The major criminal case in the US against the binary options fraudsters and their accomplices begins on July 16, 2019, with the trial against Lee Elbaz. She was the former CEO of the Israeli company Yukom Communications, which, according to the U.S. prosecution, operated boiler rooms for the binary options platforms BinaryBook and BigOption, among others. The boiler room agen

The Indictment

According to the latest findings, the former owner of Yukom Communications, the Israeli Yossi Herzog, is also accused by the U.S. Government. A total of 18 people from the Yukom environment have been charged, 5 of whom have already pleaded guilty. We currently know the identities of nine of the defendants. The identity of a further 9 defendants is not yet known.

According to the indictment, ELBAZ and her co-conspirators and subordinates induced investors to deposit funds based on misrepresentations, including:

- false statements and material omissions regarding the alignment of financial incentives between investors and the scheme;

- false statements and material omissions regarding the suitability of binary options as investments and returns on investments in binary options;

- false statements and material omissions about the names, qualifications, and physical location of representatives assisting investors; and

- false statements and material omissions regarding investors’ ability to withdraw investment funds and about the reasons that funds could not be withdrawn.

The U.S. indictment alleges that representatives of BinaryBook and BigOption also made false statements and material omissions—and engaged in the deceptive use of so-called “bonuses,” “risk

Scheme anatomy and perpetrators

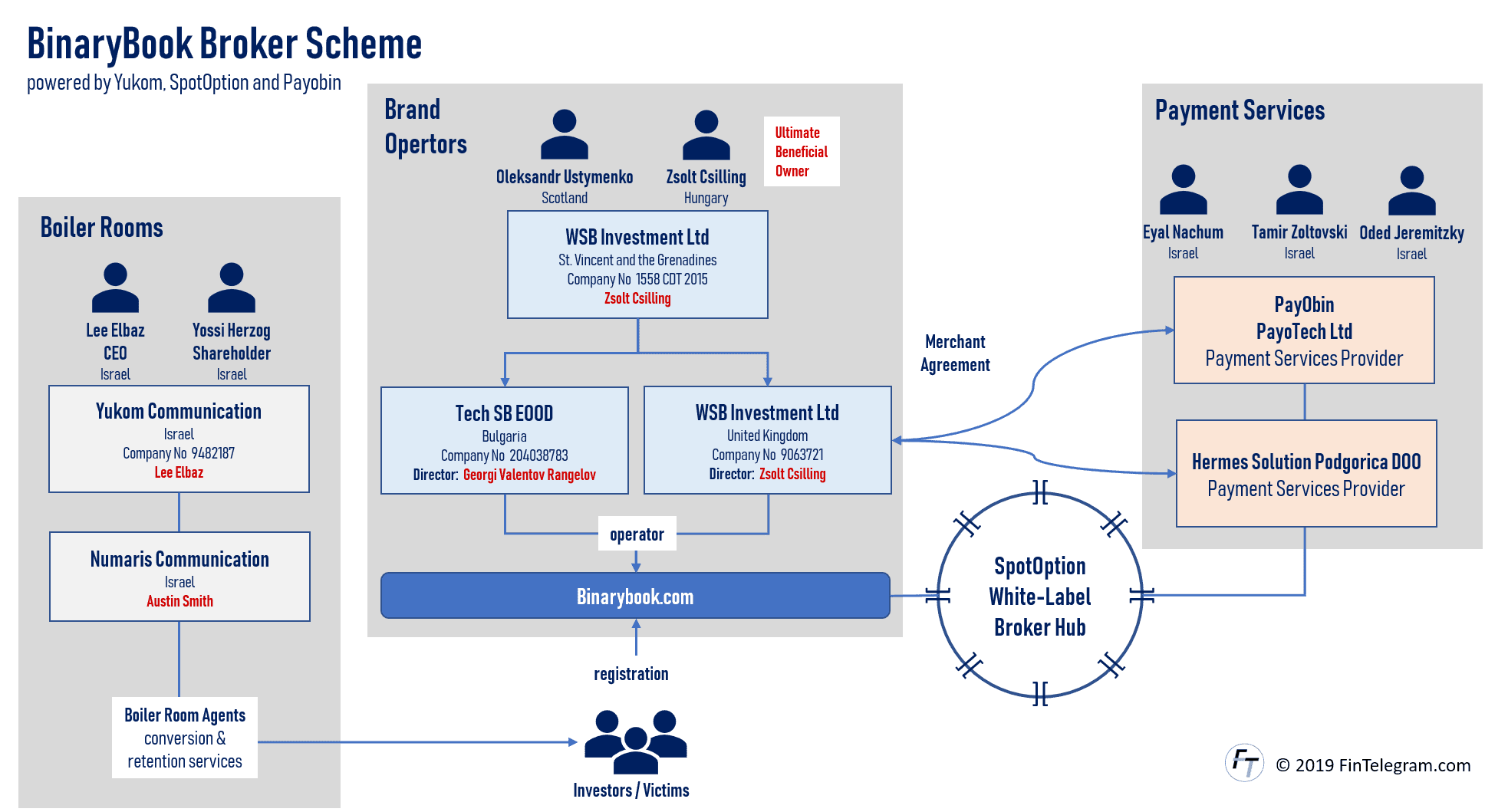

On the occasion of the upcoming court proceedings, we have taken a closer look at the relevant schemes and want to provide some background information for interested court listeners. It is important to understand, that the funds deposited by the investors victims will be split between four different levels of the scheme:

- Brand operator (e.g. BinaryBook or BigOption)

- Boiler room operators and marketing partners (e.g. Yukom, Numaris, MigFin, Market Giants, E& G Bulgaria)

- White-Label solution provider (e.g. SpotOption or PandaTS)

- Payment Services Provider (PSP such as Payobin, GPay, Hermes Solution) for money laundering

It needs the involvement of all four levels to establish an illegal broker scheme such as BinaryBook and run the investment fraud.

This involvement of different perpetrators and entities in a scheme is the reason why the BinaryBook boiler room operators are indicted in the BinaryBook and BigOption case although they have not formally owned the brand. We assume that more people from the other levels will be charged by the U.S. Government.

BinaryBook background

Let’s start with some background information on BinaryBook

- The BinaryBook platform (www.binarybook.com) was operated by WSB Investment Ltd, registered at St Vincent and the Grenadines with the company number 1558 CDT 2015.

- According to a legal opinion by Israeli lawyer Moshe Strugano, WSB Investment Ltd, a UK subsidiary with the company number 09063721 of the same name handled the payment and trading processes.

- The economic owner of the WSB Investment Group, according to the confirmations available to us, is the Hungarian Zsolt Csilling.

- According to a legal opinion available to us, Tech SB EOOD, which is registered in Bulgaria, is also associated with the WSB Investment Group. It is led by the Bulgarians Georgi Valentinov Rangelov and Metodi Andreev Aleksiev.

The Bulgarian principals Rangelov and Aleksiev can be called serial offenders in the area of illegal broker schemes. He is associated with many binary options, CFDs and cryptos operating companies in the company registers of various jurisdictions.

Connections to other scam schemes

Rangelov has also worked with the notorious Northwestern Management Services in the field of illegal brokers. For example at CFD Global, where the equally notorious Vanessa Marie-Antoine Payet was installed as a nominee director.

Rangelov and Aleksiev appear via the Bulgarian MG Ventures EOOD also in the environment of the GToptions Binary Options Scam of World Marketing Ltd from the GreyMountain Management (GMM) network.

Israeli Boiler Rooms

According to the U.S. prosecution, the boiler rooms for BinaryBook were operated by the two Israeli companies Yukom Communication and Numaris Communication. The two accused Lee Elbaz and Austin Smith worked there as CEO and Vice President respectively.

“This is not cemetery here! It’s a boiler room! …. DON’T LEAVE THE MONEY! JUST TAKE IT!”

Yukom boiler room agent (Source: indictment United States v. Lee Elbaz )

The boiler rooms have been the ultimate perpetrators behind the illegal broker schemes such as BinaryBook. The boiler room agents have actually committed the most important elements of this investment fraud.

A “conversion” in a boiler room is a salesperson responsible for converting a prospective binary options customer into an investor and obtaining an initial deposit of finds. A “retention” agent was responsible for working with the investor going forward with the goal of obtaining additional deposits.

In the Yukom Case, the U.S. Government has indicted the former Yukom and Numaris boiler room employees and managers Austin Smith, Liora Welles, Shira Uzan, Lisa Mel, and Yair Hadar. All of them have already pleaded guilty to binary options fraud.

Payment Services Provider

The payment transaction service providers involved in BinaryBook also include the well-known Israeli provider Payobin of Eyal Nachum, Tamir Zoltovski and Oded Jeremitsky and their Montenegrin venture Hermes Solution Podgorica DOO. In addition, WSB Investment maintained banking relationships with Ceska Sporitelna bank in the Czech Republic, where it held US dollar, euro and GBP accounts.