The liability of payment processors for intentional or grossly negligent participation in cybercrime schemes and the resulting damage to victims is one of the major issues in the fight against cybercrime. FinTelegram, together with EFRI, will therefore use the Payvision precedent to stimulate a public discussion around victims’ claims and provide background information in the coming weeks. Below is the initial report. Stay tuned!

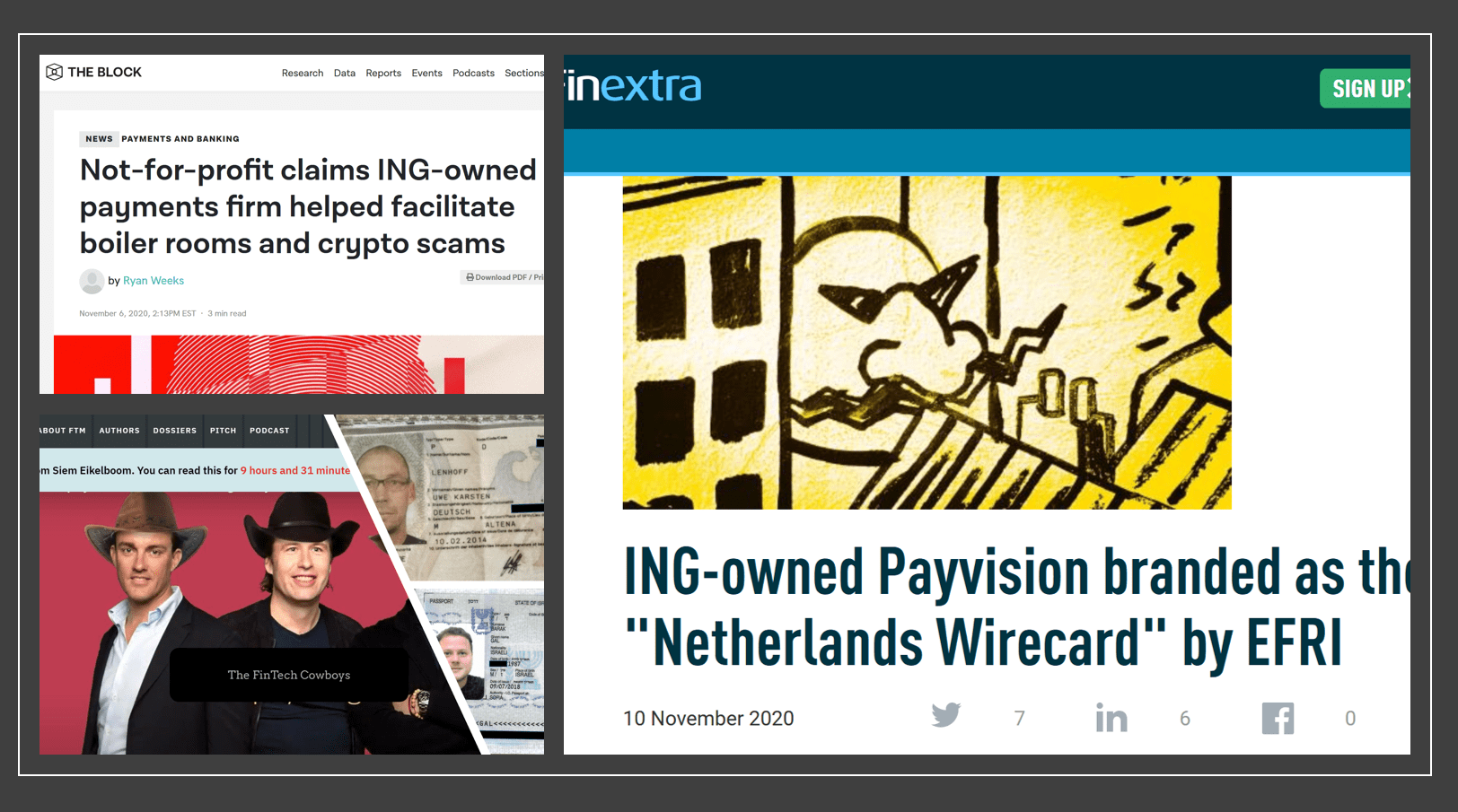

Unfortunately, the international payment processor industry is crowded with bad actors facilitating cybercrime and laundering their money. Payvision was one of them. Founded by Rudolf Booker in 2002, Payvision has been facilitating cybercrime organizations like E&G Bulgaria and their broker scams. Gal Barak and other ringleaders have been convicted of investment fraud and money laundering by courts in Germany and Austria. It was found that Payvision was one of the key facilitators who knowingly and willingly participated in the fraud. The payment processor should be liable to the victims and fully compensate the victims. The European Fund Recovery Initiative (EFRI) of Elfriede Sixt is coordinating the corresponding lawsuits.

Through the coordination of EFRI and its lawyers, negotiations with the ING subsidiary Payvision were conducted for months and did not yield any reasonable result. Payvision and ING still deny any responsibility and show no remorse. In particular, they fool the victims again by requesting each single payment slip as proof of transaction, although Payvision has a precise record of every single payment made for each victim made through their systems. ING – one of the biggest European banks – evidently approves of this disgusting approach. ING decided to terminate Payvision because of its illicit business practices but does not care about the victims.

EFRI principal Elfriede Sixt believes that it should now be up to the European courts to determine whether acquirers like Payvision that (a) processed illegal transactions and (b) willingly and willfully violated the respective legal, regulatory, and contractual obligations are liable for the complete loss of the victims. Such a ruling would bring legal certainty for thousands of fraud victims and would set the necessary standards for payment processors, says Sixt.

It is actually a shame that private organizations such as EFRI have to do the job of the national supervisory authorities such as DNB. It is beyond our understanding that DNB has still not revoked this fraud facilitator’s license (Payvision B.V.). For EFRI (and FinTelegram), it is clear that only through the intentional or grossly negligent involvement of payment processors such as Payvision can cybercrime occur at the enormous scale experienced in Europe. It’s not just money laundering but human, organizational and regulatory failures that make cybercrime possible in the first place. This makes payment processors accomplices.