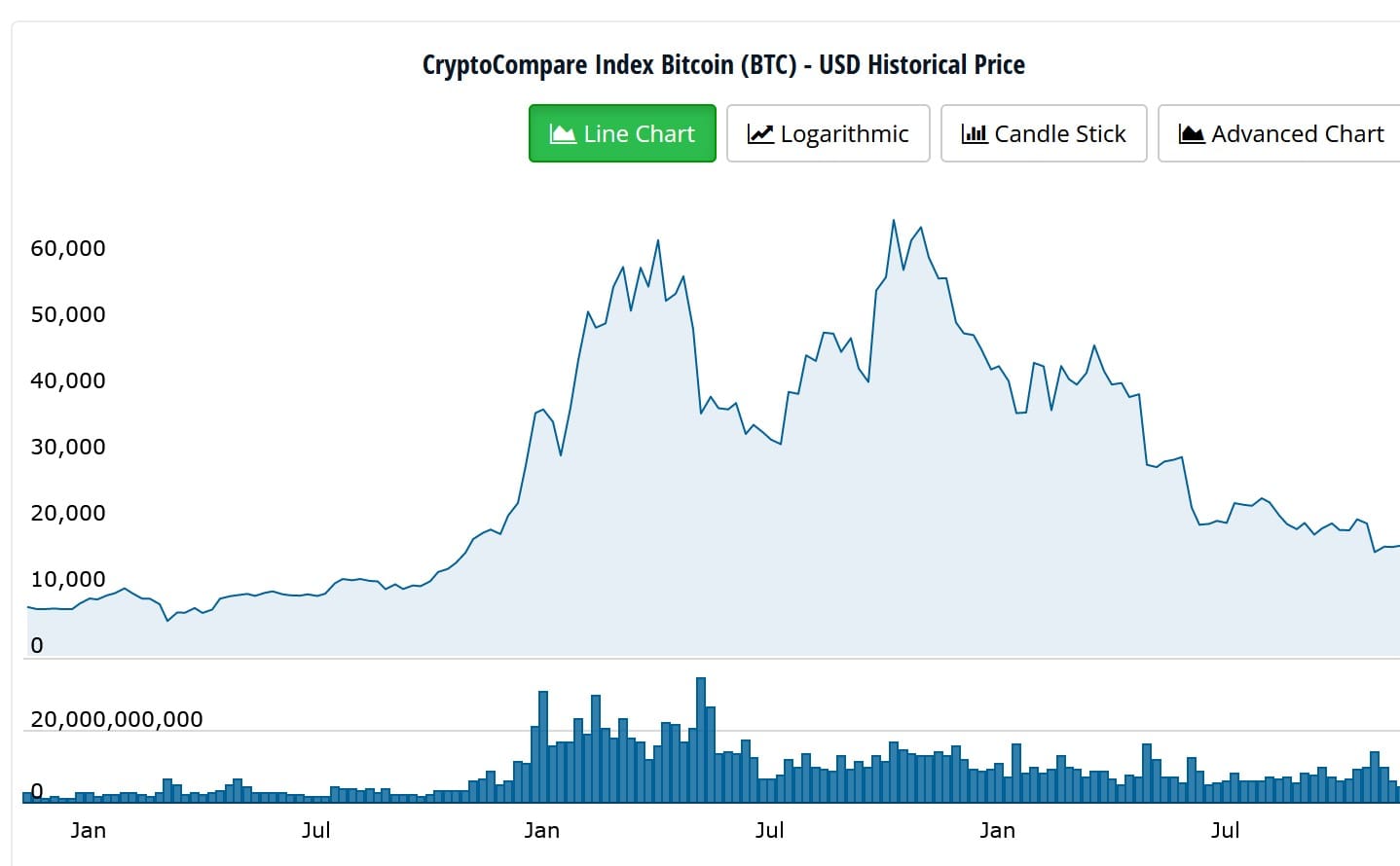

According to a European Central Bank (ECB) report, the current price of BTC is an artificially induced last gasp before the road to irrelevance. BTC peaked at $69,000 in November 2021 before falling below $17,000 in November 2022. Since Bitcoin appears to be neither suitable as a payment system nor as a form of investment, it should be treated as neither in regulatory terms and thus should not be legitimized, the ECB report argues.

Legislation on crypto assets has sometimes been slow to ratify in recent years, and implementation often lags behind. The different regulatory regimes are not proceeding at the same pace and with the same ambition. While the EU has agreed on a comprehensive regulatory package with the Markets in Crypto-Assets Regulation (MICA), Congress and the federal authorities in the US have not yet been able to agree on coherent rules.

The report’s authors argue that blockchain technology has so far created limited value for society. Moreover, the Bitcoin system is an unprecedented polluter. The entire Bitcoin system would generate as much e-waste as the entire Netherlands. This inefficiency of the system would not be a flaw but a feature. The financial industry should be wary of the long-term damage of promoting Bitcoin investments.