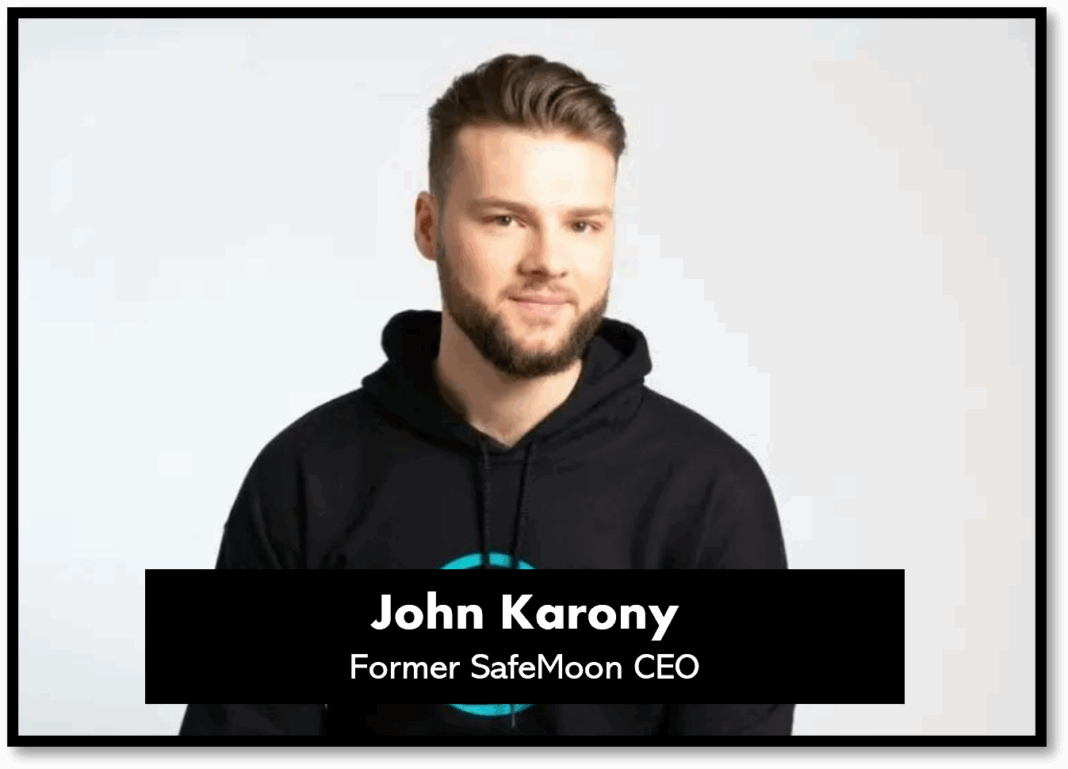

The high-stakes trial of Braden John Karony, former CEO of SafeMoon, which has gripped the crypto world with its explosive allegations and dramatic twists. Kicking off on May 5, 2025, in the U.S. District Court for the Eastern District of New York (EDNY), this case is a rollercoaster of fraud, betrayal, and international intrigue. Karony, who has been free on a $3 million bail since February 2024, faces charges of securities fraud conspiracy, wire fraud conspiracy, and money laundering conspiracy. He’s pleaded not guilty, loudly proclaiming his innocence on social media and pointing fingers at SafeMoon founder Kyle Nagy, who reportedly fled to Russia after charges were filed. With the trial set to run until May 26, 2025, the latest developments, including heated discussions on X, paint a picture of a crypto scheme gone horribly wrong.

The Charges: A Multimillion-Dollar Crypto Heist

Karony, alongside SafeMoon founder Kyle Nagy and former CTO Thomas Smith, was indicted in November 2023 for allegedly defrauding investors out of millions through their decentralized finance (DeFi) token, SafeMoon (SFM). Prosecutors claim the trio misrepresented the security of SFM’s “locked” liquidity pools, assuring investors that these funds were inaccessible to insiders and immune to “rug pulls”—a notorious crypto scam where developers drain funds and vanish. In reality, the defendants allegedly retained access to these pools, siphoning off millions to fund lavish lifestyles, including luxury cars like a custom Porsche 911, multiple Audi R8s, and real estate across Utah, New Hampshire, and Florida. At its peak, SafeMoon’s market cap soared to $8 billion, with over one million holders, but the scheme’s collapse wiped out billions in value, leaving investors reeling.

The U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) have both taken aim at SafeMoon. The DOJ charges focus on conspiracy to commit securities fraud, wire fraud, and money laundering, while the SEC alleges violations of securities laws through the unregistered sale of SFM tokens. The SEC claims the defendants withdrew over $200 million from the project, misappropriating funds for personal gain while falsely promising to take the token “safely to the moon.”

The Trial Begins: A Victim’s Pain and a Co-Conspirator’s Testimony

The trial kicked off with jury selection on May 5, 2025, and wasted no time diving into the drama. On the first day, the prosecution brought forward a SafeMoon victim who lost $20,000, highlighting the human cost of the alleged fraud. William Maurer, a 43-year-old architect, testified about investing between May and October 2021 after reading SafeMoon’s whitepaper, which promised “100% safety” through locked liquidity pools. His testimony underscored the betrayal felt by investors who trusted the company’s claims, only to see their funds vanish.

The Star Witness

In a shocking turn, Thomas “Papa” Smith, SafeMoon’s former CTO, appeared as a star witness for the prosecution on day one. Smith, who pleaded guilty to securities fraud conspiracy and wire fraud conspiracy in February 2025, is cooperating in hopes of a reduced sentence. He testified that he, Karony, and Nagy “regularly discussed how to structure responses to the public” to conceal their withdrawals from the liquidity pool.

Smith also alleged that Karony personally directed him to transfer funds to a centralized exchange, establishing a price floor for SFM and manipulating the market—a damning accusation that paints Karony as the mastermind behind the scheme. Smith even claimed Karony defrauded him by promising a 10% ownership stake in the firm running SafeMoon, only to deny it later.

Karony’s Defense: Blaming Nagy and Claiming Innocence

Karony has maintained his innocence from the start, taking to X to assert that he’s not guilty of the charges. He’s pointed the finger at Kyle Nagy, SafeMoon’s founder, who allegedly fled to Russia after the charges were filed in November 2023. Nagy’s escape has added a layer of international intrigue to the case, with reports from January 2025 suggesting he was “extorted” by Russia’s FSB security service. The U.S. authorities have labeled Nagy a fugitive, and his absence from the trial has fueled speculation about his role in the fraud.

Karony’s defense team, led by attorney Nicholas Smith (no relation to Thomas Smith), has argued that Karony was transparent about withdrawals from the liquidity pool and that investors should have been aware of the risks. They’ve also claimed that deceptive statements about SafeMoon were made by Nagy and others before Karony joined the team, portraying him as a latecomer with limited knowledge of cryptocurrency and liquidity pools at the time. Posts on X reflect a split in public sentiment: some users, like @safemoon_knight, have highlighted the defense’s strong arguments, suggesting Karony might secure a “not guilty” verdict, while others, like @0xNXTLVL, describe the trial as a mix of “drama and disbelief,” focusing on the victim’s testimony and Smith’s betrayal.

The X Buzz: A Crypto Community Divided

The trial has sparked intense discussion on X, where the crypto community is divided over Karony’s fate. Some users see him as a scapegoat for Nagy’s actions, noting that Nagy created SafeMoon and Smith was involved before Karony took the helm. Others view the prosecution’s case as airtight, especially with Smith’s testimony and the victim’s emotional account. The trial’s relatively low media profile compared to high-profile crypto cases like Sam Bankman-Fried’s in 2023 has also been a talking point, with some on X speculating that the crypto-friendly stance of the current U.S. administration under Donald Trump might influence the outcome. Karony’s earlier attempt to delay the trial in February 2025, citing potential SEC policy changes under Trump, was denied, but it reflects the broader uncertainty surrounding crypto regulation.

What’s at Stake: A Test for Crypto Accountability

As the trial continues until May 26, 2025, the stakes couldn’t be higher. If convicted, Karony faces up to 45 years in prison—a stark reminder of the consequences awaiting those who exploit the loosely regulated DeFi space. The case also tests the DOJ’s commitment to pursuing crypto fraud under a Trump administration that has signaled a softer approach to digital asset enforcement. For investors, the trial is a grim lesson in the risks of DeFi platforms promising astronomical returns without transparency or accountability.

The SafeMoon saga is a cautionary tale of greed and deception in the Wild West of cryptocurrency. With Nagy on the run, Smith turning state’s witness, and Karony fighting for his freedom, this trial is a blockbuster showdown that could redefine trust in the crypto industry. Stay tuned as this financial crime drama unfolds—justice may be served, but the scars of SafeMoon’s collapse will linger for years to come.