Capital Street FX is an offshore broker allegedly operated by Capital Street Intermarkets Limited in Mauritius. The company is registered with the FSC Mauritius as an Investment Dealer. Technology and payment services are provided through UK-registered Minus Zero Technologies Limited. It is an Indian broker scheme also believed to have an office in Dubai. Capital Street FX does not have authorization for North America, Australia, or EEA. Here is our initial review.

Key Data

| Trading name | Capital Street FX |

| Activity | Multi-asset broker |

| Domains | CapitalStreetFX.com |

| Social media | |

| Legal entity | Capital Street Intermarkets Limited (Mauritius) Minus Zero Technologies Limited (UK) |

| Jurisdictions | UK, Mauritius, India |

| Authorization | FSC Mauritius with license no C112010690 |

| Contact | +1 (949) 391 1002 support@capitalstreetfx.com |

| Leverage | up to 1:1000 (FSC Mauritius) |

| Payment options | Credit/debit card, bank wire, e-wallets, crypto |

| Payment processors | Advcash, Perfect Money, utrust Virtual Pay Mauritius Commercial Bank Ltd |

| Related individuals | Akash Kaushal (LinkedIn) Himanshu Sharma (LinkedIn) Vijay Jaiswal (LinkedIn) |

Short Narrative

In our review on Feb 1, 2023, we registered as an EEA resident with the Capital Street FX without any problems. The EEA countries, Australia, and most other jurisdictions worldwide are included in the drop-down menu, suggesting that these are target markets.

Pre-KYC & Leverage

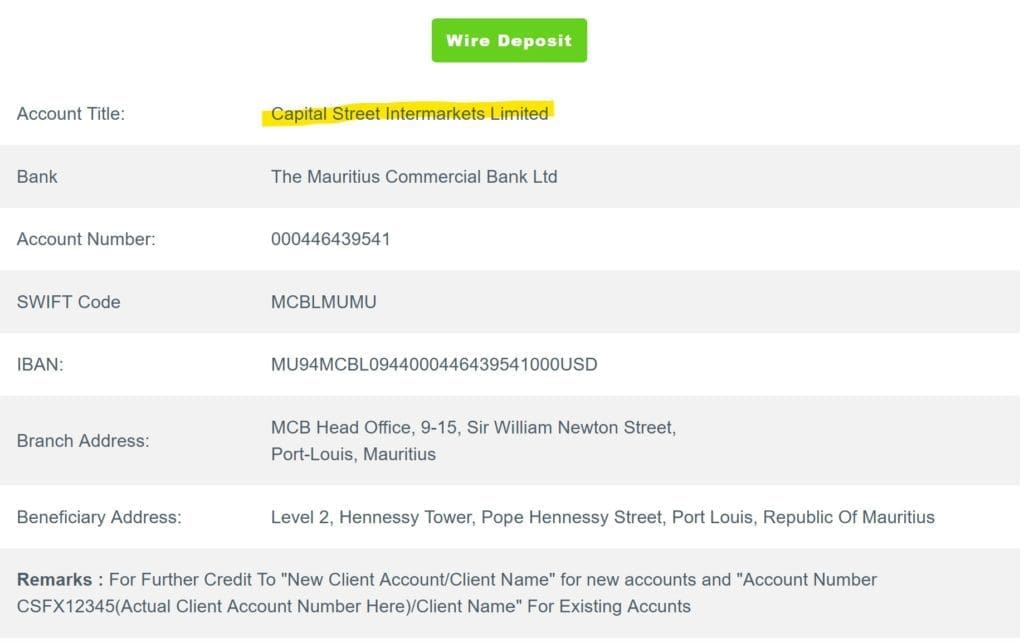

Even before the KYC check with identity and address verification, we could have theoretically made unlimited crypto deposits, or via bank wire, to the Capital Street FX bank account maintained with Mauritius Commercial Bank Ltd. This approach of theoretically unlimited pre-KYC deposits violates the regulatory framework of ESMA and CySEC.

As payment processors, we again found the usual suspects such as Virtual Pay, Advcash or Perfect Money, in addition to the Mauritius Commercial Bank for bank transfers. Crypto deposits can also be processed via utrust.

By registering with the offshore mutation, EEA customers also have an account with a leverage of up to 1:1000. Retail brokers in ESMA’s regulatory regimes are allowed to offer retail clients a maximum of 1:30 leverage. In this respect, Capital Street FX also violates the regulatory provisions.

Preliminary conclusion

We generally advise retail traders not to work with offshore brokers, even if they are not a scam, especially in high-risk segments like CFD, forex, or crypto. As a client of an offshore broker, EEA residents are also not entitled to investor compensation schemes or financial aid from Financial Ombudsman Services. Stay away!

Share Information

If you have information about Capital Street FX, its operators, and its facilitators, please share it with us via our whistleblower system, Whistle42.