In November 2021, the plaintiff PayVicki LLC, a U.S. company, filed a lawsuit against Payvision and its parent company ING for breach of contract in connection with a Strategic Partnership Agreement (the “SPA”). Under the SPA, Payvision retained PayVicki for merchant referral services and agreed to pay a commission to PayVicki based on the net revenue derived from the referred merchants. Payvision failed to provide PayVicki with commissions due and owing under the SPA and has failed to provide substantiating documents for said commissions. Accordingly, PayVicki is seeking monetary damages.

Key data

| Court case | PayVicki LLC v. Payvision US Inc. et al |

| Jurisdiction | U.S. New York Southern District Court |

| Plaintiff | PayVicki LLC |

| Defendants | PAYVISION US INC., PAYVISION B.V., ACAPTURE APAC LIMITED, and ING GROEP N.V. |

Case narrative

PayVicki demands a jury trial in the New York Southern District Court. It wants Payvision to pay compensatory damages in “an amount to be proven at trial but no less than” $225,000. According to the lawsuit, ING assumed the liabilities of Payvision in connection with its acquisition of a majority stake in those companies, including any liabilities to PayVicki for outstanding commissions.

ING had acquired the high-risk payment processor in 2018 for a valuation of €360M. Wasted money, it seems. Shortly after the acquisition, ING announced that it plans to close down Payvision (report here). ING found that Payvision was massively involved in unethical business areas and sold these areas back to founders around Rudolf Booker at a symbolic price. ING sold almost the entire business back to the exiting Payvision founders for nothing after it acquired it from them for $360M. Rudolf Booker and his friends will laugh about the ING deal even today.

Other lawsuits

Payvision, along with its former partner T1 Payments, is also currently being sued by Donald Kasdon for fraud by a former customer.

Read more about the T1 Payments court case here!

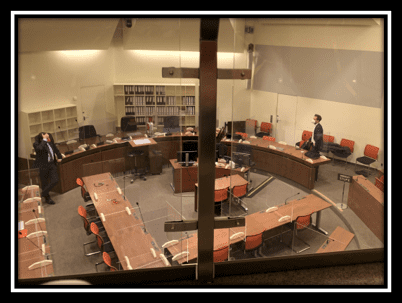

In Austria, there are currently two lawsuits pending against Payvision from victims who lost their money via Payvision merchants’ scams. The lawsuits claim that Payvision and the then CEO Rudolf Booker knowingly and wilfully facilitated scams of the notorious cybercrime principals Gal Barak and Uwe Lenhoff and laundered the stolen money for them.

Given Payvision‘s massive involvement in lawsuits and scams, it is no wonder that ING is shutting down its disgraced subsidiary. However, it is shameful and ethically highly questionable that ING claims that the victims are to blame themselves to fall victims to scammers and their enablers (its subsidiaryPayvision).