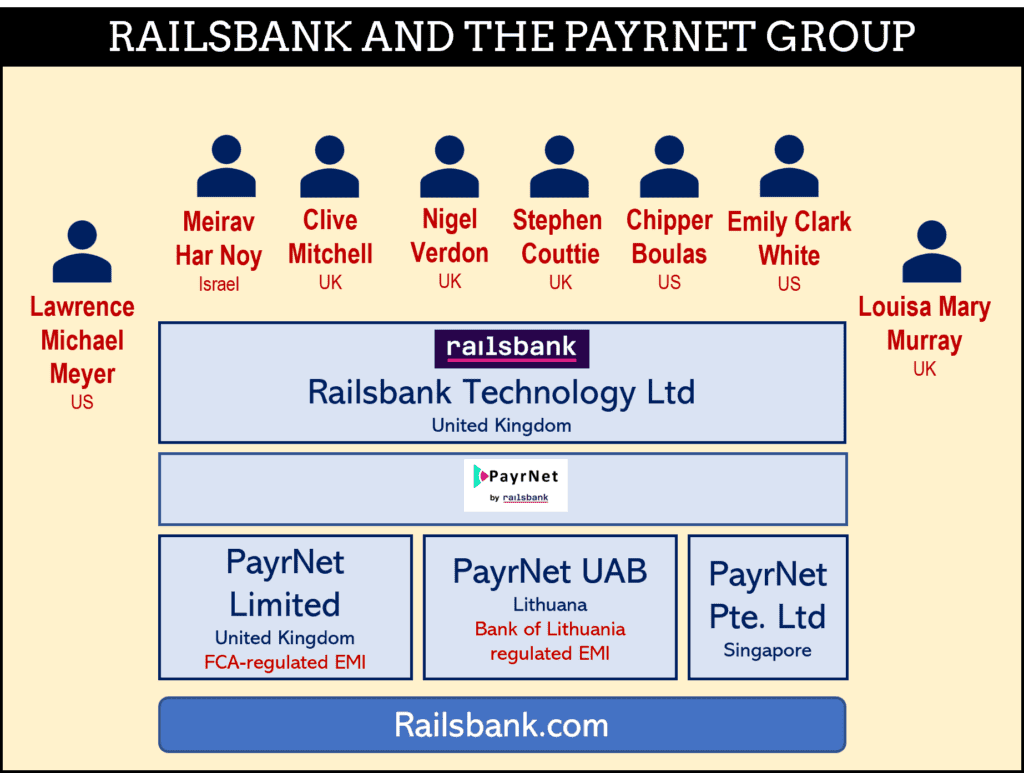

That’s really bad news for the European fintech scene. The Bank of Lithuania (BoL) has revoked the license of PAYRNET, an electronic money institution, due to serious and repeated violations of legal acts. The regulator intends to seek bankruptcy proceedings against PAYRNET and will notify law enforcement authorities. Furthermore, the regulator has restricted PAYRNET‘s ability to dispose of allocated funds, subject to certain reservations.

After assessing the institution’s financial position, the Bank of Lithuania found that the liabilities currently held by the institution exceeded its assets, therefore it is insolvent and there is no evidence that the situation could change in the near future.

Bank of Lithuania press release

PAYRNET failed to comply with the mandatory instructions given by the BoL, and provided incomplete and inaccurate information in the financial and operational reports submitted to the supervisory authority. In addition, the institution did not audit the financial statements for 2022 within the time limits established by law and did not make a decision on the distribution of profit (loss).

The institution made payments for the expenses incurred by other companies in the group of companies to which PAYRNET belongs, resulting in an irrecoverable amount of more than €7 million, which had a very negative impact on the institution’s financial position.

Client Funds Are Safe

Client funds will not be subject to restrictions. Clients who hold funds with PAYRNET must directly apply for a refund from the institution. PAYRNET is required to inform clients about the applicable settlement procedure within 5 working days. Clients’ funds will be returned to the account specified by the client, opened with a credit or other electronic money or payment institution.

Money Laundering Violations

BoL found that PAYRNET violated several laws, including the Republic of Lithuania Law on Electronic Money and Electronic Money Institutions, the Law on the Prevention of Money Laundering and Terrorist Financing, and the Law on Payments.

PAYRNET exhibited shortcomings in client due diligence procedures, including inadequate identification, verification, and monitoring of clients. The institution engaged in business relationships with high-risk clients without applying enhanced due diligence measures. Internal control systems related to money laundering and terrorist financing prevention were inadequate, lacking proper data storage and IT systems for collecting, processing and using relevant information.

Failed Business Model With Intermediaries

PAYRNET‘s business model primarily relied on intermediaries. The institution provided financial services through 90 intermediaries or other legal entities. However, it often established business relationships without conducting proper due diligence or assessing their suitability, reputation, and risk. The institution failed to control the actions of these intermediaries, including their compliance with anti-money laundering and terrorist financing measures, periodic training, and audits. Serious violations related to money laundering prevention, implementation of international sanctions, and restrictive measures were also identified.

Moreover, PAYRNET failed to store necessary data on end users. The institution lacked effective monitoring tools, did not report suspicious transactions on time, and did not comply with international financial sanctions or restrictive measures.

Law Enforcement Alarmed

PAYRNET did not properly safeguard end-user funds, failed to fulfill obligations to clients, miscalculated its own funds requirements, and did not comply with mandatory instructions from BoL. The institution’s financial position was found to be insolvent, with liabilities exceeding assets. The Bank of Lithuania intends to involve law enforcement authorities to assess potential criminal offenses.

As reported by FinTelegram, in February 2023, BoL imposed activity restrictions on PAYRNET and appointed a temporary representative for supervision. In terms of annual turnover, the institution ranked fifth among Lithuania’s electronic money and payment institutions in 2022.