We are only in the middle of the week, but the first few days have provided a lot of excitement in the crypto market. The U.S. Securities and Exchange Commission (SEC), chaired by Gary Gensler, has filed lawsuits against two major crypto exchanges, Binance and Coinbase, for violating securities laws. Both crypto exchanges are fighting back and are now heavily blaming the regulator for not providing the requested guidance.

Coinbase is proud to represent the crypto industry in court to finally get some much-needed clarity. Instead of publishing a clear rule book, the SEC has taken a regulation-by-enforcement approach that is harming America. We’re ready for this. In the meantime, let’s all keep moving forward and building as an industry. America will get this right in the end.

Coinbase campaign on LinkedIn

The SEC has classified some tokens traded on crypto exchanges as securities. Therefore, Binance and Coinbase would have had to register with the SEC to operate their trading platforms and trade, respectively. They did not do so and thus would have violated U.S. securities laws.

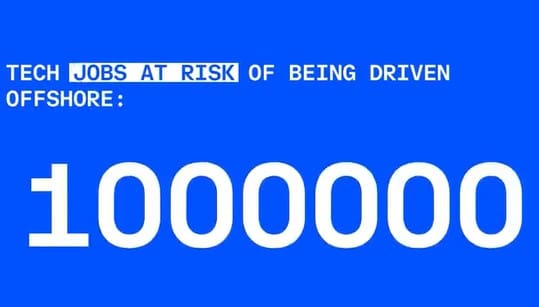

Currently, the two crypto exchanges are fighting back on social media with campaigns against the SEC approach for which Gary Gensler is responsible.. Coinbase is also running an educational campaign on LinkedIn, explaining how many times they would have tried in vain to get guidance from the SEC. In addition, the regulation-by-enforcement approach would also ensure that a million jobs could go offshore.

Coinbase CEO Brian Armstrong posted his opinion on Twitter and summarized the situation:

- 1. The SEC reviewed the Coinbase business and allowed them to become a public company in 2021.

- 2. Coinbase does not list securities and rejects the vast majority of assets.

- 3. The SEC and CFTC have made conflicting statements, and don’t even agree on what is a security and what is a commodity.

- 4. This is why the US congress is introducing new legislation to fix the situation, and the rest of the world is moving to put clear rules in place to support this technology.

We will see how this exciting regulatory match plays out. SEC Chair Gary Gensler is not without political controversy either. Especially the Republicans have massive reservations about his crypto policy.