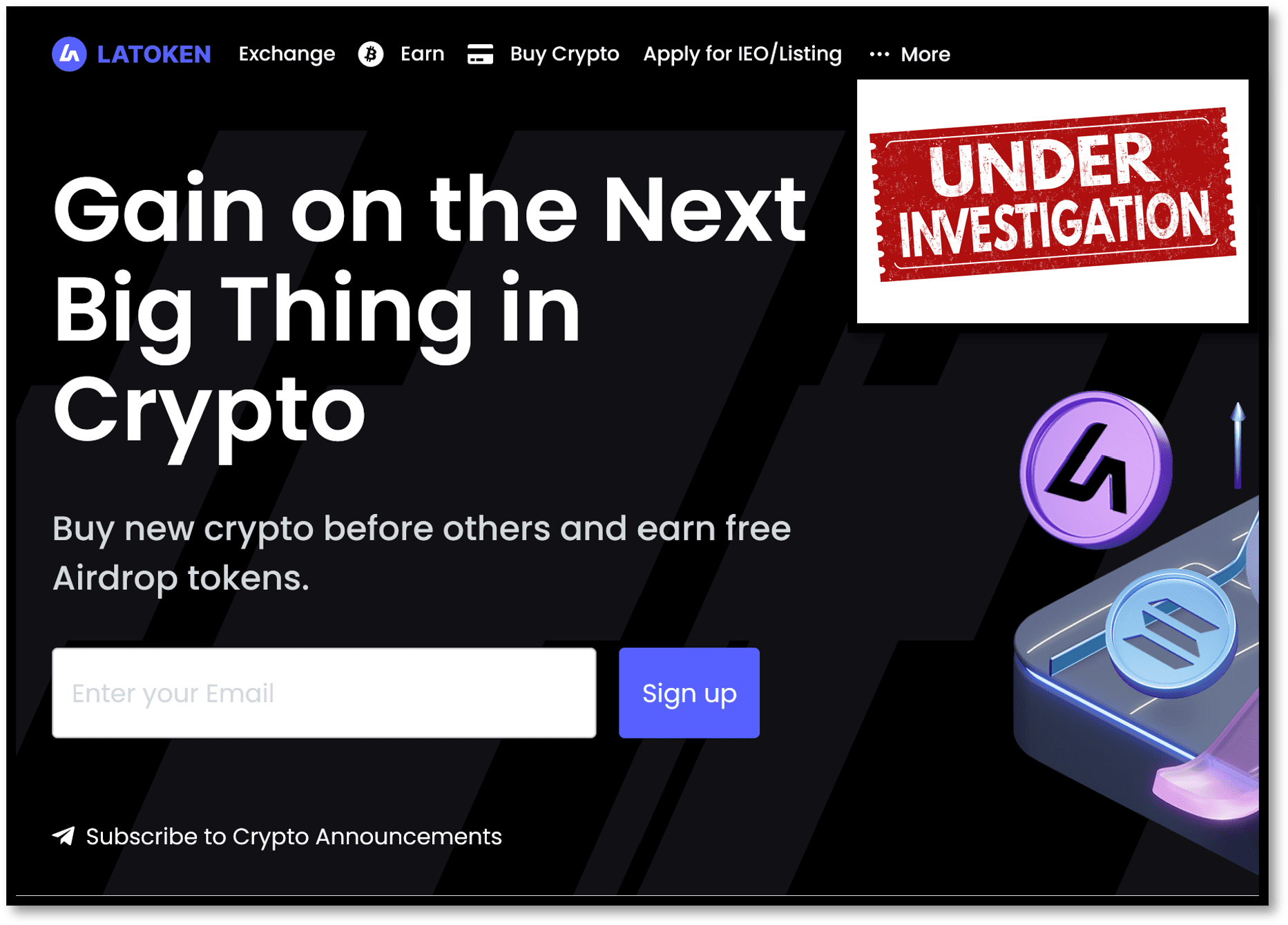

The German BaFin announced today that it had initiated investigations against LiquiTrade Limited in the Caymen Islands. This offshore entity is behind the well-known LATOKEN crypto exchange, which it jointly operates with Payex OÜ, registered in Estonia. Until June 2022, Payex OÜ had a crypto license from the Estonian FIU. BaFin suspects LATOKEN is offering financial services in Germany without permission. LATOKEN accepts Security Token Offerings (STO).

Key Data

| Trading name | LATOKEN |

| Business activity | Crypto exchange (including Security Token Listings) |

| Domain | https://latoken.com |

| Legal entities | LiquiTrade Limited, Caymen Islands Payex OÜ, Estonia |

| Related individuals | Valentin Preobrazhenskiy (LinkedIn) Aleksandr Panas Deniss Kudrjašov |

| Authorization | No |

| Warnings | BaFin |

Short Narrative

Most recently, the U.S. SEC had opened investigations against Coinbase on suspicion that the leading U.S. crypto exchange was listing and trading Security Tokens without a license. Coinbase has always denied this accusation. LATOKEN, on the other hand, explicitly states on its website that it gives users access to Security Token Offerings (STO).

LATOKEN offers its own LA token, which was issued in 2017 in an Initial Coin Offering (ICO) and raised $18 million. Currently, the LA Token has a market capitalization of around $29 million.

Times are getting more challenging for crypto exchanges. Regulators worldwide are taking massive action against unregulated operators, especially when regulators suspect that crypto exchanges are allowing security tokens to be traded, as in the case of LATOKEN.