Update Aug 28, 2019: Fintelegram is informed that the client of ICoption took legal action against the evidently innocent PSP in two different jurisdictions, possibly seeking to obtain his funds twice. It is also worth noting that the Qatar courts sentenced the PSP in absentia. So far, the client of ICoption has not explained to FinTelegram whether he has filed reports with the Qatar authorities against the owners and managers of ICoption, i.e., the ultimate perpetrators.

Binary options have been banned in most jurisdictions since 2018, and the individual scams have long since vanished in the dark of the web. However, the legal treatment of the binary options legacy with its dozens of thousands of victims is in full swing. Criminal charges, fraud complaints, and regulatory actions, as in the case of the Yukom Enterprise schemes around Lee Elbaz, Yossi Herzog, and Kobi Cohen in the U.S

The ICoption week in Qatar

Apparently, not only in the U.S. and Europe are the perpetrators behind the binary options scams being chased by authorities, victims and their lawyers, but also in Qatar and Saudi Arabia. This week there will be an interesting court meeting in Qatar in the context of a $5 million lawsuit related to the ICoption binary options scam.

A wealthy and highly respected investor in Qatar had invested more than $1.2 million in the ICoption scam between June and December 2015, making more than $4 million in profits. His ICoption dashboard showed a total balance of $5.6 million. So he wanted to have this $5.6 million paid out. The payout was denied. The usual process of binary options scammers. In this case, however, the investor used his considerable financial resources to defend himself.

The investor filed a lawsuit in Qatar. First against an innocent payment service provider over $5.6 million. In the first instance, he won this lawsuit. This Sunday in Qatar another court date is scheduled in this case.

FinTelegram and the parties

FinTelegram and its EFRI have talked extensively with the parties involved and received valuable information. In return, it was agreed that we would not disclose the parties’ names for the time being. The ICoption cash flow diagram was prepared by the plaintiff, i.e. the ICoption investor from

ICoption, Primero Capital and Ultra Solutions

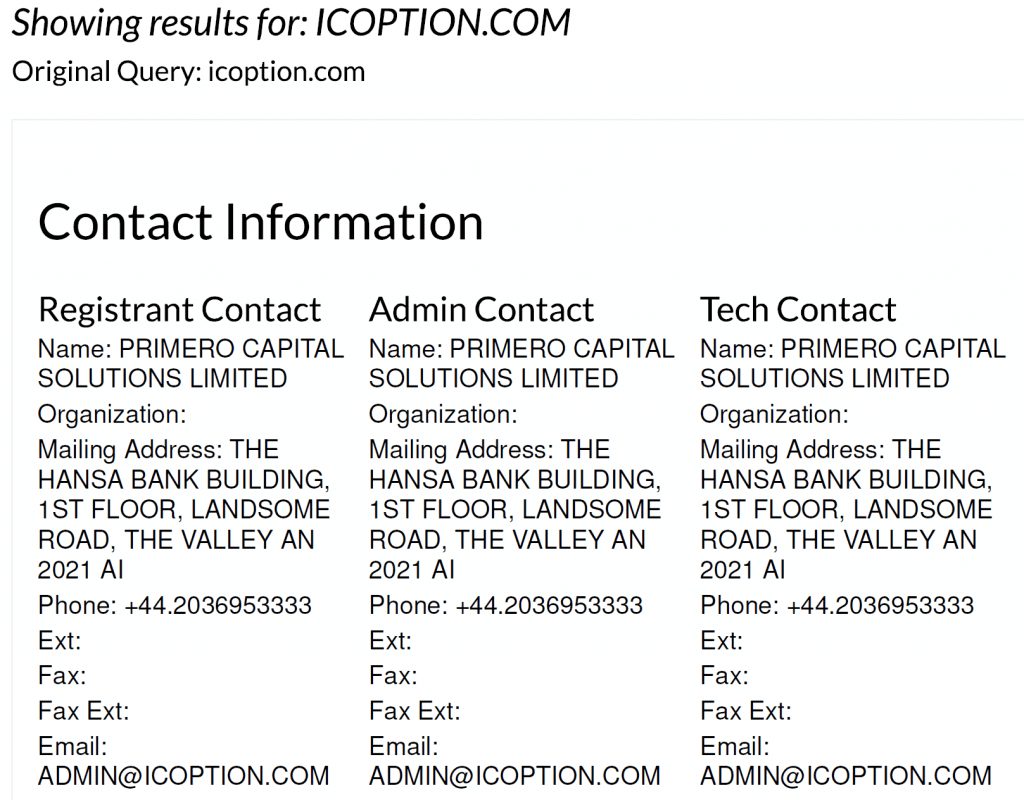

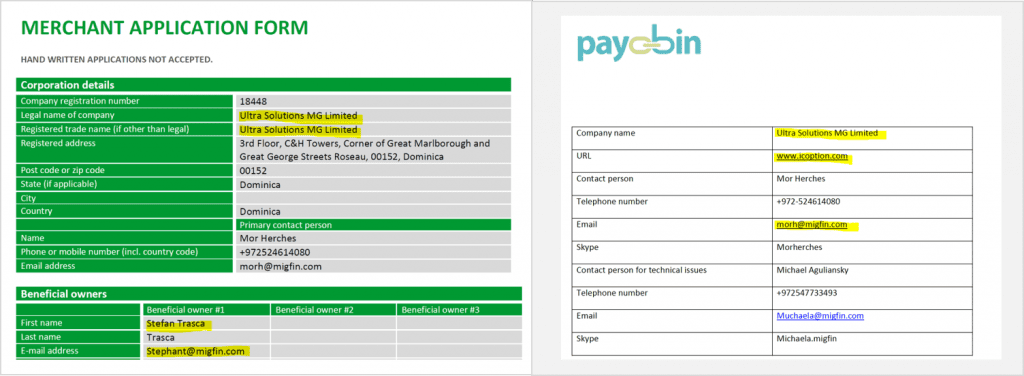

From the court documents, it is again confirmed that the Tel Aviv-based MIG G.A. Marketing Finance Ltd (MigFin) has been the operator of the ICoption scam. The plaintiff specifically named Primero Capital Solutions Ltd and Ultra Solutions MG Limited.

Payobin, Payotech, and MoneyNet International

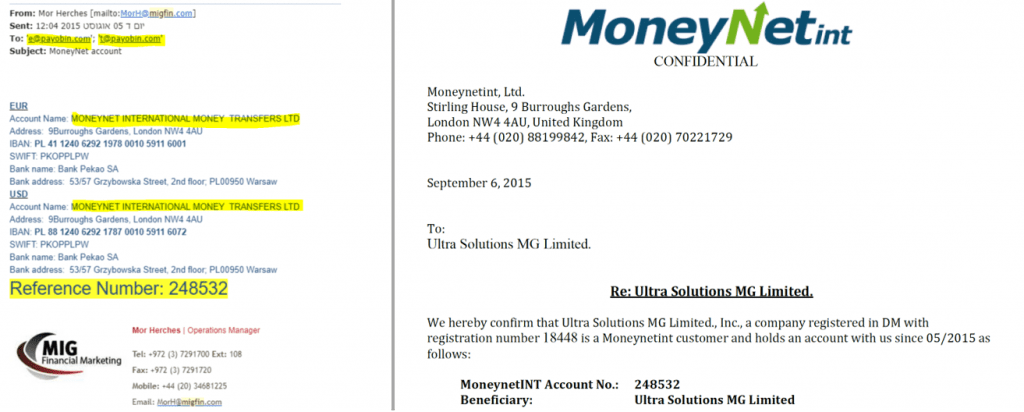

Apart from MigFin, both plaintiff and defendant independently refer to the Payobin of Eyal Nachum and Tamir Zoltovski involved in the ICopion binary options scam as a facilitating payment service provider. In addition, both parties also cite MoneyNet International Ltd as the payment service provider involved.

The legal representatives of Eyal Nachum and Tamir Zoltovski have confirmed to FinTelegram that they are aware of the complaint filed by the investor from Qatar. It was also confirmed that Payobin acquired merchants such as Ultra Solutions MG Limited, the operator of the binary options platforms ICoption and TitanTrade. However, any wrongdoing was denied.

As a matter of fact, FinTelegram has received KYC documents that prove beyond any reasonable doubt that it was indeed Payobin and their beneficial owners, Eyal Nachum (email: e@payobin.com) and Tamir Zoltovski (email: t@payobin.com) who carried out the KYC on ICoption and were involved in the email communication with MigFin about bank details and payments.

In the corresponding screenshots above, you can see that MigFin instructed Payobin’s Eyal Nachum and Tamir Zoltovski to transfer the money from ICoption to a MoneyNet International Ltd account.

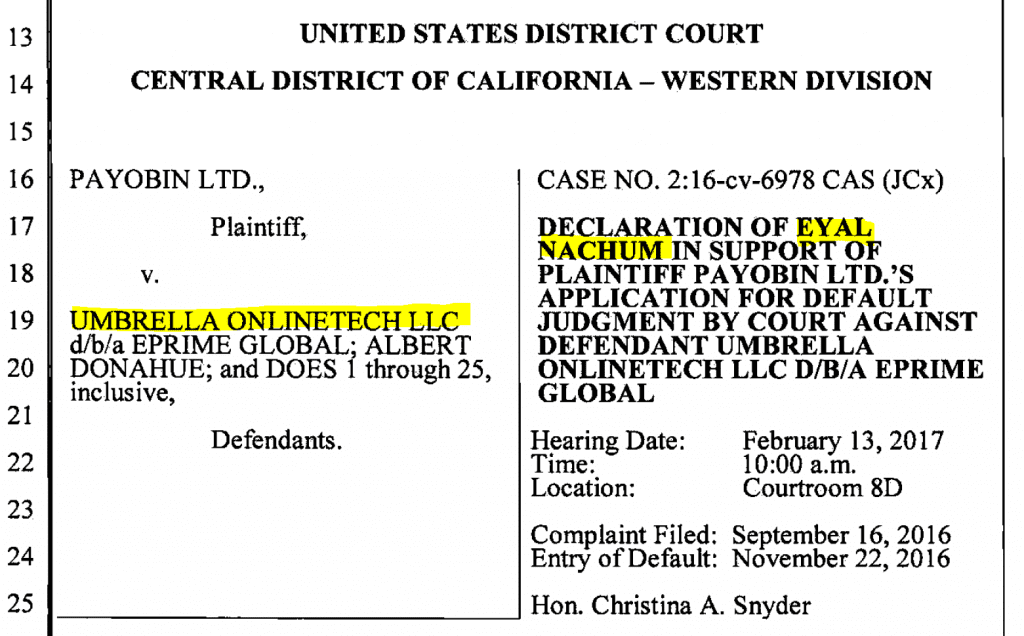

ICoption and the Payobin lawsuit against Umbrella OnlineTech (ePrime Global)

In addition to the FinTelegram information available, there is further conclusive evidence that Payobin was involved in the ICoption scam as a payment service provider. In November 2016, Pay o bin Ltd, the UK subsidiary of the Israeli Payotech Ltd, filed a lawsuit in the USA against its partner Umbrella OnlineTech LLC (2:16-cv-06978) The documents submitted by Eyal Nachum as CEO of Payobin prove that they, together with their US partner Umbrella OnlineTech LLC, have been active in the US market with ICoption and other binary options schemes as a payment services provider. The court documents contain relevant agreements, accounts, and communications.

FinTelegram reached out to the manager then responsible for Europe at Umbrella OnlineTech. He signed the agreements with Payobin and confirmed that he coordinated the payment services with Payobin back then.

to be continued