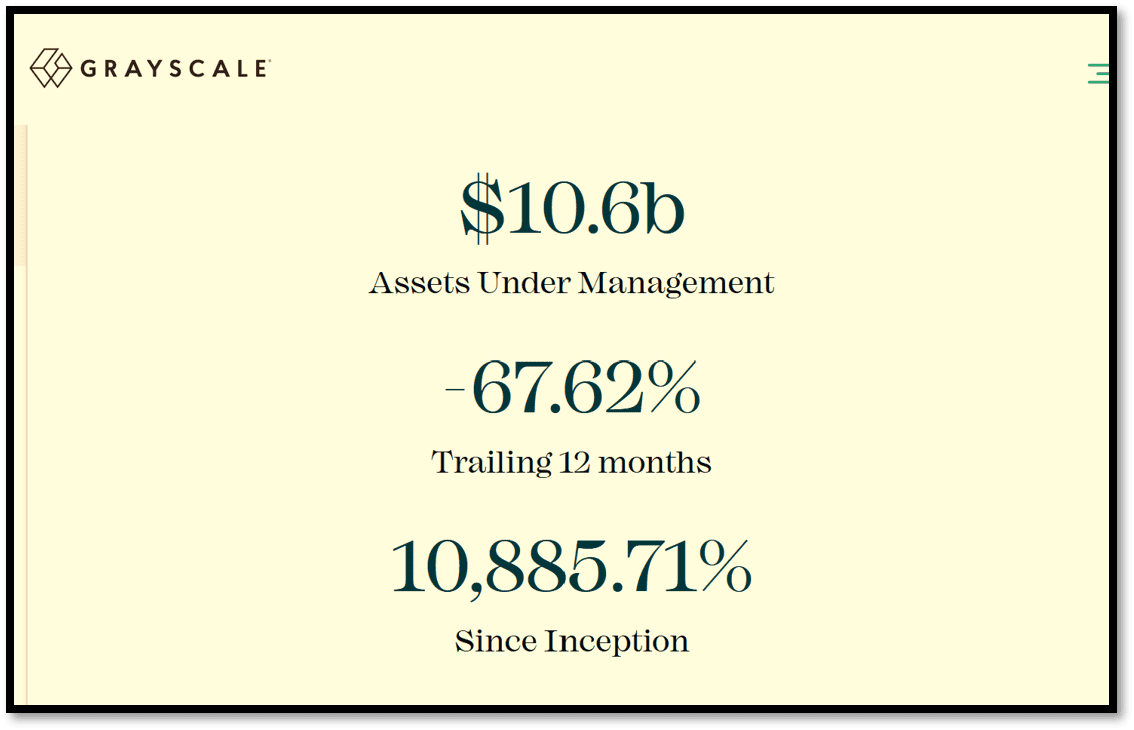

The big players in the global crypto scene are waging war against each other. New York-based hedge fund Fir Tree Capital Management is suing Grayscale Investments for information to investigate potential mismanagement and conflicts of interest at its $10.7 billion Grayscale Bitcoin Trust (GBTC), Bloomberg reports. GBTC is trading at a 43% discount to the value of the Bitcoin it holds, partly because the firm issued many shares in the past few years and didn’t redeem any of them.

Fir Tree, which manages around $3 billion, is known for making a large short bet against the stablecoin Tether (USDT) earlier this year.

Fir Tree alleges that Grayscale has breached the trust agreement by not allowing shareholders to review relevant documents. With the lawsuit, Fir Tree wants to force Grayscale to lower its fees, begin stock redemptions, and hand over documents relating to its relationship with the Digital Currency Group (DCG). GBTC is the largest publicly traded crypto fund in the world, with $10.7 billion in assets. The hedge fund also wants to stop Grayscale’s efforts in converting its Grayscale Bitcoin Trust (GBTC) into a spot exchange-traded fund (ETF).

In its complaint, Fir Tree said that around 850,000 retail investors had been “harmed by Grayscale’s shareholder-unfriendly actions.” Grayscale is owned by Barry Silbert’s Digital Currency Group, which also runs Genesis Global Trading, a crypto lender and broker that halted withdrawals in November.