EXCERPT

An interesting New York Post probe spotlights Cambodia’s coastal city of Sihanoukville—now dubbed the “cyber-scam capital of the world.” Trafficked workers are forced to run global crypto-investment and romance schemes that launder billions and threaten financial-system integrity. Sihanoukville is a coastal city in Cambodia and the capital of Preah Sihanouk Province, at the tip of an elevated peninsula in the country’s south-west on the Gulf of Thailand.

KEY POINTS

- Scale — Amnesty counts 53 active scam centres generating ≈ US $12.5 bn/yr, half of Cambodia’s GDP (Source: reuters.com).

- Human trafficking — Victims lured by fake tech jobs, stripped of passports, punished with electric shocks and beatings (Source: reuters.com).

- “Pig-butchering” tactics — Scammers groom targets online, then siphon funds via bogus crypto platforms (Source: arxiv.org).

- Deepfakes & AI amplify credibility, widening victim pool and complicating attribution (Source: reuters.com)

- Regulatory vacuum — UN & NGOs say local enforcement sporadic; compounds often reopen after raids (Source: reuters.com)

- Cross-border flows — Funds routed through OTC crypto brokers, unlicensed exchanges, and high-risk payment processors.

SHORT NARRATIVE

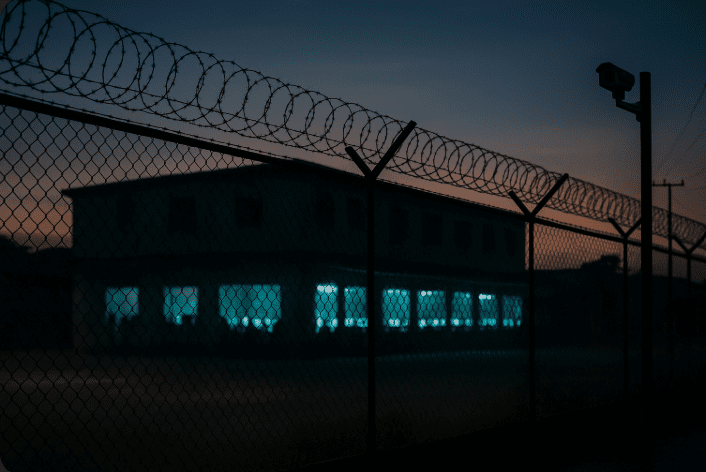

The Post recounts the ordeal of “Alice,” a trafficked recruiter who texted, “I don’t trust you… You just want to sell me like an animal.” Held behind razor-wire in Sihanoukville, she had to ensnare Western investors in sham crypto trades or face torture. Her story echoes hundreds of survivor testimonies gathered by Amnesty and academic researchers: a highly organised convergence of human-trafficking syndicates, Chinese triads, and rogue casino operators now pivoted to cyber-fraud at industrial scale.

EXTENDED ANALYSIS

Legal Exposure

- Forced-labour & trafficking offences trigger extraterritorial jurisdiction under U.S. TVPA, U.K. Modern Slavery Act, and EU Anti-Trafficking Directive.

- Potential Global Magnitsky and UK Human-Rights Sanctions designations for compound owners, security firms, and crypto facilitators.

Regulatory Gaps

| Gap | Impact | Mitigation |

|---|---|---|

| Weak licensing of Cambodian casinos/SEZs | Compounds masquerade as POGOs and fintech BPOs | IMF/World Bank technical assistance; FATF follow-up review |

| Unregistered VASPs servicing scam proceeds | Obscures audit trail | Enforce FATF Travel Rule; expand “red-flag” typologies |

| Limited KYC on high-risk corridors (USDT/Tron) | Rapid layering & cash-out | Chain-analysis monitoring; correspondent-banking risk-appetite review |

Operational Red Flags

- High-volume USDT inflows from Southeast-Asia IPs to newly-opened retail accounts.

- Funds resurfacing via Hong Kong money-service businesses within 24 h.

- Repeated micro crypto deposits preceding large OTC sell orders (“structuring”).

ACTIONABLE INSIGHT

Compliance teams should map exposure to Cambodian counterparties and unlicensed Asian OTC desks, flagging any flows with nexus to Sihanoukville, Poipet or KK Park. Implement a “triple-hit rule”: if geography + typology + high-risk asset (e.g., TRC-20 USDT) align, auto-escalate to Level 2 review and file an immediate SAR/STR.

CALL FOR INFORMATION

Have intel on Southeast-Asian scam compounds, crypto mixers, or shell suppliers? Share information via our whistleblower platform, Whistle42.