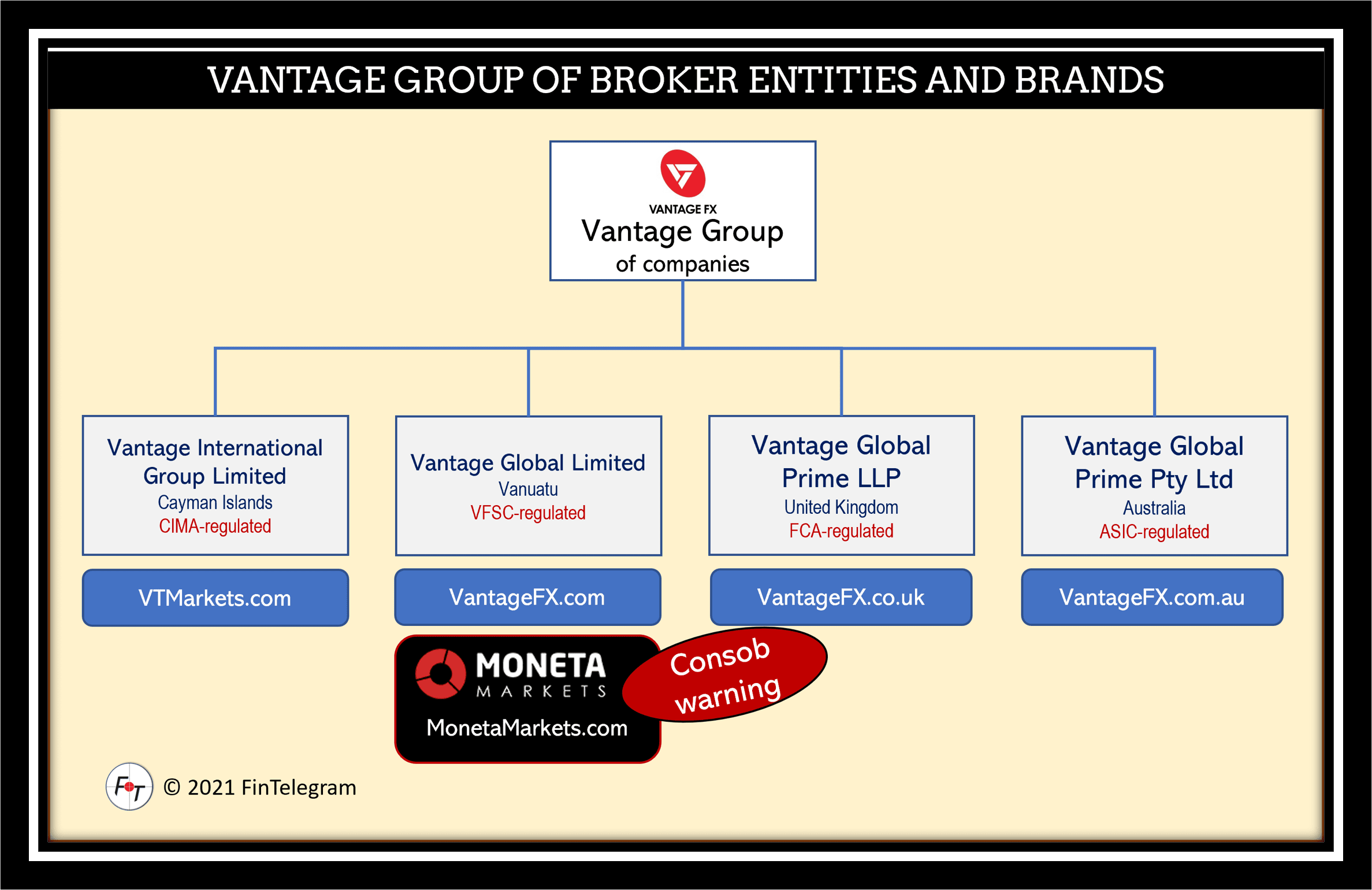

We recently communicated with David Bily (LinkedIn), founder of forex and CFD offshore broker Moneta Markets (www.monetamarkets.com), to get the background of Vantage Group of companies. David confirmed that Moneta Markets is operated as a white label solution of Vantage Group by Vanuatu-based and VFSC-regulated offshore entity Vantage Global Limited. David opined that a license or permission would not be required for Moneta Markets in the EU. However, Consob sees differently and recently issued a warning against Moneta Markets and Vantage Global Limited.

Key data

| Brands | Vantage FX, Moneta Markets |

| Domain | www.monetamarkets.com |

| Legal entities | Vantage Global Prime LLP, UK, regulated by FCA Vantage Global Prime Pty Ltd, Australia, regulated by ASIC Vantage Global Limited, Vanuatu, regulated by VFSC Vantage International Group Ltd, Caymen Islands, regulated by CIMA |

| Jurisdictions | UK, Australia, Vanuatu, Caymen Islands |

| Platform | PandaTS |

| Related individuals | David Bily, Moneta Markets |

| Warnings | Consob |

The narrative

According to David Bily, Moneta Markets operates as an independent broker within the Vantage Group and follows its own course. A license from an EU regulator would not be required, as Moneta Markets would not allow the onboarding of consumers if they came from regulatory regimes that require a permit.

However, as residents of EU member states, we had no problem to registering and onboarding with Moneta Markets and would have been able to make deposits using credit and debit cards or via cryptocurrencies. Moneta Markets also offers EU consumers leverage of up to 500:1, which is a multiple of what is allowed in ESMA‘s regulatory regime. Moneta Markets, therefore (a) has no permission to operate in the EU and (b) furthermore violates regulatory requirements with its offer.

Apparently, the Italian regulator shares our view and/or experience and issued a corresponding investor warning combined with a cease and desist order on December 16, 2021 (resolution no. 22128 of 16 December 2021).