The shares of the leading US crypto exchange Coinbase dropped after the company reported a loss of over $1 billion for Q2 2022 and missed analysts’ estimates. Coinbase’s revenue declined nearly 64% as investors exited the crypto market after the 2021 bull run. Retail transaction revenue came in at $616.2 million, down 66% and below analysts’ $667.1 million consensus. Coinbase reported a $1.1 billion net loss, compared with $1.59 billion in net income in the same quarter last year.

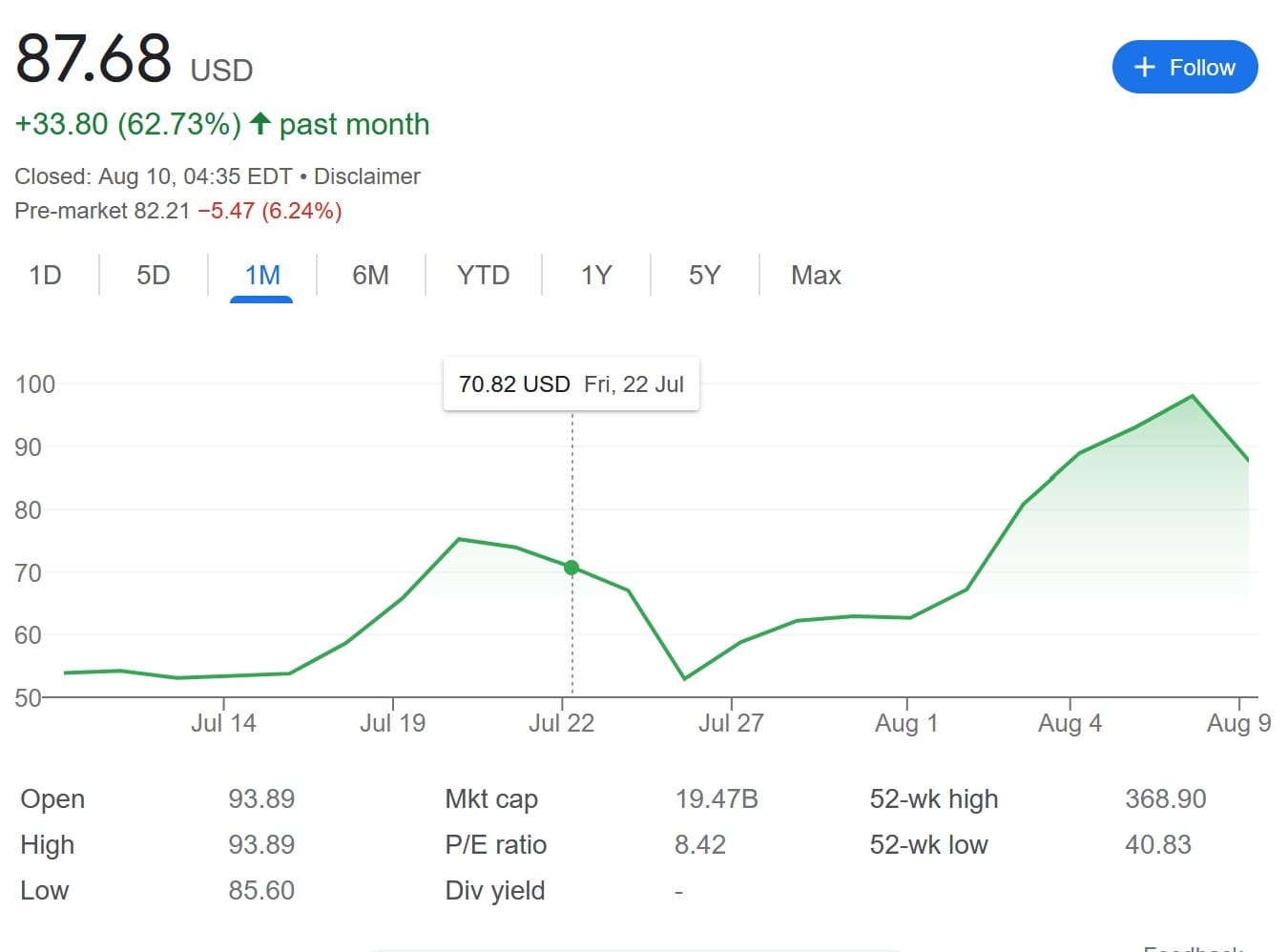

Over the last four weeks, the Coinbase share price has increased more than 62%. Most recently, the share price exploded after the announcement of the partnership with the world’s largest asset manager BlackRock. Yesterday’s decline, however, was rather moderate.

Coinbase is being forced to resize its business in response to market conditions. The company’s stock tumbled 75% during Q2 2022, while the bitcoin price plunged by about 59%. Coinbase will be extending its hiring freeze into the foreseeable future and cutting 18% of its headcount.

One factor for the billion-dollar loss was a $377 million noncash cryptocurrency-related impairment charge. Coinbase’s own cryptocurrency assets at the end of June were worth $428 million, down from about $1 billion at the end of March. Over 40% of the cryptocurrency assets were in bitcoin.