The crypto bull-run happened amidst the COVID-19 pandemic. Bitcoin (BTC) finished 2020 just shy of $30,000 with a market cap of around $530 billion. A year ago, the price had been $7,100. 2020 was the year of institutional investors and PayPal’s entry. With the crypto explosion, the digital Assets Under Management (AUM) of Barry Silbert‘s pioneering Grayscale Investments crypto trusts have surpassed the $20 billion mark. That’s quite something, isn’t it?

According to most crypto experts, the 2020 BTC bull-run has not been driven by retail investors in 2017 but by institutional investors. PayPal has reportedly been buying up massive BTC holdings. It is well known that PayPal plans to introduce BTC and some other cryptos as a means payment method for its merchants soon. Hence, the payment processor needs to build up its crypto inventory and has been on the buy-side.

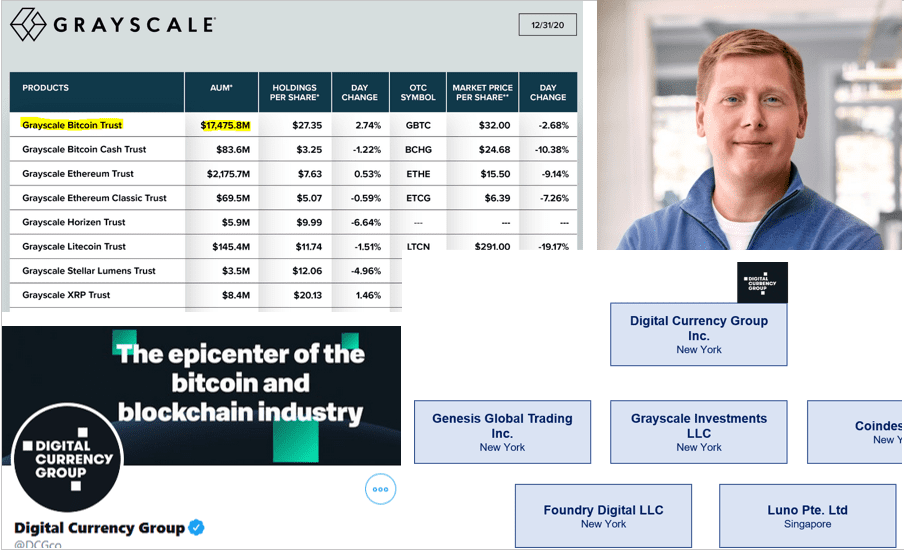

The Grayscale Bitcoin Trust (GBTC) was another big BTC buyer and held more than $17.4B worth of BTC as of December 31, 2020. Besides GBTC, Grayscale Investments manages several other crypto trusts that specialize in specific cryptocurrencies. With the crypto prices rise in the last three weeks of December 2020, Grayscale Investments started 2021 with more than $20B digital Assets Under Management (AUM) in its different crypto trusts. With management fees ranging from 2% to 2.5%, Grayscale Investments, as the trusts management firm, earns more than $400 million in management fees with its approximately 20 employees, as duly noted by crypto analyst Joshua Frank. That’s impressive, too.

Established in 2013, Grayscale Investments (www.grayscale.co) is a digital currency asset manager. In November 2019, the AUM was $2.7B, making the 2021 numbers the more impressive. The company rightfully bills itself the world’s largest digital currency asset manager. It is part of the New York-based Digital Currency Group (www.dcg.co) of Barry Silbert (LinkedIn profile) and his partners.

The Digital Currency Group crypto empire includes the crypto trading platform Genesis (www.genesistrading.com) and the leading crypto publication CoinDesk (www.coindesk.com).

While the crypto bull-run was most likely not caused by the COVID-19 pandemic it certainly took advantage of it. In 2020, crypto established itself as an alternative asset class among institutional investors. It impressively outperformed stocks and gold and seems to be the most promising asset class in the dawning era of cyberfinance.