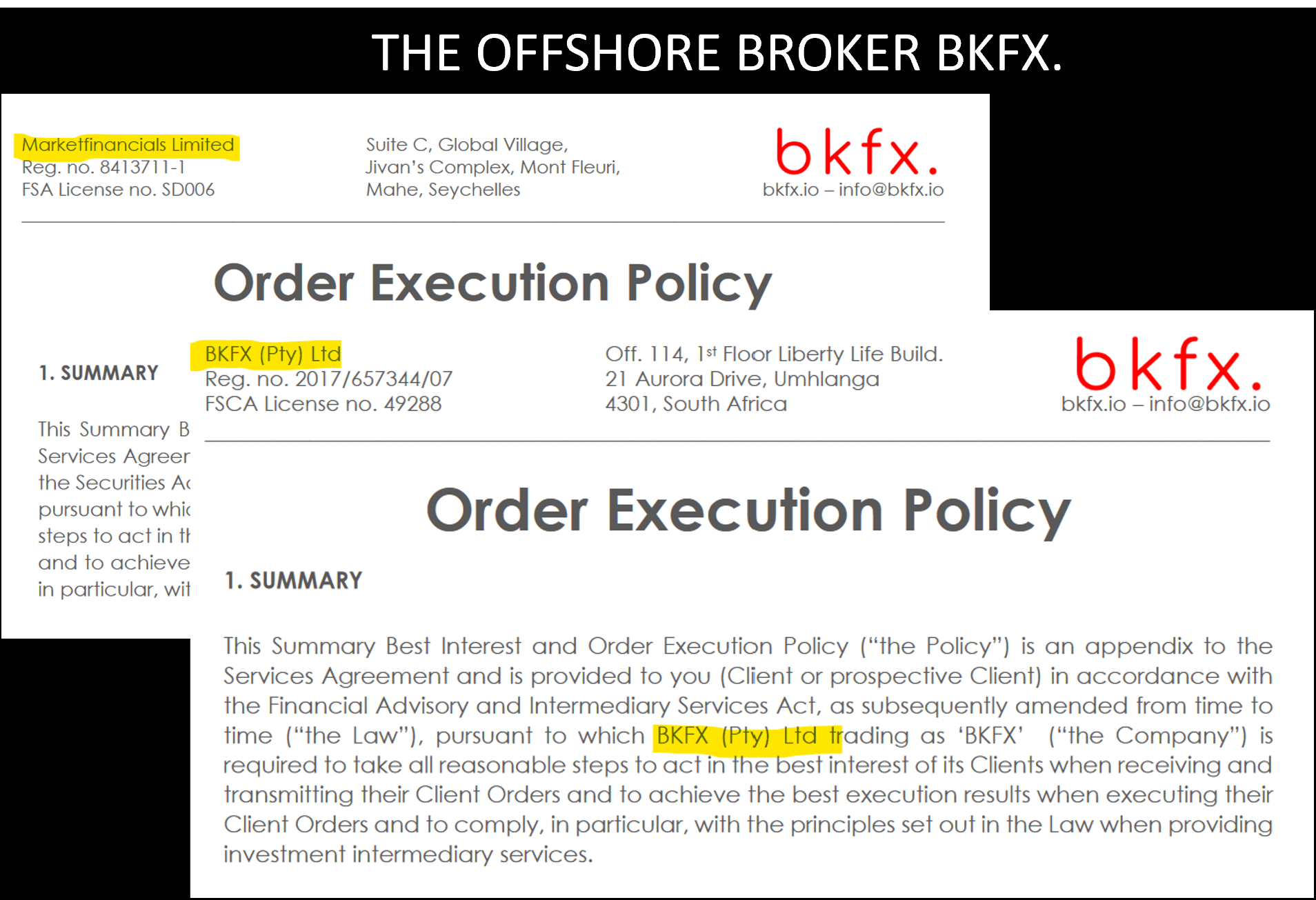

We have already alerted investors against the offshore broker BKFX, operated by the FSCA-regulated BKFX (Pty) Ltd in South Africa and BKFX LLC registered in St. Vincent & The Grenadines. BKFX solicited clients from the EU, UK, and other jurisdictions withouth regulatory permission. In an email we received today in our several accounts, BKFX informed that it would terminate the business in our country, i.e., in the EU and the UK, by 31 August 2022. That’s good news for investors. Goodbye and please don’t come back!

Key data

| Trading name | BKFX |

| Domain | https://bkfx.io/ |

| Social media | LinkedIn, Facebook, Instagram, Twitter |

| Legal entities | BKFX (Pty) Ltd BKFX LLC |

| Jurisdictions | South Africa St. Vincent & The Grenadines |

| Regulators | FSCA South Africa FSA SVG |

| Payment options | Credit and debit card, alternative payments, crypto |

| Payment processors | SticPay, LetKnow, Perfect Money, EntreBiz |

MarketsFinancial history

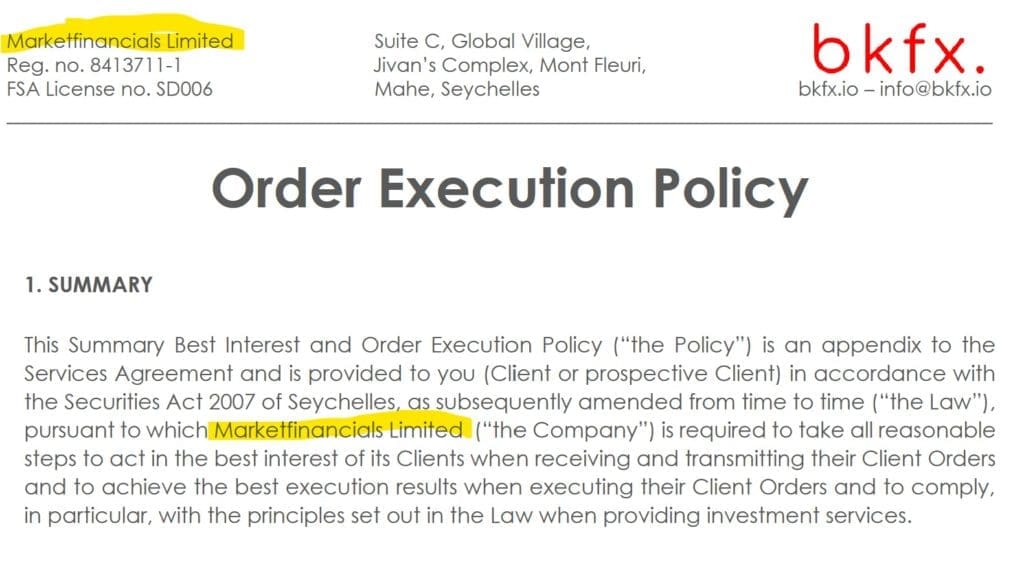

Until 2020, BKFX was operated by MarketFinancials Limited, a company registered in Seychelles and regulated by FSA Seychelles. It was part of TechFinancials, a fintech software provider. In Jan 2019, the then AIM-listed TechFinancials announced that it signed an agreement with Cyprus-based M&N Equity Research Ltd to sell its shares in MarketFinancials. In early 2020, TechFinancial ceased its AIM listing and became a private company. No further announcement on the sale of MarketFinancials was published. It is not clear who actually acquired MarketFinancials but M&N Equity Research is one of the operators of Invest100 and xbprime.

Read our MarketFinancials report here!

Today’s Entities & Regulation

Since 2020, BKFX is operated by the following entities:

- BKFX (Pty) Ltd is authorized and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa;

- BKFX LLC is registered by Saint Vincent and the Grenadines Financial Services Authority (FSA);

Updated Review

In our initial review on April 20, 2022, our people were able to register as EU and UK residents. BKFX is active in most of the world’s regulatory regimes, except the US, Canada, Syria, North Korea, Iran, and Iraq.

After confirming the email address, we were able to open a trading account and make pre-KYC deposits with unverified BKFX profiles:

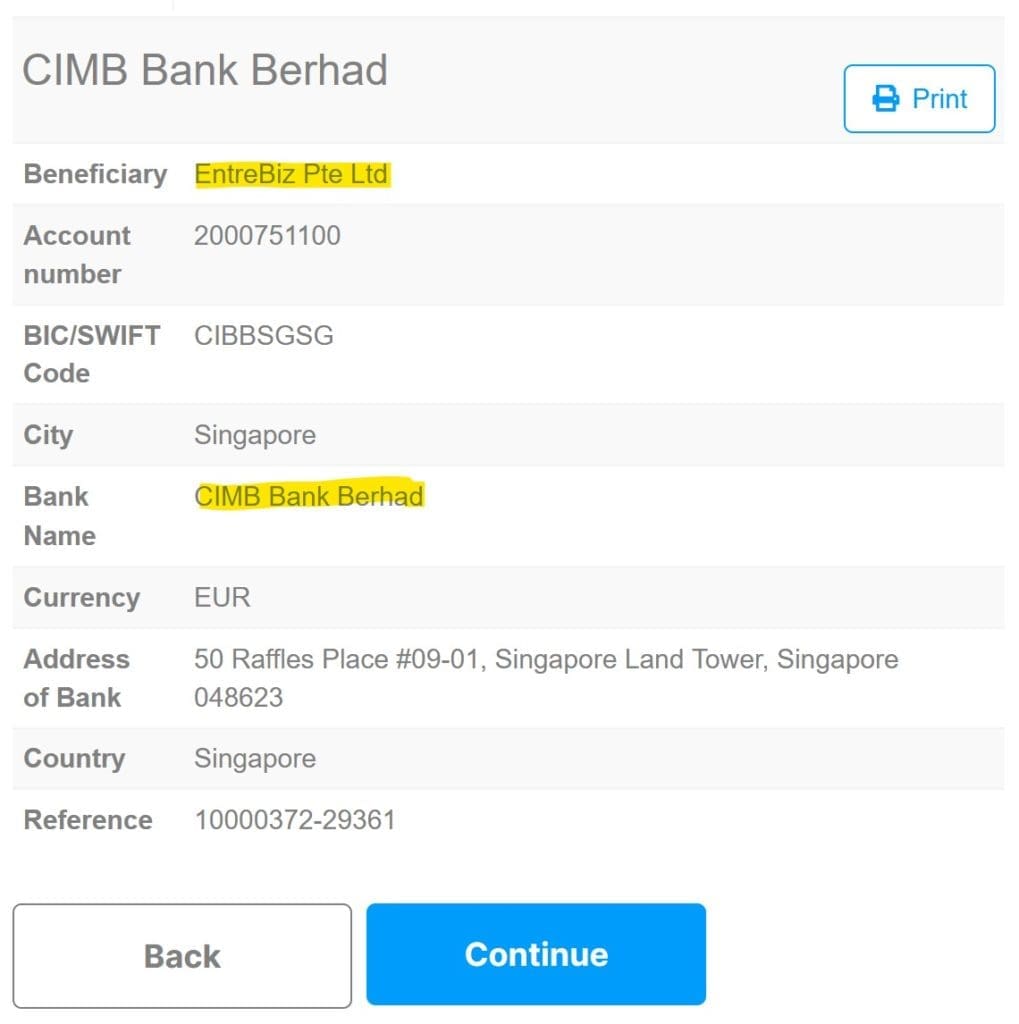

- Bank wire deposits are available in EUR and USD and are capped at $10,000. Wire transfers are made to EntreBiz Pte Ltd‘s bank account at CIMB Bank Berhad in Singapore. EntreBiz (https://www.entrebiz-pte.com) is a full-service software & applications development provider acting as an unauthorized payment processor for BKFX.

- Credit and debit card deposits were made through Virtual Pay (VP), a payment processor in Kenya. The pre-KYC deposits are capped at $10,000.

- When depositing crypto (ADA) via the licensed Estonian Let Know, we could have made a maximum pre-KYC deposit of $10,000.

- Pre-KYC deposits via Russian Perfect Money and SticPay were also capped at $10,000.

Preliminary conclusion

BKFX operates in the UK and EU, and most other regimes without the required authorization and, therefore, illegally. The South African FSCA license does not authorize BKFX to solicit clients in the regulatory regimes of FCA, ESMA, or ASIC. Just to name a few. Onboarding with pre-KYC deposits of up to $10,000 is also incompatible with ESMA regulations which cap pre-KYC deposits at the equivalent of around $3000. Moreover, the leverage of up to 1:2,000 as well as its bonus schemes is not compliant with these regulatory frameworks.

Clients of these offshore brokers are not eligible for Investor Compensation Schemes in the UK, EU, or Australia. Furthermore, there is no supervision and no monitoring of whether client funds are held in segregated accounts. Offshore regulators do not even check whether investments or trading actually take place through authorized exchanges or liquidity providers. And finally, clients are not entitled to the assistance of Financial Ombudsman Services.

Share information

If you have any information about BKFX, its partners, and facilitators, please share it with us through our whistleblower system, Whistle42.

I can’t believe how terrible people have become in the world, how can a broker call me up and make me believe that I was investing into something genuine, in a couple of months I had been fleeced out of my life savings, till this day haven’t even been able to get fully back on my feet. Having taken my time to do some research would like to speak with other people who have been through similar experience, together without a doubt I am sure with likeminded minds we can all get our money back. I met with a genius Freddictine gmail dot com who helped me get back on my feet again