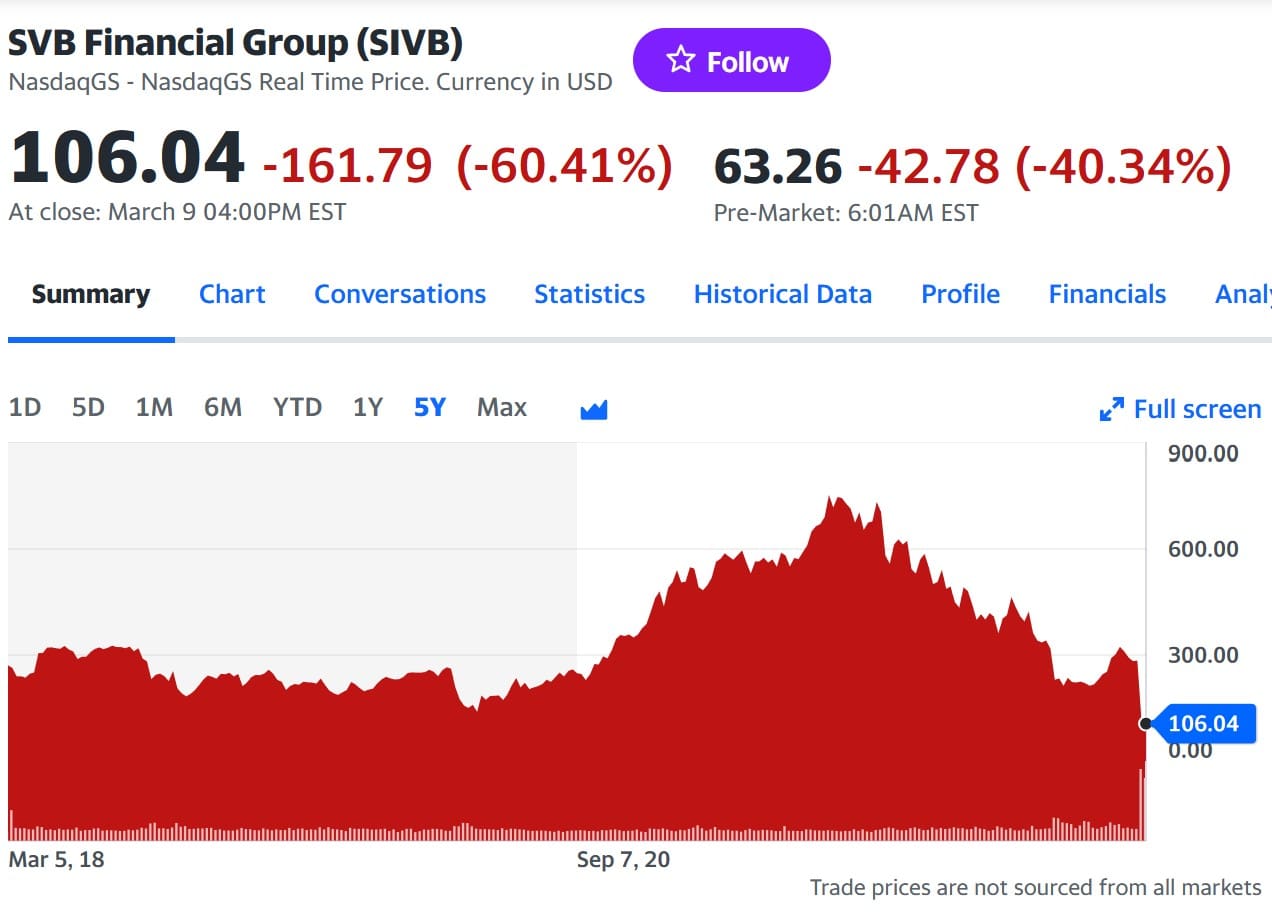

First, it hit the Californian Silvergate Bank. Now, shares of SVB Financial (SIBV), which owns Silicon Valley Bank, the 16th largest bank in the US, plunged 60.41% after the company announced it was raising more than $2 billion in new capital to offset $1.8 in losses. The shares are now down 84% from November 2021 high. Silicon Valley Bank is heavily involved with all aspects of the U.S. startup scene, including crypto.

The SVB stock plunged 24% in premarket trading before exchanges opened in New York on Friday, set to extend its 60% decline on Thursday.

SVB said in a series of SEC filings that it would raise $2.25 billion in equity capital, heavily diluting its existing stockholders. SVB said it would be “repositioning” its balance sheet by having sold all of its $21 billion in available-for-sale securities and booked a staggering loss of $1.8 billion on those sales in Q1 2023.

Alexander Yokum, an analyst with CFRA Research, explained that SVB‘s problems could be attributed to its heavy involvement with struggling venture capital and the private equity industry.

We are certainly not yet at the bottom of this downward trend, which not only includes crypto and FinTechs, but now also the entire financial sector. Investors and entrepreneurs should continue to keep their seatbelts fastened.