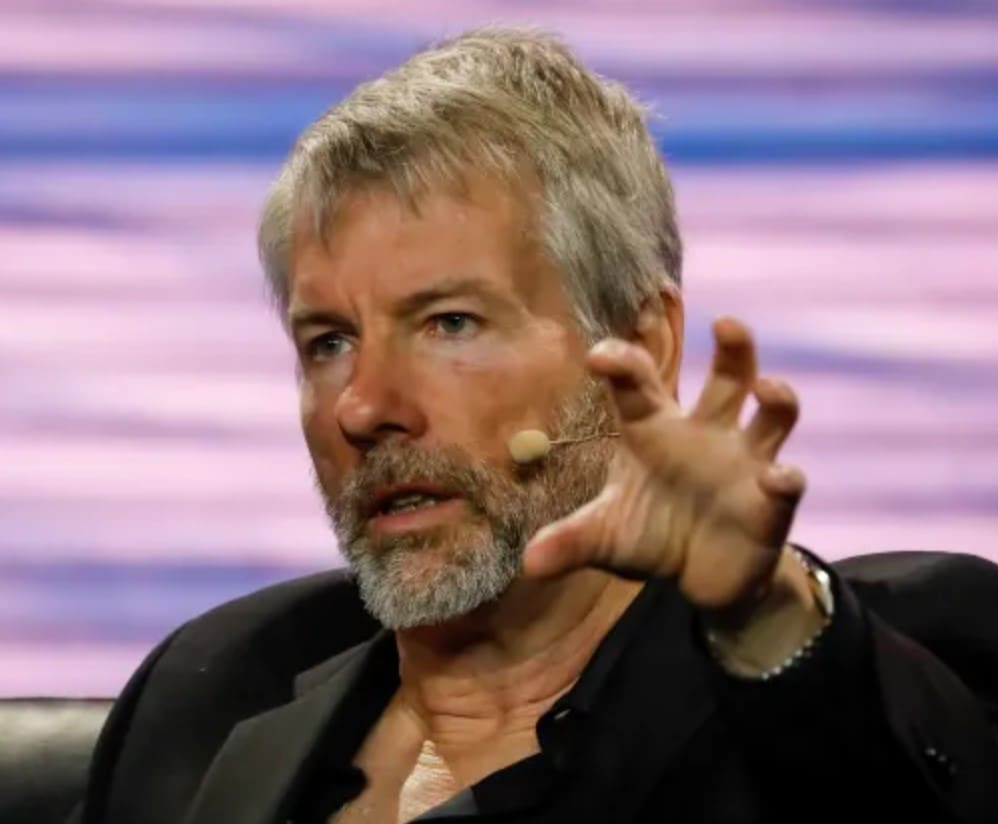

Via Twitter, District Attorney General Karl Racine announced that his authority is suing MicroStrategy co-founder and Executive Chairman Michael Saylor for evading $25 million in district taxes. The complaint alleges that MicroStrategy conspired to help Saylor evade the taxes. Under Saylor’s leadership, MicroStrategy spent close to $4 billion acquiring bitcoin at an average price of $30,700, and he has said he considers the company’s stock a sort of bitcoin ETF.

It’s the first lawsuit brought under DC’s recently amended False Claims Act, encouraging whistleblowers to report residents who evade our tax laws by misrepresenting their residences.

The AG’s office said it’s seeking to recover a total sum of over $100 million in unpaid taxes and penalties. Shares of MicroStrategy were down more than 6% Wednesday afternoon on the news. Michael Saylor, who pushed the company into bitcoin, stepped down as CEO earlier this month.

According to the complaint, Saylor claimed to reside in Virginia or Florida, which have lower or no personal income tax rates, while actually living in several different homes around D.C., including a penthouse apartment in the Georgetown neighborhood or on his yacht on the Georgetown waterfront or Potomac River when the apartment was undergoing renovations. The complaint includes several screenshots of posts that appear to be from Saylor’s Facebook page dating back several years and referencing the view from his “Georgetown balcony” and discussing his “home” while tagging Washington, D.C.

In a statement, Michael Saylor said that he respectfully disagrees with the position of the District of Columbia, and is looking forward to a fair resolution in the courts.

In a statement, MicroStrategy said, “The case is a personal tax matter involving Mr. Saylor. The Company was not responsible for his day-to-day affairs and did not oversee his individual tax responsibilities. Nor did the Company conspire with Saylor in the discharge of his personal tax responsibilities. The District of Columbia’s claims against the Company are false and we will defend aggressively against this overreach.”