustrating the critical role of insider disclosures in uncovering and addressing financial fraud.

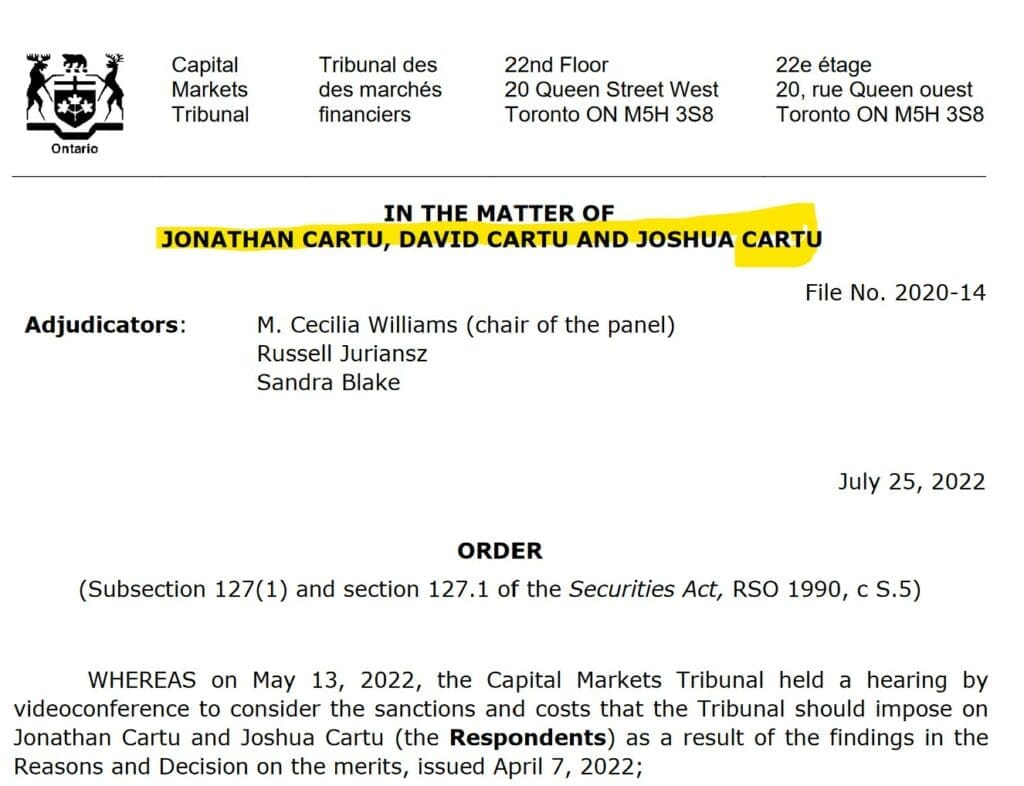

In Canada, the Ontario Securities Commission (OSC) has pursued actions against the Cartu brothers for their involvement in binary options fraud, culminating in significant financial penalties and operational bans. In May 2021, OSC settled with David Cartu, who agreed to a seven-year ban and a CAD 300,000 penalty. Later, Ontario’s Capital Markets Tribunal ordered Jonathan Cartu and Joshua Cartu to pay CAD 3.3 million. These regulatory responses underscore the international scope of the efforts to combat the fraudulent activities associated with GMM.

The GMM and Wirecard Symbiosis

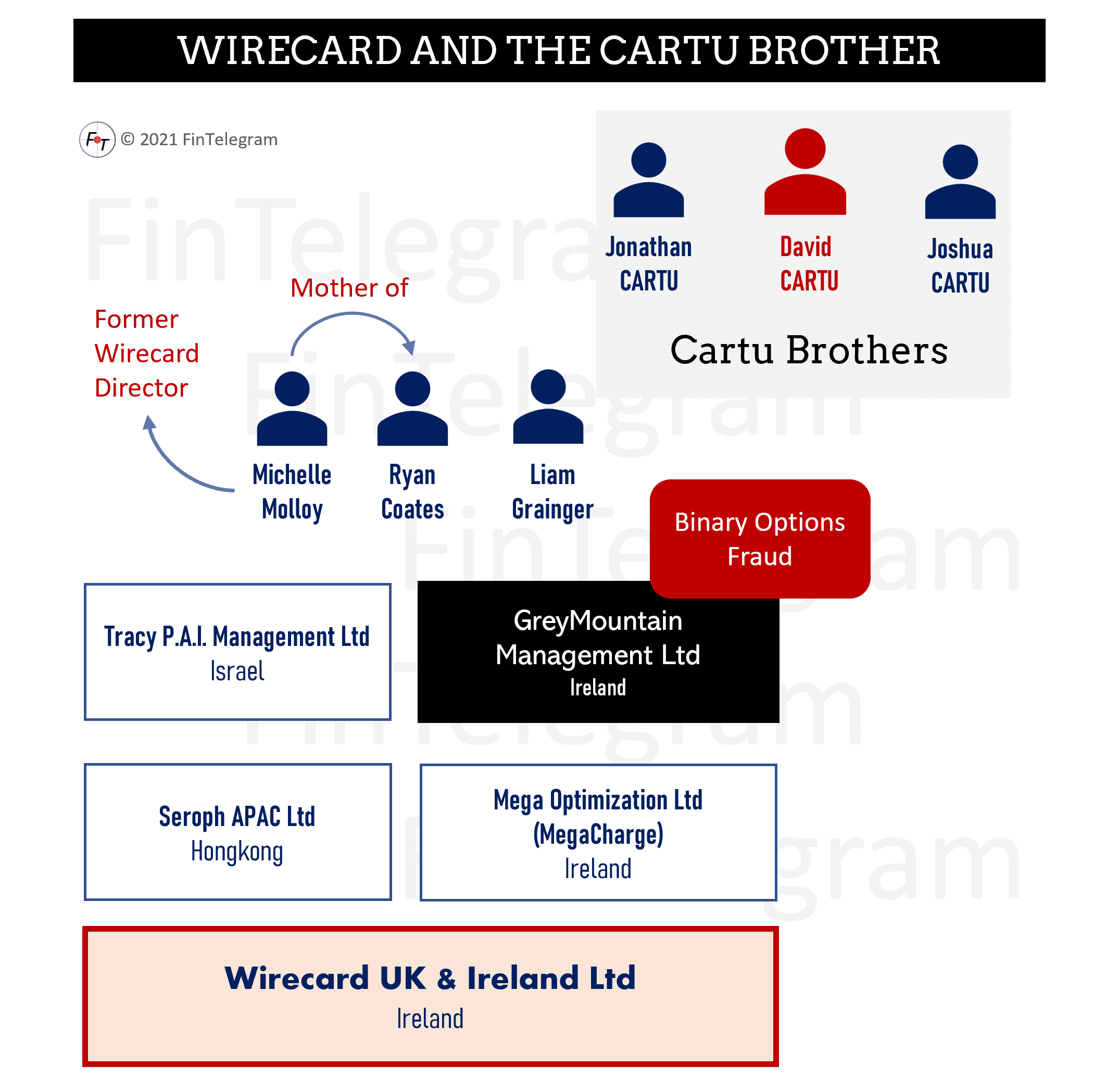

The association between GreyMountain Management and Wirecard suggests a mutually beneficial relationship that exploited Wirecard’s payment processing capabilities to further GMM‘s binary options fraud schemes. The shared operational base in Dublin and personnel connections between GMM and Wirecard accentuate the depth of their collaboration. Legal actions of betrayed investors against GMM directors in Ireland, revealing the siphoning of funds by the Cartu brothers, highlight the dire financial implications for investors and the subsequent legal accountability of the involved parties.

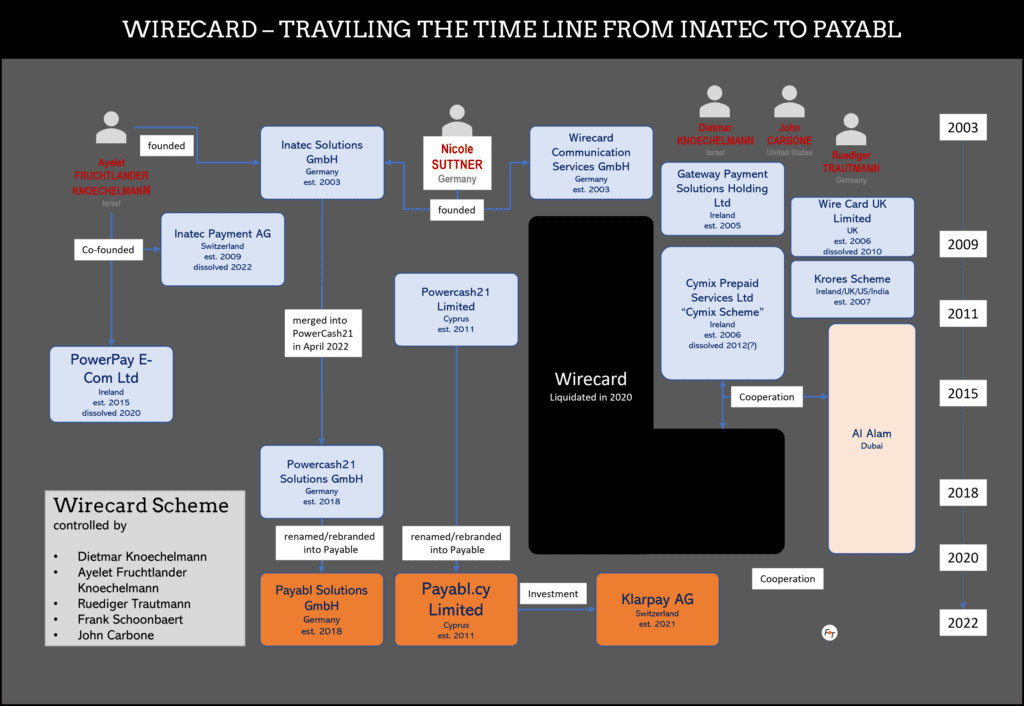

The direct connection between GMM and Wirecard was the then Wirecard UK & Ireland CEO Michelle Molloy. Her son, Ryan Coates, worked at GMM through her agency. Molloy later moved to the Cartu brothers at short notice after leaving Wirecard. Both companies had their offices in the same office building in Dublin. Molloy was hired by then Wirecard top executive Dietmar Knoechelmann. Knoechelmann left Wirecard shortly afterward but continued to work in the Wirecard network via PowerCash21, which he founded together with former Wirecard COO Ruediger Trautmann in 2011.

PowerCash21 became the Payabl Group in 2022. Today, it operates with the Wirecard business model as a high-risk payment processor via a payment license in Cyprus.

The Broader Implications of Binary Options Fraud

The binary options market, emerging from the Israeli online gambling sector in 2010 and later reclassified as a financial instrument, has been fraught with fraudulent activities, leading to substantial financial losses for retail customers worldwide. Regulatory bans in Israel and the EU reflect the significant investor protection concerns and the concerted efforts to curb such deceptive practices.

Conclusion and Legal Queries

The intricate web of operations linking GMM and Wirecard amidst the broader binary options fraud landscape invites further legal scrutiny and raises pivotal questions regarding the efficacy of regulatory frameworks in preempting such schemes. The persistence of such fraudulent activities necessitates a reevaluation of the current regulatory measures and a call for enhanced international cooperation to safeguard the financial system against sophisticated fraud schemes. The legal proceedings and regulatory actions to date represent only a portion of the comprehensive response required to address the multifaceted challenges posed by binary options fraud and associated financial crimes.