The digitalization of global society and its networking via email and social media gave birth to a new threat – cyberscams. In the field of online

#CyberScams are a global and borderless phenomenon. By means of sophisticated social media web campaigns, billions of people can be reached real-time. People from different cultures and jurisdictions can be reached via email and social media in real-time. Contact and business transactions can be made via fake ID, fake companies and encrypted email services without actually leaving traceable traces.

Cyberscams and Society

Cyberscams are the most attractive category for technically savvy criminals, both financially and in terms of risk. Cyberscam brings significantly higher revenues for the attackers and carries a significantly lower risk of getting caught. Actually, most of the #CyberScam perpetrators operate with “near-complete” impunity as some studies suggest.

Criminal revenue reaches unprecedented amounts with the various online cybercrime categories. Rarely have millions been captured in bank robberies, whereas every mediocre #CyberScams easily result in many millions for the perpetrators. According to the UK National Crime Agency, cybercrime already accounted for more than 50% of all reported crimes in the UK already in 2018. According to the UK Financial Conduct Authority (FCA) alone caused investment scams in the UK in 2018 GBP 197 million in losses for investors.

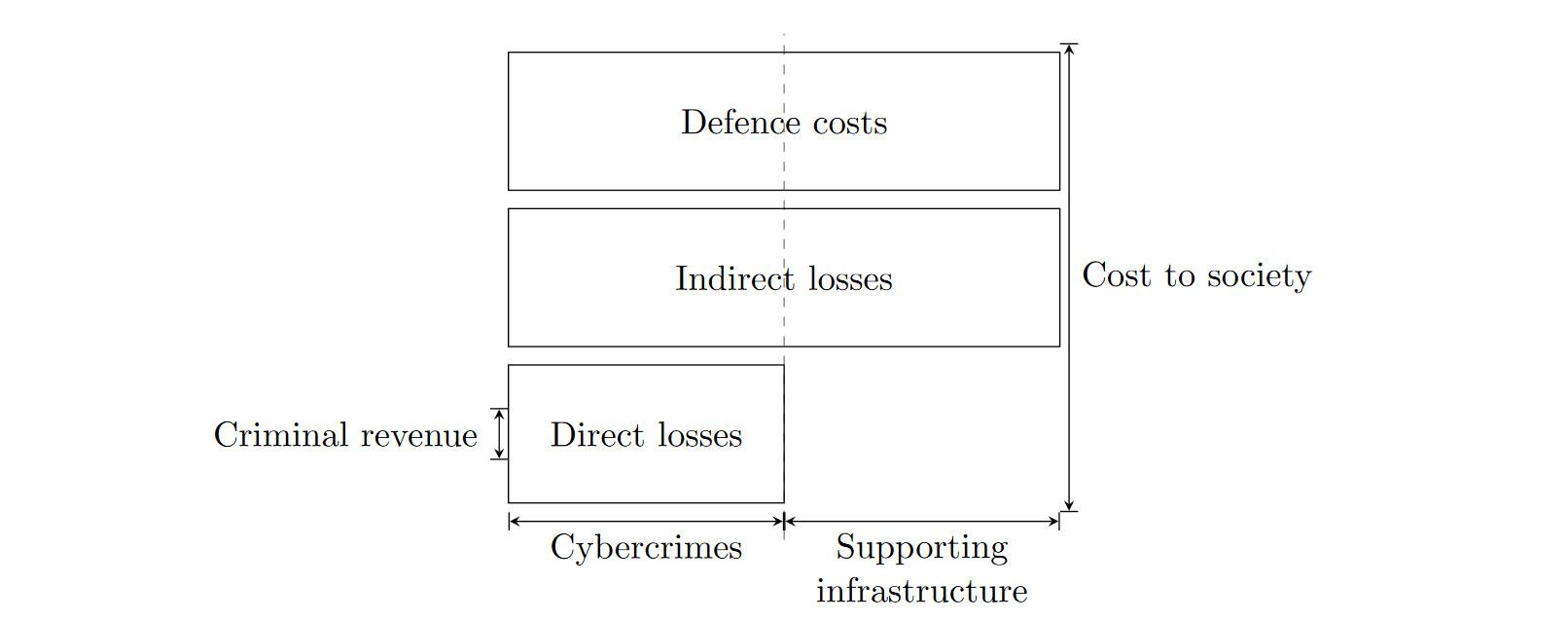

The revenue of cybercriminals is rising dramatically, as shown by the study Measuring the Changing Cost of Cybercrime conducted in 2012 and 2019 by the University of Cambridge.

Criminal revenue is defined as the gross receipts from crime. It does not include the criminal’s‘lawful’ business expenses, but we do need to count criminal inputs, so as to get an accurate estimate of the criminal-revenue contribution to GDP. For example, where phishing is advertised by email spam sent by a botnet, we add the criminal revenue of the

The Cambridge study also summarises the results of other studies. In particular, it processes the data of various victim studies in different countries:

- The study estimates that already 6% of the population could be victims of #CyberScams.

- The decline in traditional crimes over recent years is outperformed by the increase of reported cybercrime offenses.

- A 2017 victimization study in Australia counts 13% of the surveyed participants as victims of cyberscams with average damage of several hundred dollars.

- A French victimization study also shows that more people are affected by cybercrime than by traditional crimes.

Statistically, people in Europe are already more likely to become victims of cyberscam than of traditional crime. With actions like #CyberSecMonth, the EU is, therefore, focusing on creating public awareness of the dangers of #CyberScams.

Sorry, no decline in crime

It must be noted that available #CyberScams data is still thin at present. Cybercrime is still a relatively new phenomenon for both statistics and authorities. The fact is, however, that the alleged “decline in crime” as shown by some national crime statistics is a mere illusion and only due to the fact that cybercrime in its various forms has not yet been properly included in the statistics.

As traditional crimes such as bank robbery, burglary or car theft become increasingly difficult and less lucrative due to sophisticated technical security mechanisms, cybercrime becomes more attractive. This trend towards cybercrime is amplified by the virtualization of money and investments. In criminology, it is now acknowledged that the decline in traditional crimes may indeed be much smaller than the increase in cybercrime offenses.

Impunity of perpetrators

The core problem is that #CyberScam perpetrators operate with near-complete impunity. We should certainly spend an awful lot more on catching and punishing the perpetrators. We will not get a real handle on #CyberScams until we put an end to impunity.