According to the SEC fraud complaint and a Reuters report, FTX manipulated its software to grant Alameda Research, the hedge fund owned by FTX founder Sam Bankman-Fried (SBF), special treatment, including a feature on that prevented the automatically sale of Alameda‘s assets if it was losing too much borrowed money. If these revelations are true, it disproves SBF‘s previous strategy that losing customer assets would have been just a mistake. This is classic fraud.

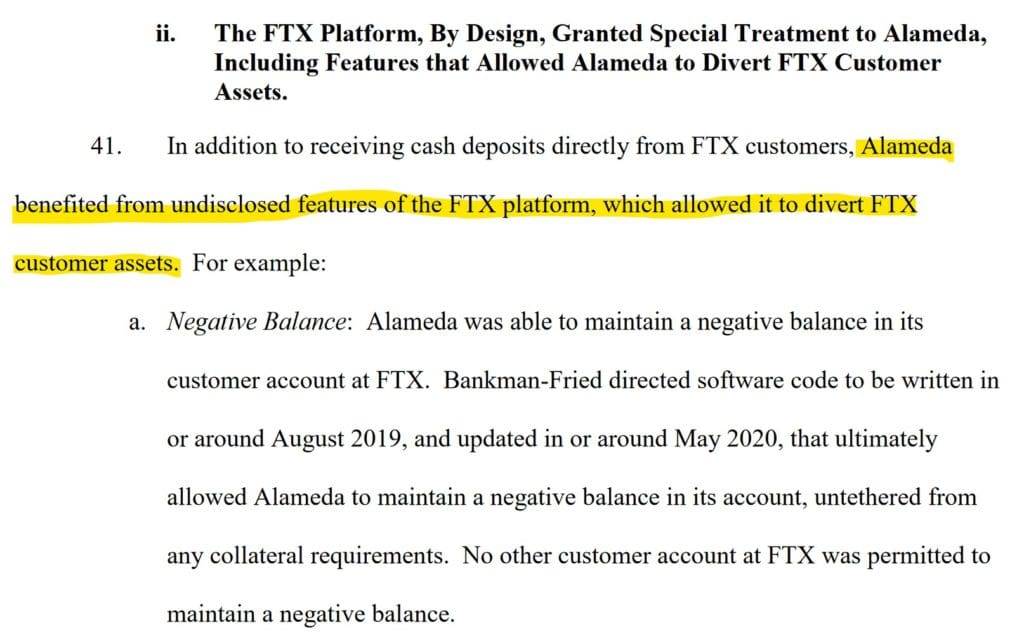

The software tweak allowed Alameda to keep borrowing funds from FTX irrespective of the value of the collateral securing those loans. The manipulated software ultimately allowed Alameda to maintain a negative balance in its account, untethered from any collateral requirements. No other customer account at FTX was permitted to

maintain a negative balance.

That tweak in the code got the attention of the U.S. Securities and Exchange Commission (SEC), which charged Bankman-Fried with fraud. According to the SEC complaint, “the FTX platform, by design, granted special treatment to Alameda, including features that allowed Alameda to divert FTX customer assets.“

The SEC said the tweak meant Alameda had a “virtually unlimited line of credit.” Furthermore, the billions of dollars that FTX secretly lent to Alameda didn’t come from its own reserves but were other FTX customers’ deposits, the SEC said.

It is currently not apparent how SBF can refute these allegations. Moreover, he has meanwhile been convicted several times in public as a liar. His credibility has clearly slipped into the red.