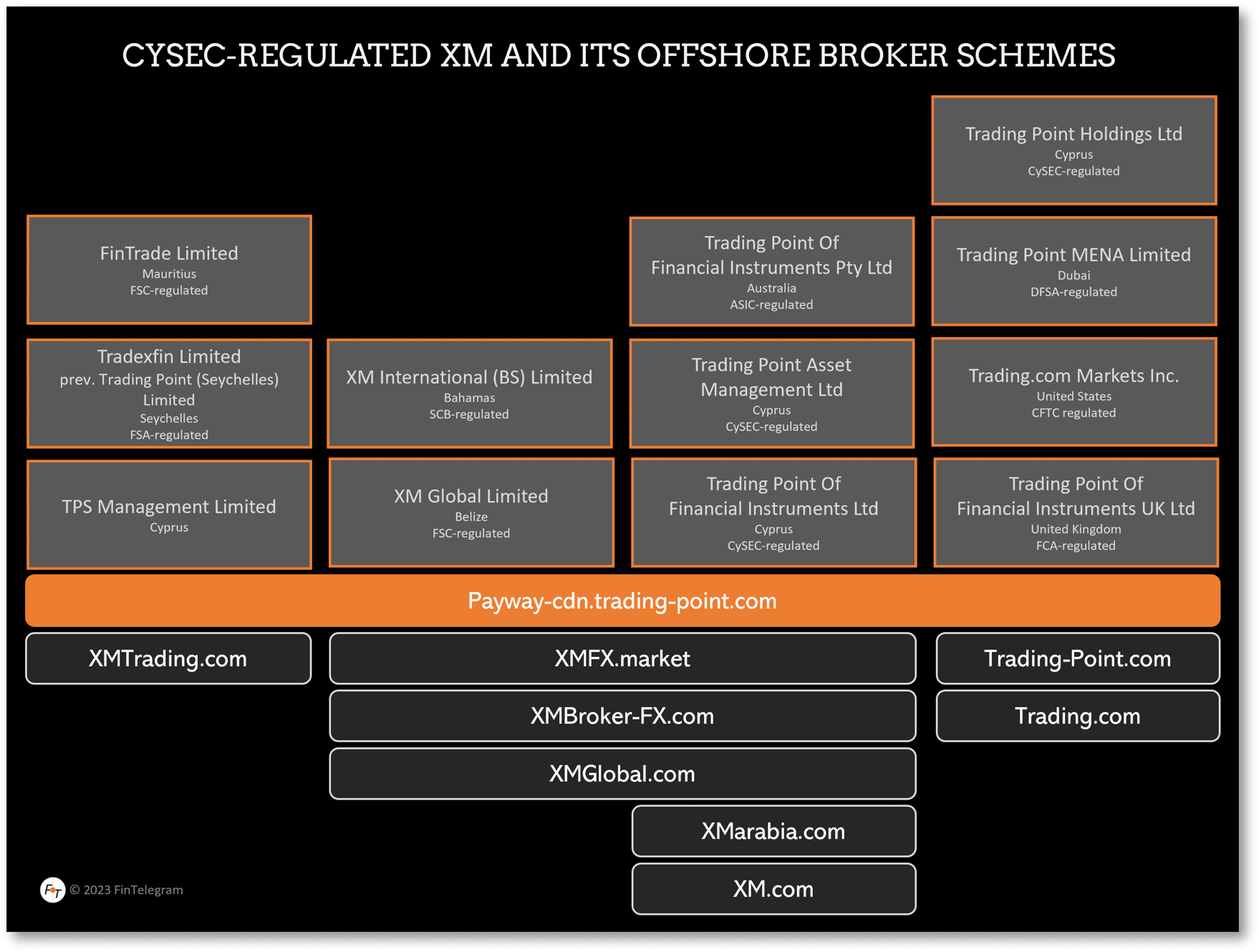

XM is a CySEC-regulated broker and part of the Trading Point Group; Its mirror platforms XMTrading and XMGlobal are huge offshore broker schemes operated through offshore entities and TPS Management Limited in Cyprus. While more than 98% of the XMTrading website visitors come from Japan, XMGlobal websites XMFX.markets and XMBroker-FX.com attract almost 85% of its visitors from China and 71% from Malaysia, respectively. Here is our initial review.

Key data

| Trading names | XM XMTrading Trading Point |

| Domains | www.xm.com www.xmtrading.com www.xmbroker-fx.com www.xmglobal.com www.xmfx.market https://www.xmarabia.net www.trading.com https://www.trading-point.com |

| Legal entities | Tradexfin Limited (Seychelles), prev. Trading Point (Seychelles) Limited FinTrade Limited (Mauritius) Trading Point Holdings Ltd (Cyprus) Trading Point of Financial Instruments UK Limited (UK) Trading Point of Financial Instruments Pty Ltd (Australia) TPS Management Limited (Cyprus) Trading Point Asset Management Ltd (Cyprus) XM Global Limited (Belize) Trading Point MENA Limited (Dubai) Trading Point of Financial Instruments Ltd (CySEC) XM International (BS) Limited (Bahamas) |

| Jurisdictions | Seychelles, Mauritius, Cyprus |

| Regulator | CySEC for Trading Point with license number 120/10 CySEC for Trading Point Asset Management with license number 256/14 FCA for Trading Point of Financial Instruments UK ASIC for Trading Point of Financial Instruments FSC Belize for XM Global Limited DFSA for Trading Point MENA Limited CFTC for Trading.com Markets Inc. SCB for XM International (BS) Limited FSA Seychelles for XMTrading FSC Mauritius for XMTrading |

| Leverage | up to 1:30 for CySEC and FCA up to 1:1000 (offshore) |

| Proper KYC | yes |

| Investor protection & Ombudsman | yes, for CySEC entity no for offshore scheme |

| Payment options | Credit/debit cards, e-wallets |

| Payment processors | Eurobank Ergasias Payabl, Nuvei, Neteller, Skrill, SticPay |

| Related individuals | Dimitris Dimitriou (LinkedIn) Constantinos Cleanthous (LinkedIn) Christoforos Livadiotis (LinkedIn) Andreas Loizides (LinkedIn) Marios Papapostolou (LinkedIn) Bilal Waheed (LinkedIn) Rishi Zaveri (LinkedIn) Carol Papantoniou (LinkedIn) Elena Nicolaou (LinkedIn) Constantinos Costa (LinkedIn) |

The Trading Point Group

Until mid-2019, XMTrading was operated by Trading Point (Seychelles) Limited and was a visible part of the Trading Point Group. Around May 2019, the company was renamed Tradexfin Limited, and the website has removed all links to Trading Point. In addition to the offshore entities FinTrade Limited and Tradefinex, Cyprus-based TPS Management Limited, a subsidiary of Tradefinex, is also named as the operator of XMTrading. The company is managed by Dimitris Dimitriou.

The logos of XM and XMTrading are almost identical, only the addition of “Trading” distinguishes them. The look and feel is also identical. Moreover, XMTrading uses Trading Point‘s payment API (payway-cdn.trading-point.com). It is obvious to us that XMTrading are still closely affiliated with Trading Point group and XM.

The XFMX.market, XMGlobal.com and XMBroker-FX.com websites are operated by XM Global Limited on Belize together with the CySEC entity, their websites state. Nevertheless, they offer leverage of up to 1:1000.

XMarabia.com is operated by the CySEC Entity, the website states.

Regulatory Check

XMTrading does not officially accept clients from EEA jurisdictions. However, it was possible for us to register with an EEA residual address in our review on February 17, 2023. The XMGlobal mutations XMFX.market and XMBroker-FX.com officially welcomed EEA residents. In the dropdown menus, the EAA jurisdictions as well as their locations and streets, are stored ready. Evidently, the onboarding of EEA residents is part of the strategy.

We could have theoretically transferred unlimited amounts of money to XM Global Limited‘s account at Greek Eurobank Ergasias without verifying our identity or address via international bank transfer in the XMGlobal broker schemes.

When depositing by credit/debit card, the amount was limited to €2,000. As payment processors for card payments we discovered Payabl and Nuvei.

We would have been able to deposit a maximum of €2,000 before verifying our identity or address as part of the KYC check. Thus, XMTrading is also within the regulatory framework of ESMA.

In terms of leverage, XMTrading is very generous and offers up to 1:1000. In most jurisdictions. However, a maximum of 1:30 is allowed for retail clients. Japan, where the majority of clients apparently come from, is more flexible.

The Client Base

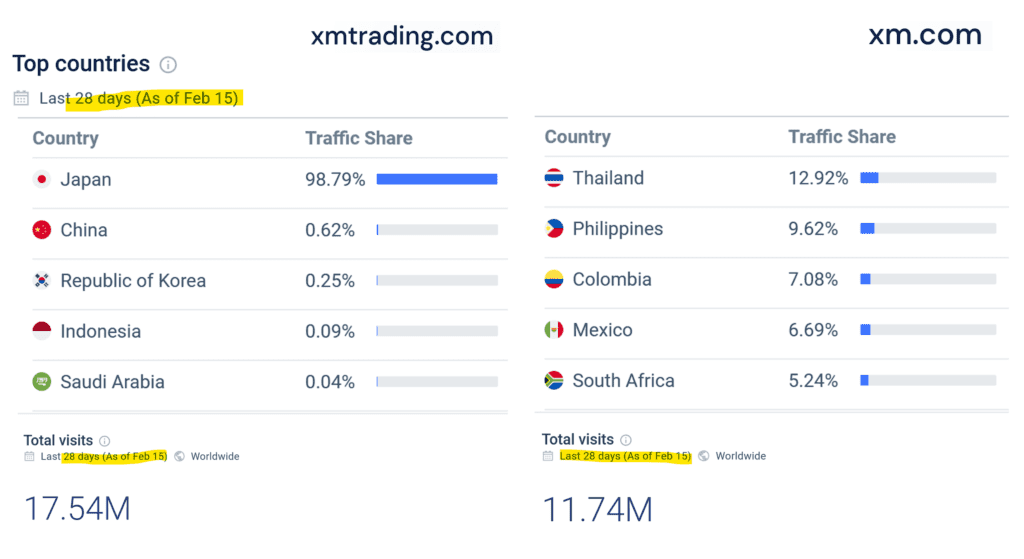

XMTrading is a huge offshore scheme that has its clients mainly in Japan. In the last 28 days (before February 15, 2023), more than 17.5 million people visited the XMTrading.com website. More than 98% of them came from Japan. This was also the case from November 2022 to January 2023.

In comparison, the XM.com website has had around 11.7 million visitors in the last 28 days, with the majority coming from Asia (except Japan), Latin America and South Africa. In total, the various XM and XMTrading websites have had around 30 million visitors. That is impressive.

Share Information

If you have any information about XMTrading, its operators, and its facilitators, please share it with us through our whistleblower system, Whistle42.