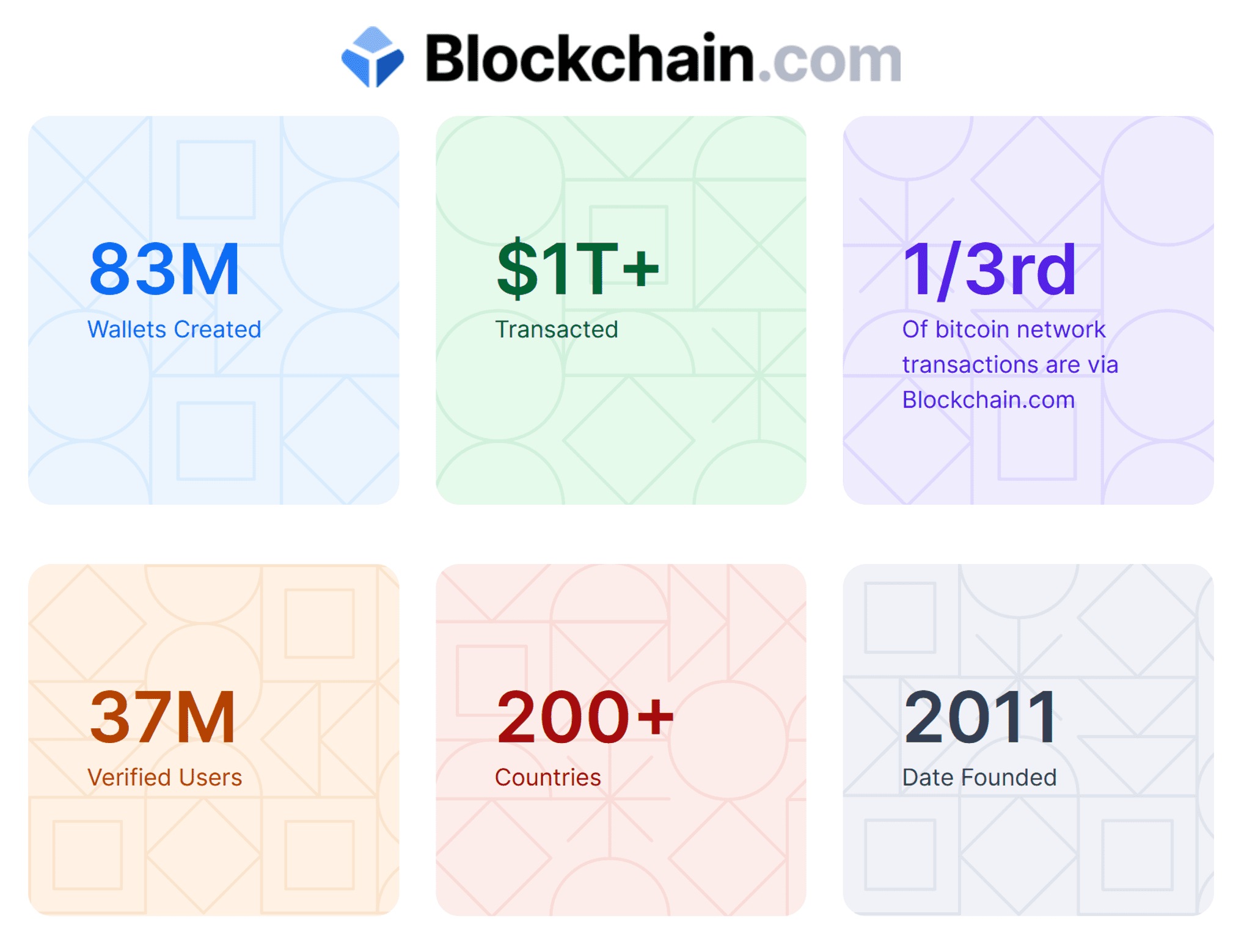

The Celsius Network and Three Arrow Capital debacle perfectly demonstrated that the crypto market has a fundamental regulatory issue. In March 2022, the UK FCA warned that it could not efficiently regulate the crypto giant Binance Group, which operates a wide variety of legal entities in different jurisdictions. The same is arguably true for the Blockchain.com Group. The company claims to have 37 million verified users with $1T+ transactions, which accounts for one-third of all Bitcoin. Largely without supervision because the company is not licensed but just registered.

The Lithuanian Move

Lithuania is a very relaxed place for crypto operators like Binance or Blockchain.com as no license is required. They only need to register with the Lithuanian Financial Crimes Investigation Service (FCIS) and comply with the AML regulations. The FCIS (www.fntt.lt) is responsible for the supervision of the activities of Virtual Currency Exchange Operators and Depository Virtual Currency Wallet Operators. This supervision is related only to the prevention of money laundering and/or terrorist financing.

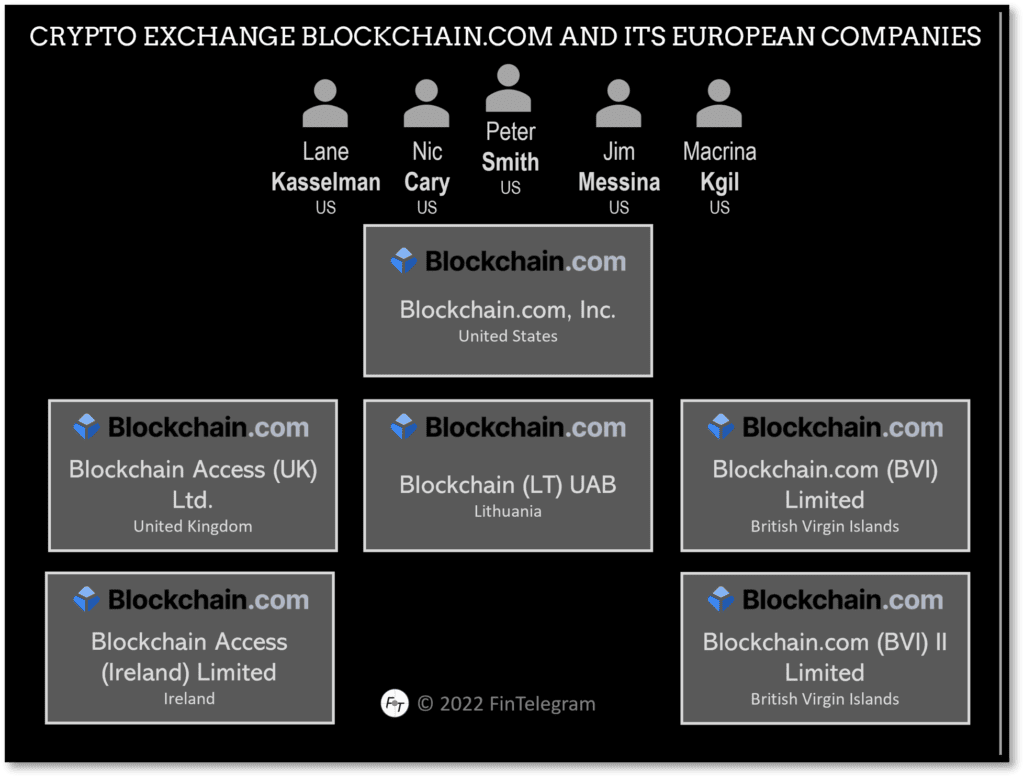

As reported by FinTelegram, the Blockchain.com Group operates with various legal entities in the United States, United Kingdom, Ireland, Lithuania, and offshore. Until recently, clients in the UK and Europe (EEA) were serviced through Blockchain Access (UK) Ltd, which was an FCA-regulated agent of FCA-authorized e-Money Institute (EMI) Modelr FS Limited.

Around February and March 2022, EEA clients were transferred from the UK entity to the Lithuanian Blockchain (LT) UAB, registered with FICS.

The Legal Maze

In its very essence, Blockchain.com is a US venture, founded by the Florida-resident Peter Smith, which runs most of its business via legal entities outside the US.

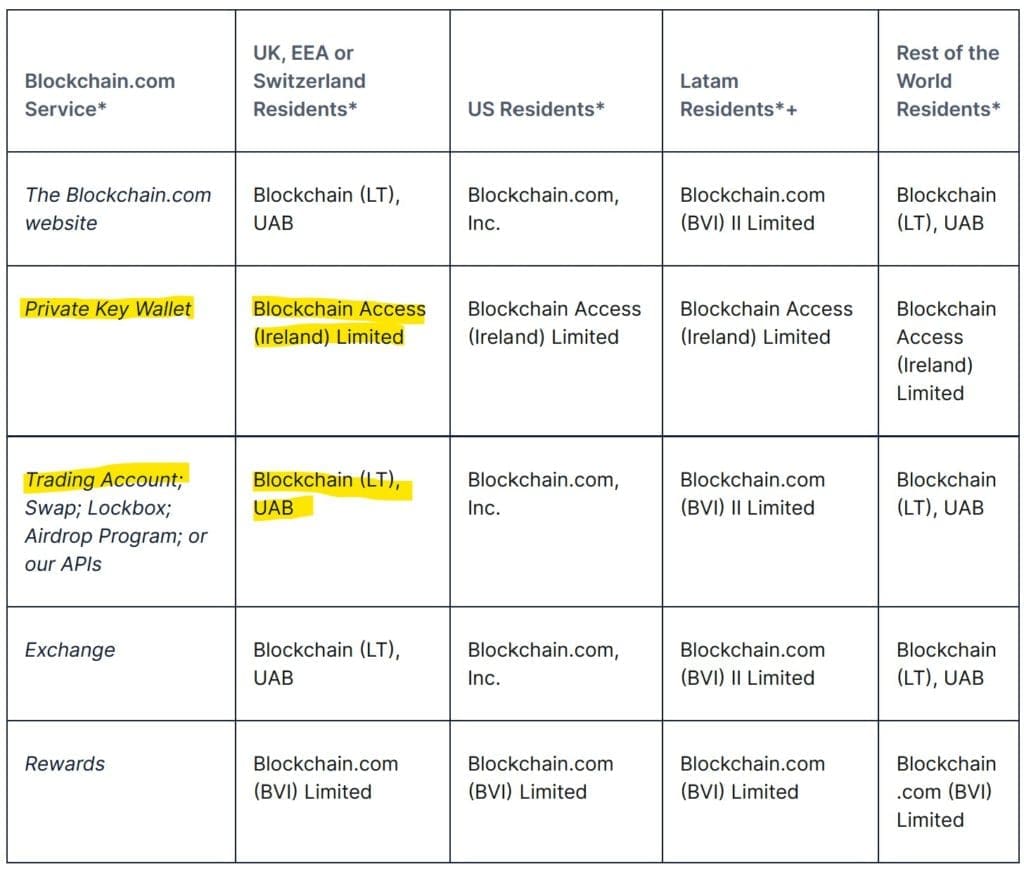

Their Client Agreement reflects this scenario as outlined by FinTelegram recently (see the legal matrix right). Not all services for EEA clients are handled by the Lithuanian company. There is also Blockchain Access (Ireland) Ltd, which also handles the so-called Private Key Wallet services for customers in the United States and the rest of the world. In the U.S., Blockchain.com, Inc. has a money transmitter license in some states.

The Regulatory Issue

The events of the last few weeks with the collapse of crypto hedge fund Three Arrows Capital and crypto lender Celsius Network has driven the entire crypto industry to the brink. Many investors have lost money in the process. Crypto exchanges have lent cryptos to these collapsed companies and now have to make high write-offs that may go to the financial substance. All of this has passed the regulators by.

How can it be that a company like Blockchain.com has 37 million clients but no financial regulator is responsible? Most of the business is done through a company in Lithuania, where you don’t need a license, just a registration. How much longer can lawmakers stand by and watch?

In the Blockchain.com case, with such a portfolio of companies across different regulatory regimes, efficient oversight is a next to impossible task. In fact, according to Blockchain.com‘s Client Agreement, each retail user must work with multiple legal entities in different jurisdictions depending on the services. In such an environment, complaints and audits are hardly possible for retail clients.

We did not find any balance sheet of Blockchain.com Group despite intensive search and no reports on how the funds of the clients are held and invested. Also, the Lithuanian FCIS as the regulator for the group’s so-called Trading Accounts and the Exchange Services will have problems determining if the business is done properly.

There are already numerous complaints about Blockchain.com from customers. On Trustpilot, for example, the company has a 2.3-star “scam rating”. It’s time to intervene to protect investors.

Share Information

If you have any information or complaints about Blockchain.com, its companies and activities, please let us know through our whistleblower system, Whistle42.