With our series “Chasing Scam Facilitators,” we want to expose how the cybercrime organizations around the many investment and broker scams work. The individual scams come and go, but the boiler rooms, fraudulent marketing &affiliate schemes, and payment processors behind them remain. FinTelegram wants to map and document this international cybercrime scene with this series. Don’t let them get unpunished!

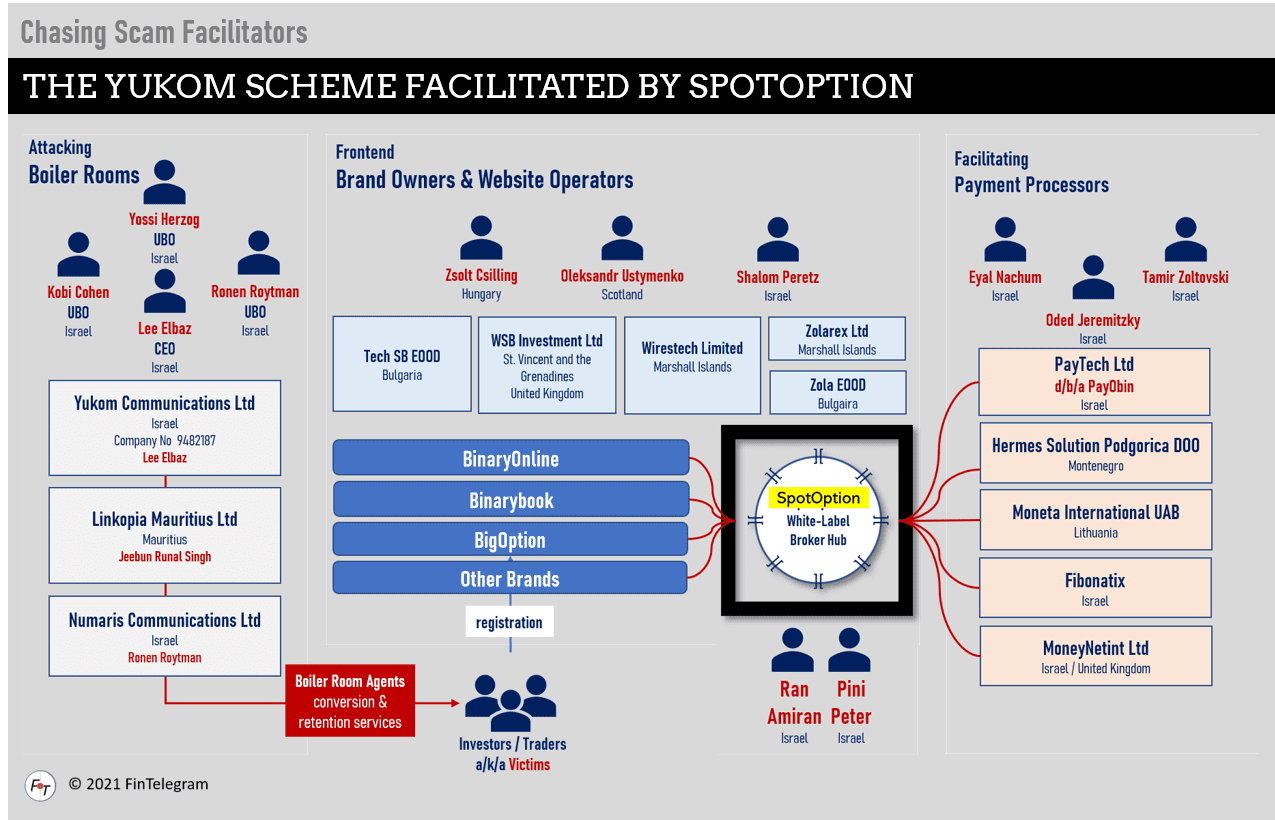

Broker scams are like icebergs. You can see only the tip sticking out of the water, i.e., domain, website, offshore entities, and nominees a/k/a monkeys. Underwater or in the darkness of the Internet, the real perpetrators and facilitators are hiding. These scam-facilitators are white label providers, the boiler room operators, marketing and affiliate systems, and the payment processors. In the case of the Yukom scam, these were the boiler rooms in Israel and Mauritius, mostly Israeli payment processors, and the white-label operator SpotOption, which provided the software and trading infrastructure. U.S. Government, the U.S. CFTC, and now the U.S. SEC are after them.

The open $140M Yukom Case

One of the largest white label partners of Pini Peter and his SpotOption was the Israeli Yukom scheme, ran by Israeli forex veterans Yossi Herzog and Kobi Cohen and their team. In early 2018, SpotOption‘s offices in Ramat Gan, Israel, were raided by the U.S. FBI and Israeli police to secure evidence for the Yukom Case. Back then, Pini Peter claimed that it was not a raid but voluntary cooperation with law enforcement. In the trial against Lee Elbaz, FBI Agent Greg Fine explained how SpotOption was used to defraud customers (read the report here).

The Yukom group’s boiler rooms in Israel and Mauritius operated several fraudulent binary options brands such as BinaryBook, BigOption, or BinaryOnline. According to U.S. indictments, the Yukom scheme allegedly defrauded investors of about $140 million.

In 2019, the Israeli citizen Lee Elbaz, the former Yukom CEO, was sentenced to 22 years in prison and $28 million in restitution payments for the investment fraud. Five of her former employees have also pleaded guilty and were sentenced to prison terms and restitution payments:

- Lee Elbaz (a/k/a “Lena Green”), the former CEO of the Israel-based company, Yukom Communication Ltd;

- Lissa Mel (a/k/a “Monica Sanders”) worked as boiler room agent for Numaris, one of the Yukom boiler room operators;

- Austin Smith, (a/k/a “John Ried“) former Vice President of Numaris, one of the Yukom boiler room operators, and founder of Wealth Recovery International;

- Liora Welles (a/k/a “Lindsay Cole” “Lindsay Wells,” and “Lindsay Taylor”), boiler room agent;

- Shira Uzan (a/k/a “Shira Baror” and “Emily Laski”), boiler room agent;

- Yair Hadar (a/k/a “Steven Gold”), boiler room agent;

The Yukum Case is far from over for the U.S. authorities. In total, to our knowledge, at least 15 more people have been indicted by U.S. prosecutors to date. Among them are the masterminds Yossi Herzog and Kobi Cohen.

| Defendant | Defendant | Defandant |

| Yosef “Yossi” Herzog | Ori Maymon | Afik Tori |

| Yakov “Kobi” Kobi Cohen | Nissim Alfasi | Gilad Mazugi |

| Elad Bigelman | David Barzilay | Hadas Ben Haim |

| Runal Jeebun | Sabrina Elofer | Yousef Bishara |

| Oron Montgomery | Anog Maarek | Nir Erez |

The U.S. Commodity Futures Trading Commission (CFTC) has also brought fraud charges against Yukum, the companies, and the individuals involved. While Lee Elbaz and her team are serving their prison sentences in the U.S., their former bosses are on the run and wanted by U.S. authorities.

The $100M SEC Complaint

Interestingly, the Yukom case is not referred to in the SEC Complaint announced yesterday. Apparently, the SEC doesn’t want to bother the U.S. prosecutors and the CFTC. While the U.S. prosecutors and the CFTC are focusing on the fraudulent brands and boiler rooms, the SEC is taking care of SpotOption, which provided both the white label broker solution and the trading infrastructure. The agency refers to other complaints it has already filed that are also related to SpotOption:

The SEC Complaint charges SpotOption with violating the anti-fraud and registration provisions of the federal securities laws, and Pini Peer and Ran Amiran with violating the registration provisions of the federal securities laws and with controlling SpotOption in its violations of the anti-fraud provisions of the federal securities laws. The complaint seeks disgorgement of ill-gotten gains, prejudgment interest, financial penalties, and permanent injunctions against all three defendants.

The SEC primarily wants money from the Defendants and could enter into a settlement involving tens of millions of dollars. This would also replenish the investor protection fund for the SEC’s whistleblower program, which is financed entirely through monetary sanctions paid to the SEC by securities law violators. The SEC has awarded approximately $812 million to 151 individuals since issuing its first award in 2012.

The Others

SpotOption has had even more big scam fire besides Yukom and the operators already sued by the SEC. For example, the giant scam network of GreyMountain Management (GMM) of brothers David Cartu, Jonathan Cartu, and Joshua Cartu (“Cartu Brothers”) has worked with SpotOption. The Canadian Ontario Securities Exchange (OSC) and the U.S. CFTC have already brought fraud charges against GMM. The cases are still active and not yet settled or decided. Thrilling, isn’t it?

Besides SpotOption, there were (and still are) other white label hubs that are and were massively involved in the scam business. PandaTS by Maor Lahav or Tradologic of Gal Barak are to be mentioned here. Some of those white label hubs are even regulated by EU authorities, such as the CySEC in Cyprus.

We will discuss these “other” scam networks and white label hub operators in the course of our Chasing Scam Facilitators series as we cover the payment processors that facilitated and still facilitate these hubs and their scams.

Stay tuned and follow our Chase Scam Facilitators series.