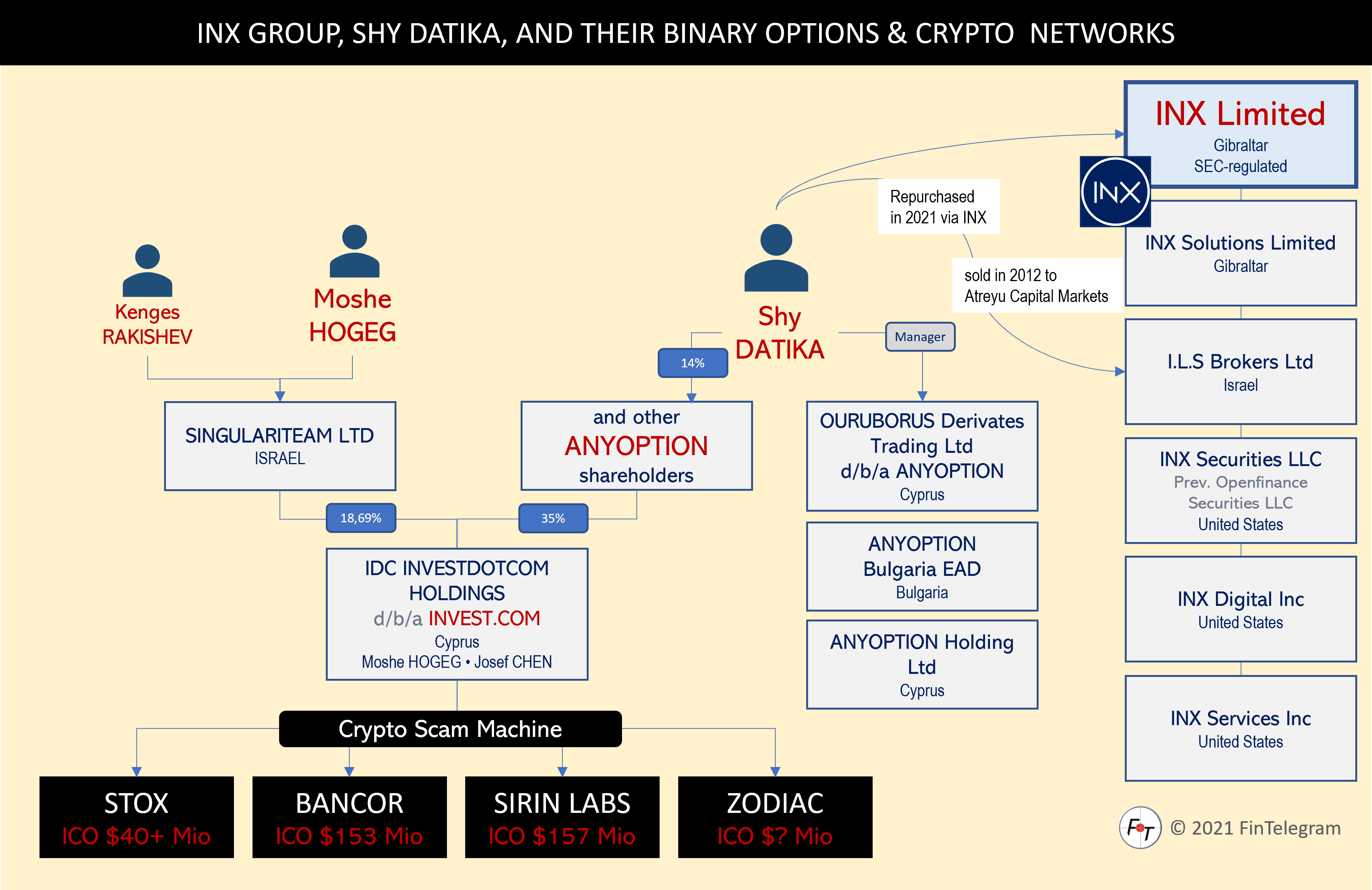

In April 2021, the Israeli INX Group closed its IPO with $83.6 million in gross proceeds from over 7,300 retail and institutional investors. 92.9M INX Tokens were sold in the IPO for $0.90. The first SEC-registered security tokens offering in the U.S. INX acquired I.L.S Brokers and Openfinance; and launched its INX Securities a/k/a Openfinance crypto trading platform (securities.inx.co), which approved the listing of its own INX Token. INX co-founder Shy Datika is a binary options veteran and used to run Anyoption until he sold the binary options scheme to notorious Israeli crypto activist Moshe Hogeg (see report here).

The cleaned track record

On LinkedIn, Shy Datika fails to mention his Anyoption activities. Although he has been the driving force there for more than nine years, this evidently is not important or pleasant for him. Of course, IDC or Moshe Hogeg are not mentioned either. It is telling that the founder and president of the issuer of the first SEC-registered security token is keeping quiet about his crypto past. It isn’t?

At this point, we would like to explicitly state that we consider the INX idea and the establishment of a marketplace for (security) tokens to be excellent and forward-looking. Only the fact that the operator is covering up his past in exactly this context has to be questioned.

Forex and binary options

According to the SEC filing, Shy Datika is the founder and CEO of I.L.S Brokers Ltd, a Tel-Aviv-based broker. He, too, was involved as an executive of ForexManage Ltd, eTrader, or Anyoption. In 2012, Datika sold I.L.S Brokers to Tel Aviv-listed Leader Capital Markets Ltd (now Atreyu Capital Markets Ltd). Datika was a co-founder and principal of the binary options outlet Ouroboros Derivatives Trading Ltd, a CySEC-regulated investment firm d/b/a Anyoption (www.anyoption.com).

Anyoption and crypto

Anyoption was co-founded in 2008 by Shy Datika, who also ran the company as CEO. In June 2017, Cyprus-based IDC Investdotcom Holdings Ltd (IDC), controlled by Moshe Hogeg (pictured right with Lionel Messi), “sort of” acquired Anyoption and its affiliated companies. Back then, Finance Magnates reported that Anyoption shareholders would receive

- a $3.5 million cash payment,

- 35 percent of the shares of IDC, and

- $1 million worth of Stox (STX) tokens.

In return, IDC was to receive access to Anyoption’s customer list. IDC allegedly understood at the time that Anyoption had $7 million available capital. This transaction certainly marked Datika’s entry into the crypto space. Later, Hogeg filed a lawsuit against Datika and/or his entities in Cyprus, claiming that there was no capital left in Anyoption and that the company was insolvent. Datika subsequently sued Hogeg in Israel because the latter would not pay what was agreed. Whatever!

According to the Times of Israel, the transaction happened when it became clear that Israel would soon pass a law banning binary options. Datika’s sister, Liora Shimoni, happens to be a top official in the office of the State Comptroller, the government body whose role is to be a watchdog against corruption.

INX and back to the roots

According to its recent press release on June 15, 2021, INX acquired Datika’s I.L.S Brokers (www.ilsbrokers.com) for $4.74M “to expand INX’s global institutional reach.” This brings Shy Datika‘s past full circle, which is apparently currently manifesting itself in the INX Group. Except for Anyoption, IDC, and Moshe Hogeg. The SEC prospectus also does not mention that Datika and his group received Stox tokens as part of the sale of Anyoption to IDC. Although the prospectus describes the ICO hype of 2017/18 in detail, it simply neglects this detail. Whether or not the prospectus is accurate and complete within the meaning of applicable U.S. securities laws is up to the SEC to decide.