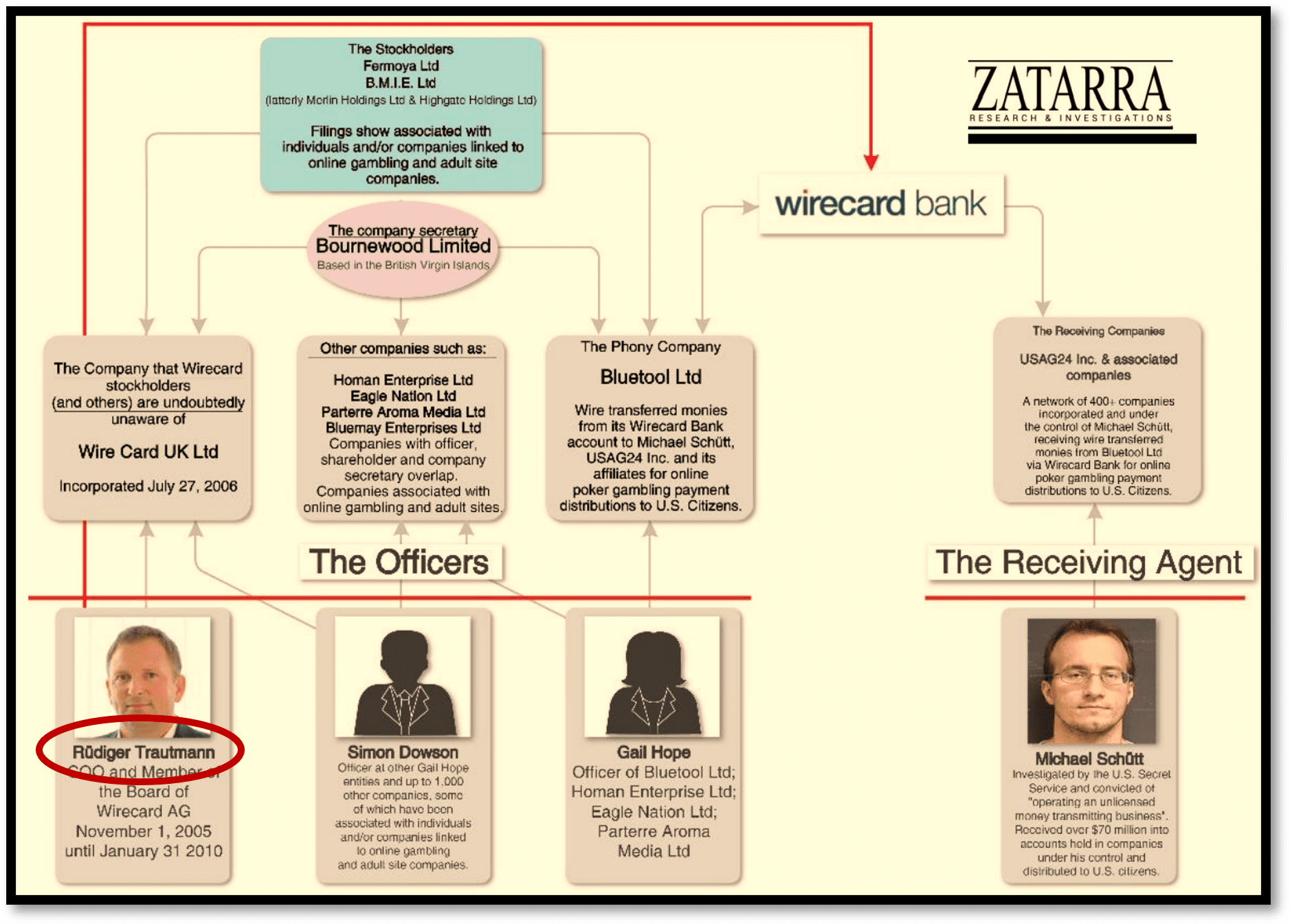

The German Ruediger Trautmann was Wirecard’s COO between 2005 to 2010. According to the Zatarra Report, Trautmann incorporated numerous undisclosed companies in the Wirecard scheme during his tenure. One of these satellite companies was Wire Card UK Limited, where he served as a director from 2006 until its dissolution in 2010. This Wire Card UK did not belong to the German Wirecard Group but was part of the scheme. The similarity of the names was probably no coincidence.

Fraser Perring refers to the above arrangement as the “Trautmann set-up” and sets out in his analysis that this was an undisclosed entity in the Wirecard scheme. The company shares were held by Fermoya Ltd in Tortola, BVI, and B.M.I.E. Limited in Essex, UK.

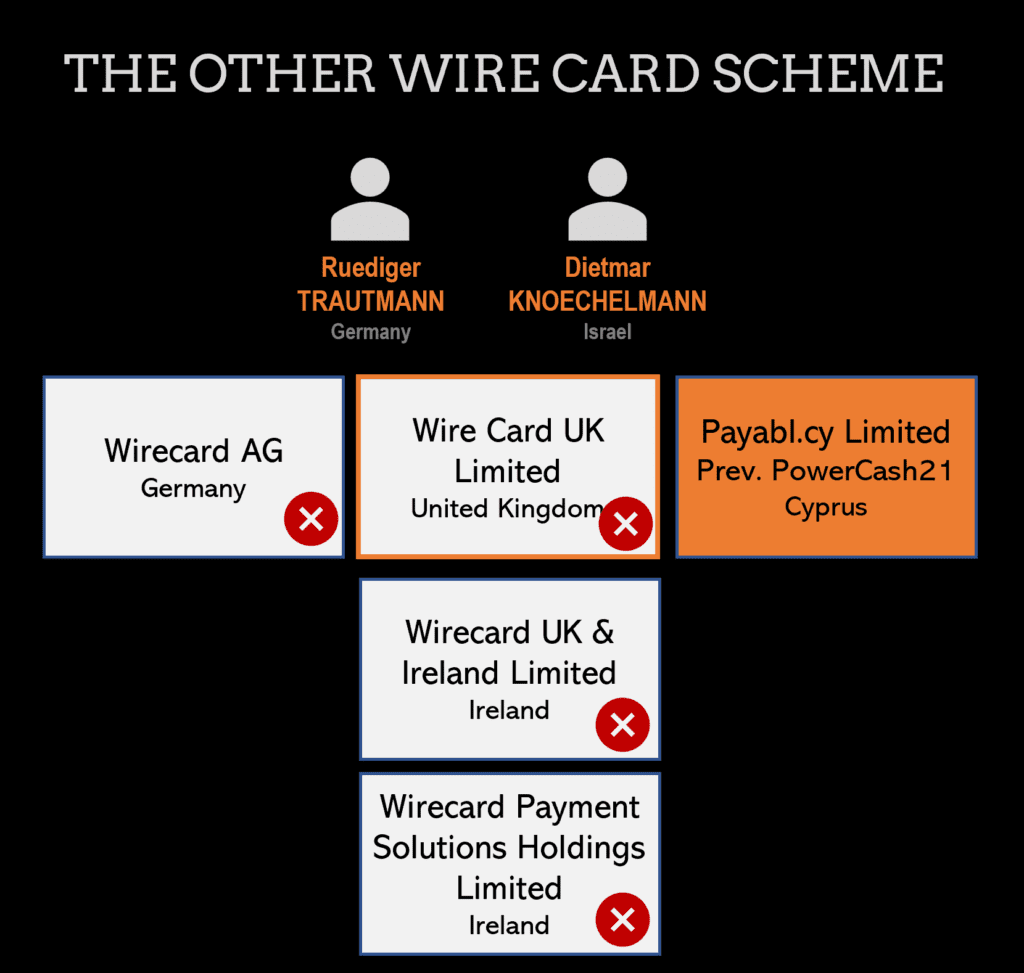

In addition to Trautmann’s Wire Card UK, there was also the official Wirecard UK & Ireland Limited in Dublin, Ireland, founded by Dietmar Knoechelmann, CEO of Wirecard Payment Solutions in Ireland until 2009. Trautmann and Knoechelmann were partners for many years. During their time as executives of the Wirecard Group they also had functions and shares in satellite companies in the Wirecard scheme.

In 2010, Dietmar Knoechelmann and Ruediger Trautmann then founded the Payabl Group, which operated as PowerCash21 until 2021. According to the Zatarra Report, the former PowerCash21 and Inatec, which were controlled by Trautmann and Knoechelmann, were also satellite companies in the Wirecard scheme. In 2022, PowerCash21 and Inatec merged into the “new” Payabl.

In this early phase of the Wirecard scheme until 2010, Trautmann and Knoechelmann allegedly sold some companies to Wirecard, the Zatarra Report suggests. Both were also involved in the Wirecard scheme after they departed from the Wirecard Group.