Malta is different. For sure, it is when it comes to regulation and compliance. Following the Paytah case, one fails to understand how the Malta Financial Services Authority (MFSA) and the Financial Intelligence Analysis Unit (FIAU) have failed to clamp down Phoenix Payments Limited d/b/a Paytah. Interpol investigates the MFSA-regulated high-risk payment processor, Paytah‘s former Chief Legal and Compliance Officer (CCO) claims. She is currently under the protection of the Maltese Whistleblower Act, but Paytah is still licensed. The public court documents show that she had her job terminated as soon as she raised material AML/KYC issues.

The Management and their companies

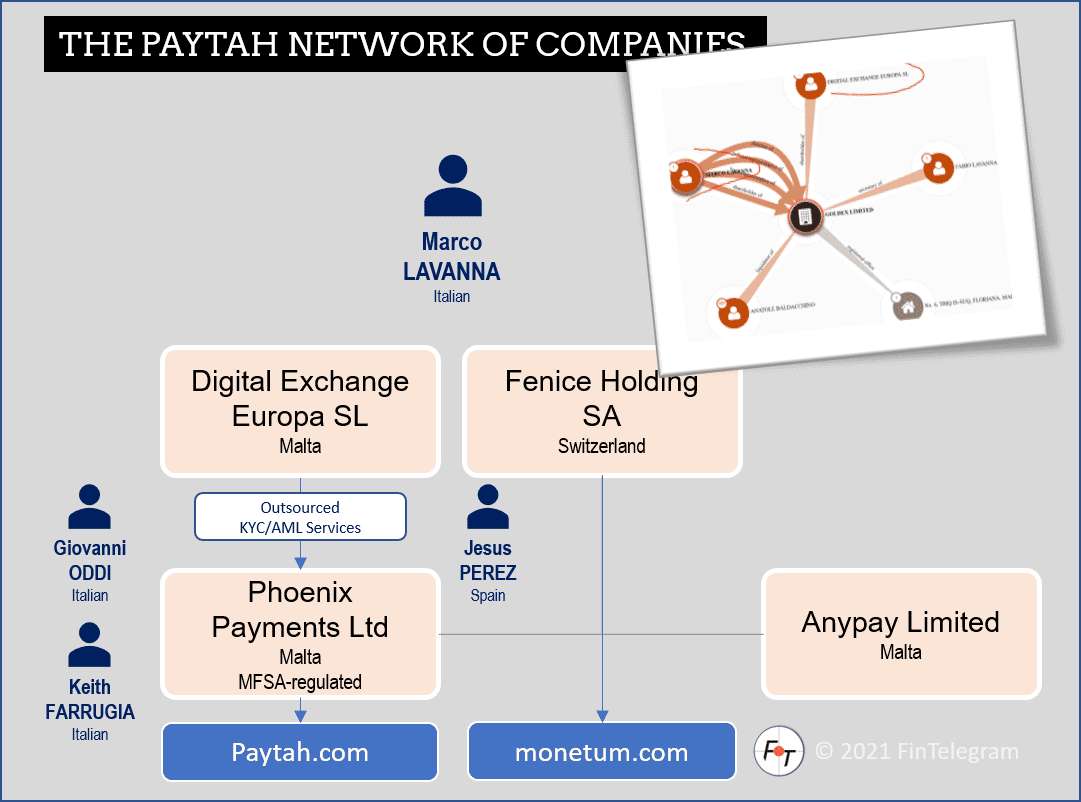

Paytah’s directors are Marco Lavanna, Keith Farrugia, and Francesc Xavier Alabart Lopez. Another important person is the Spanish citizen Jesus Perez. According to his LinkedIn profile, the latter is also the Chief Product Officer of Monetum, a Swiss crypto payment processor related to Marco Lavanna (LinkedIn). Paytah management ran several payment processors in different companies and apparently did not take regulatory requirements too seriously. To put it very mildly.

Currently, it seems the company does not have MFSA-accepted or approved CFO or Chief Compliance Officer in place. However, they are still deemed fit and proper by MFSA despite being involved in business with a series of Estonia crypto firms who have lost their licenses and facilitated scams with hundreds of EU victims.

The former CCO’s report was sent to the FIAU’s Whistleblower Supports Unit back in September 2020. Months ago, however, Pahtay was still acting with the MFSA license.

Paytah’s KYC/AML Mess

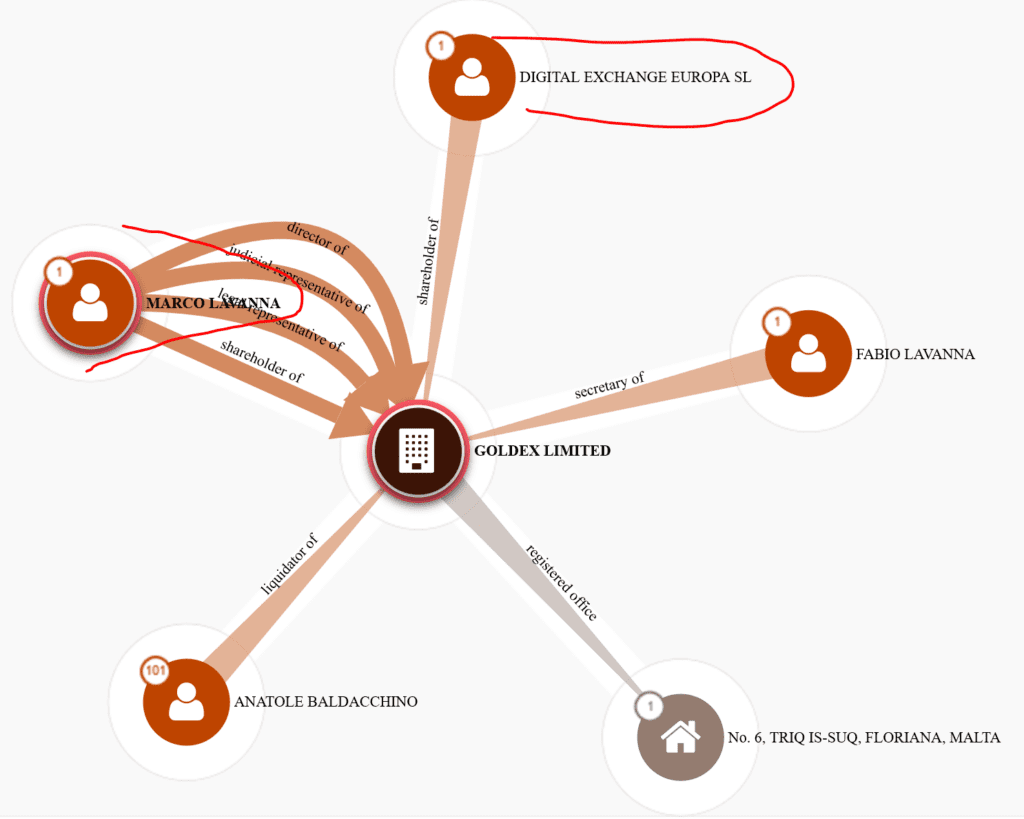

The former CCO notes that Paytah has engaged massively in cryptocurrencies with Estonian companies without sufficient AML/KYC. The onboarding of clients would be outsourced to Digital Exchange Europa SL, which did not have the relevant experience. According to information on Offshore Leaks, this Digital Exchange Europa is also attributable to Marco Lavanna and the Swiss Fenice Holding SA, which acts as a crypto payment processor. Again and again, Lavanna and the rest of the management would have been involved in accepting high-risk customers. And AML/KYC data would have been passed on or disappeared.

What about the victims?

The European Fund Recovery Initiative (EFRI) sent a complaint to the MFSA a few weeks ago detailing that the Paytah broker had supported scams. Many victims of these broker scams made deposits through Paytah. The former CCO confirmed this practice in the whistleblower report. It was also confirmed that accepting scam operators as clients were apparently done willfully and knowingly.

The court documents reveal that Paytah tried to sell its shares to an “English man who never disclosed his identity,” according to the whistleblower. The same possible buyer was introducing “very risky Crypto clients” to Paytah (see screenshot above). The court documents also reveal that the former Chief Legal and Compliance Officer of Paytah was offered a six-month salary payment to leave the company and not file any reports to the authorities, which offered was not accepted.

The authorities liability

Paytah’s shabby business has been known to the Malta authorities for many months. To date, no regulatory action has been taken by MFSA and FIAU against Paytah. This is very telling for a country facing a crucial test by Moneyval in the upcoming months. Maltese media have revealed the shocking news about MFSA being that the regulator pays local media houses by direct orders.

The FIAU is also under pressure. Reports have emerged showing that proceedings involving FIAU remain secret. FIAU’s Director Kenneth Farrugia and his assistant Alfred Zammit have been highly criticized in Malta for being weak with the strong and strong with the weak.

MFSA’s outgoing CEO, disgraced Joe Cuschieri, had the power to cancel the license of Paytah. This responsibility also lies upon other MFSA executive board members, including Cuschieri’s Las Vegas trip’s companion and MFSA General Counsel Edwina Licari, Michelle Mizzi Buotempo, and CEO ad interim Christopher Buttigieg.

Supervision is an obligation that must be carried out in order to protect the financial markets and investors. It is not at the discretion of a supervisory authority to decide whether to take action against violations. This leads to ever new Wirecard’s.

Regulators who violate their legal duty of supervision are liable to pay damages to their regulated firms’ victims.