In May 2023, Bittrex Inc, a U.S. crypto exchange, filed for bankruptcy protection following a complaint filed by the U.S. Securities and Exchange Commission (SEC) of running an unregistered securities exchange. The Seattle-headquartered Bittrex had already halted its operations within the U.S. In a new motion, the company is contesting the SEC’s authority to regulate its operations through securities violations.

The bankruptcy filing is stated to have no bearing on Bittrex Global, which caters to customers outside the U.S. Bittrex Global operates from Liechtenstein.

The SEC has accused Bittrex of operating as an unregistered securities exchange, broker-dealer, and clearing agency. However, Bittrex argues that the SEC’s actions left them with no alternative but to speculate about the classification of various tokens traded on their platform as they closed their operations in the U.S.

In the motion to dismiss, Bittrex took a similar approach to Coinbase. The arguments are also very similar. This same approach suggests that Bittrex is strategically seeking to take advantage of the robust legal framework established by Coinbase.

After a six-year investigation during which the Securities and Exchange Commission (“SEC” or “Commission”) refused to name a single cryptocurrency asset (token1) that it claimed Bittrex, Inc. (“Bittrex”) unlawfully listed for trading on its platform (the “Bittrex Platform”), the SEC has now charged Bittrex with multiple securities laws violations for failure to register. Yet the Commission is still missing essential elements of its claims. And those claims exceed its authority and defy key securities-laws precedents. This is inexcusable. When the government brings an enforcement action, especially after a prolonged investigation, it should adhere rigorously to the

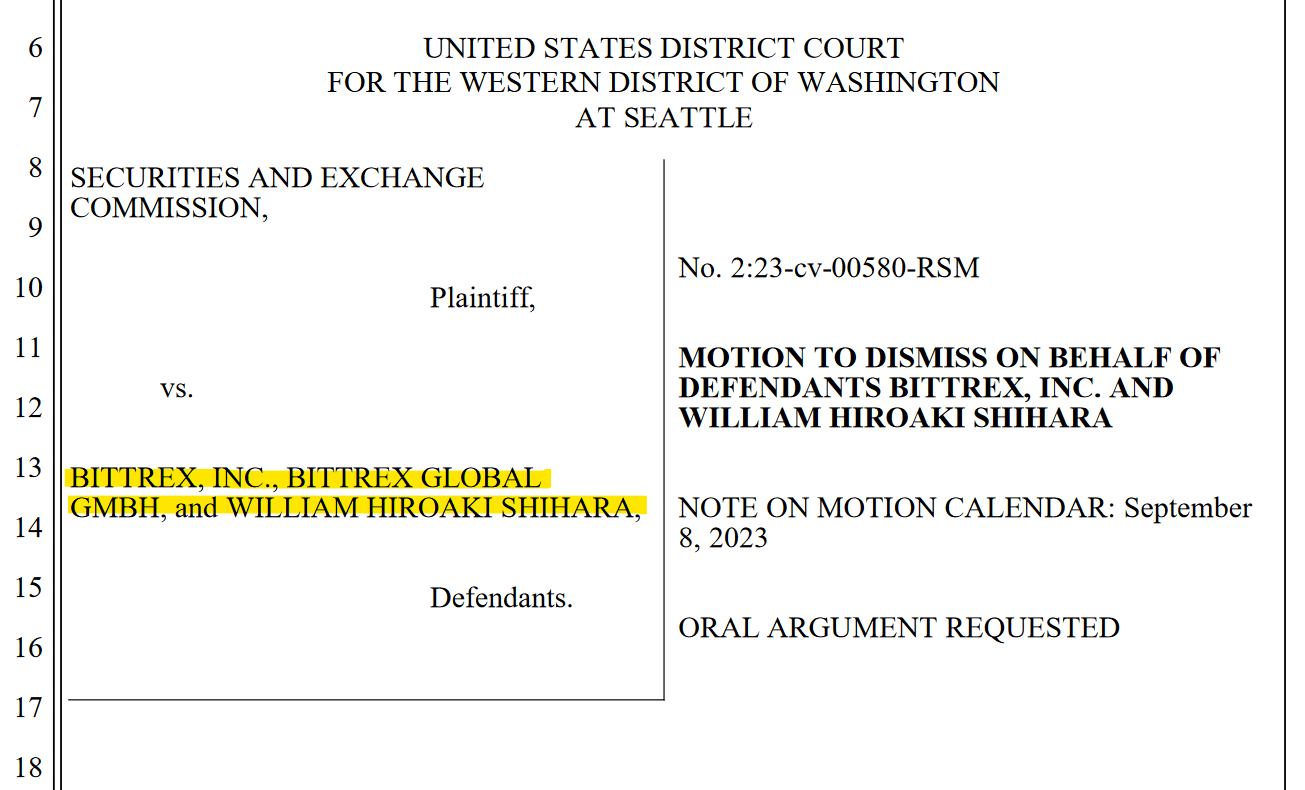

Bittrex motion (link)

pleading standards and relevant statutory constraints. The SEC failed to do so here.

According to Bittrex‘s legal motion, the U.S. Congress must explicitly authorize the SEC to regulate tokenized securities. They argue that the Exchange Act and the Securities Act of 1933 do not grant the SEC the authority to casually categorize tokens as securities.

Bittrex contends that the interpretation of outdated legislation should require congressional approval. They assert that while old statutes may sometimes be applicable to new and unforeseen situations, employing an old statute, originally designed to address one issue, to solve a new and distinct problem may indicate that the agency is acting without a clear mandate from Congress. Bittrex cites the precedent of West Virginia v. EPA in 2022 to support their argument.