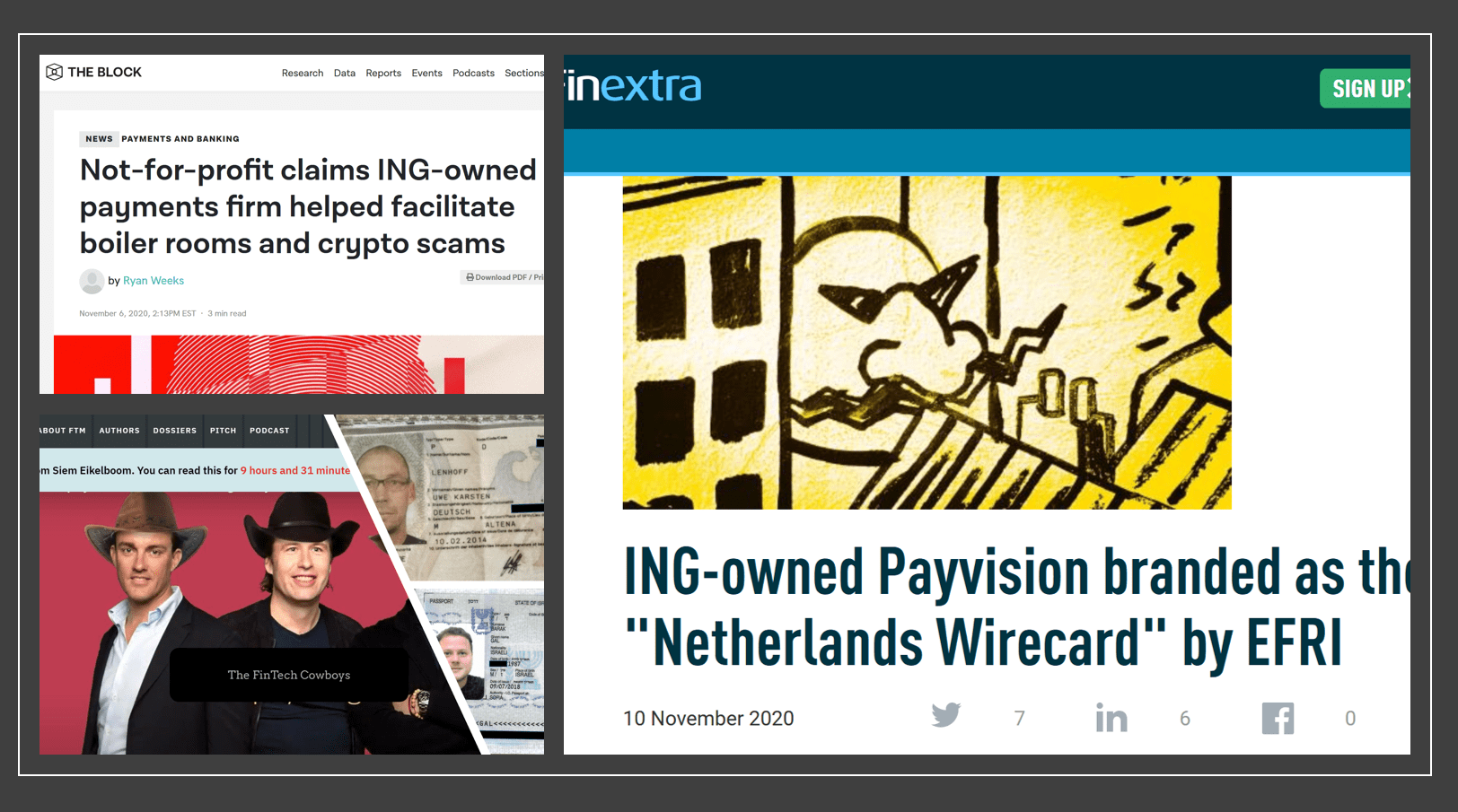

It was expected! ING subsidiary, founded and headed by Rudolf Booker, has been a massive facilitator for cybercrime organizations, scams, and shady high-risk businesses. As a payment processor, for example, Payvision laundered tens of millions for Israeli cybercrime kingpin Gal Barak and his scams until shortly before his arrest in early 2019. Recently, the European Fund Recovery Organization (EFRI) has filed a lawsuit against Payvision on behalf of the victims. The company’s reputation was recently destroyed. Now, ING announced it would “phase out” Payvision.

ING announced that its subsidiary Payvision will start phasing out its services as a payment service provider and acquirer. After a thorough evaluation of all options, ING has concluded that it is not feasible to achieve its ambitions with Payvision. The phase-out process should be completed by the second quarter of 2022.

As recently as March 2018, ING announced the completion of its acquisition of Payvision for a valuation of €360 million. It was a very expensive bad investment that could continue to cost ING a lot of money. Dutch financial media have dubbed the Payvision founders around Rudolf Booker the “FinTech Cowboys.” In fact, Payvision was something like a Dutch Wirecard Mini-me (report here)

According to the press release, Payvision and ING will inform their clients of the consequences the decision will have for them, which in most cases will involve selecting a new service provider. Both Payvision and ING allegedly will support their clients in the transition to a new service provider. Until the termination of services, Payvision will continue to fulfill its contractual obligations to meet clients’ expectations.

Payvision employees have been informed of the decision and its consequences. In close consultation with the works council, Payvision will support the affected employees through the transition in line with its employer practice standards.

Stay tuned for a detailed Payvision analysis.