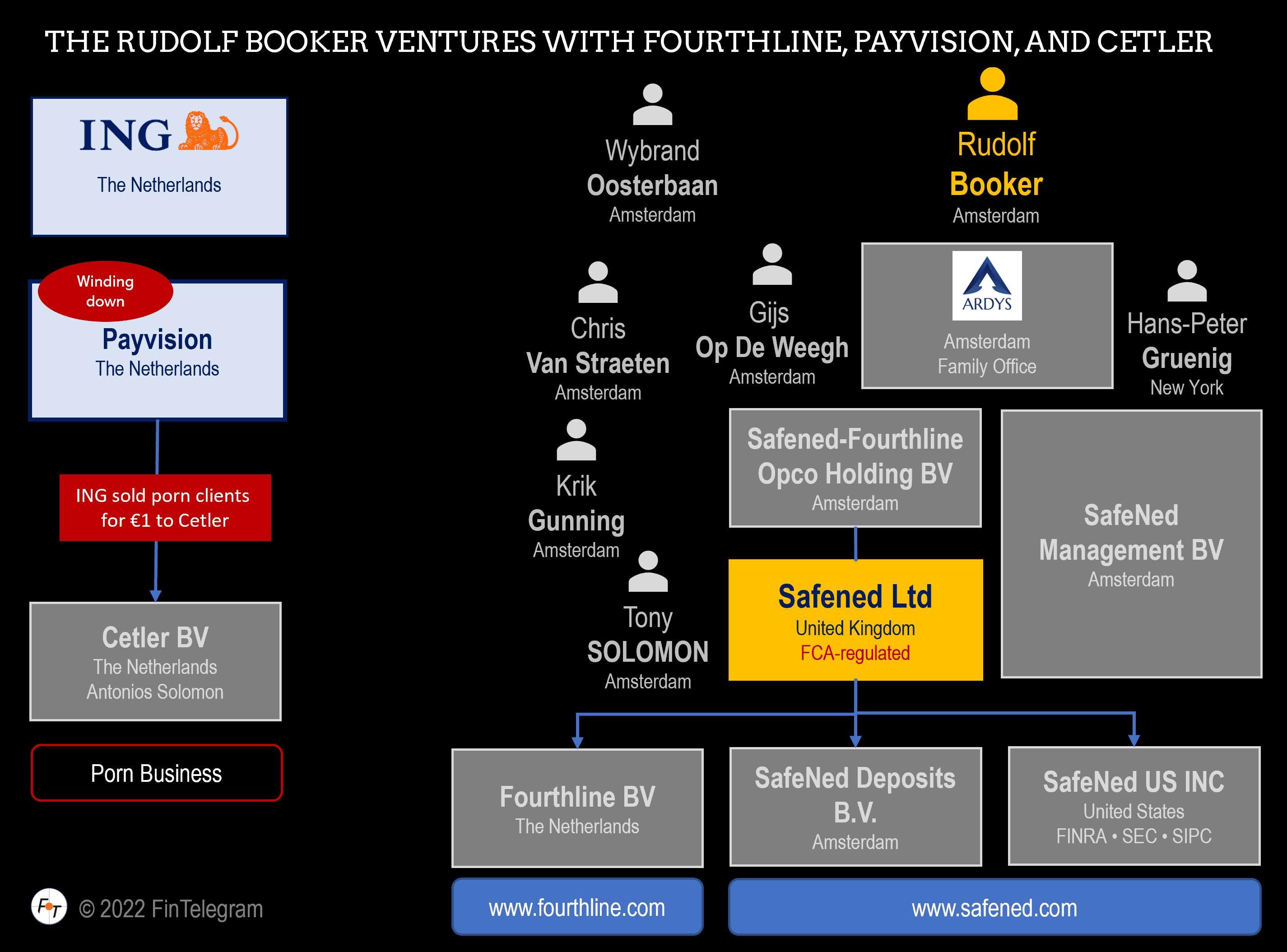

On the 28th of October 2021, ING announced that its subsidiary Payvision would be terminated. The Amsterdam-based FinTech, founded by Rudolf Booker, had just been acquired by ING in 2018 for €360 million. However, it turns out that Payvision facilitated cybercrime and porn business with its payment services. Booker was forced to leave in April 2020. Evidently, he wants to build on his cybercrime expertise and develop RegTech venture Fourthline. In a recent tweet, investor protection advocate Elfriede Sixt calls this a joke!

Until at least Sept 2021, the Amsterdam-registered entity Fourthline B.V. (prev. SafeNed-Fourthline B.V.) (KvK 58905413) had a license from the Dutch AFM (here) and was registered as a payment institution with the De Nederlandsche Bank (DNL) together with Stichting SafeNed Payments B.V.

However, Fourthline became a compliance and KYC solution provider for FinTechs and financial institutions. Krik Gunning is one of the company’s co-founders and CEO. Chris van Straeten is the Chief Financial Risk Officer. Both are part of the management team of other companies owned or controlled by Rudolf Booker.

Increasingly smarter technology and ongoing in-depth data analytics are required to give criminals no space.”

Fourthline CEO Krik Gunning (Source: banken.nl)

According to the Fourthline website, customers are said to include N26, Solaris, kpn, or Trade Republic. One of Fourthline‘s first and largest customers was the collapsed German Wirecard which does not speak for the quality of Fourthline‘s solution, does it?

The EFRI Lawsuits

Elfriede Sixt currently represents thousands of broker scam victims through the NGO European Fund Recovery Initiative (EFRI). Many of these scam operating entities were clients (merchants) of Payvision. The scam victims have made deposits via Payvision. EFRI is currently coordinating lawsuits filed by the victims against Payvision, which she believes, along with then Payvision CEO Rudolf Booker, knowingly and willingly facilitated the scams. Hence, they would be responsible for the losses.