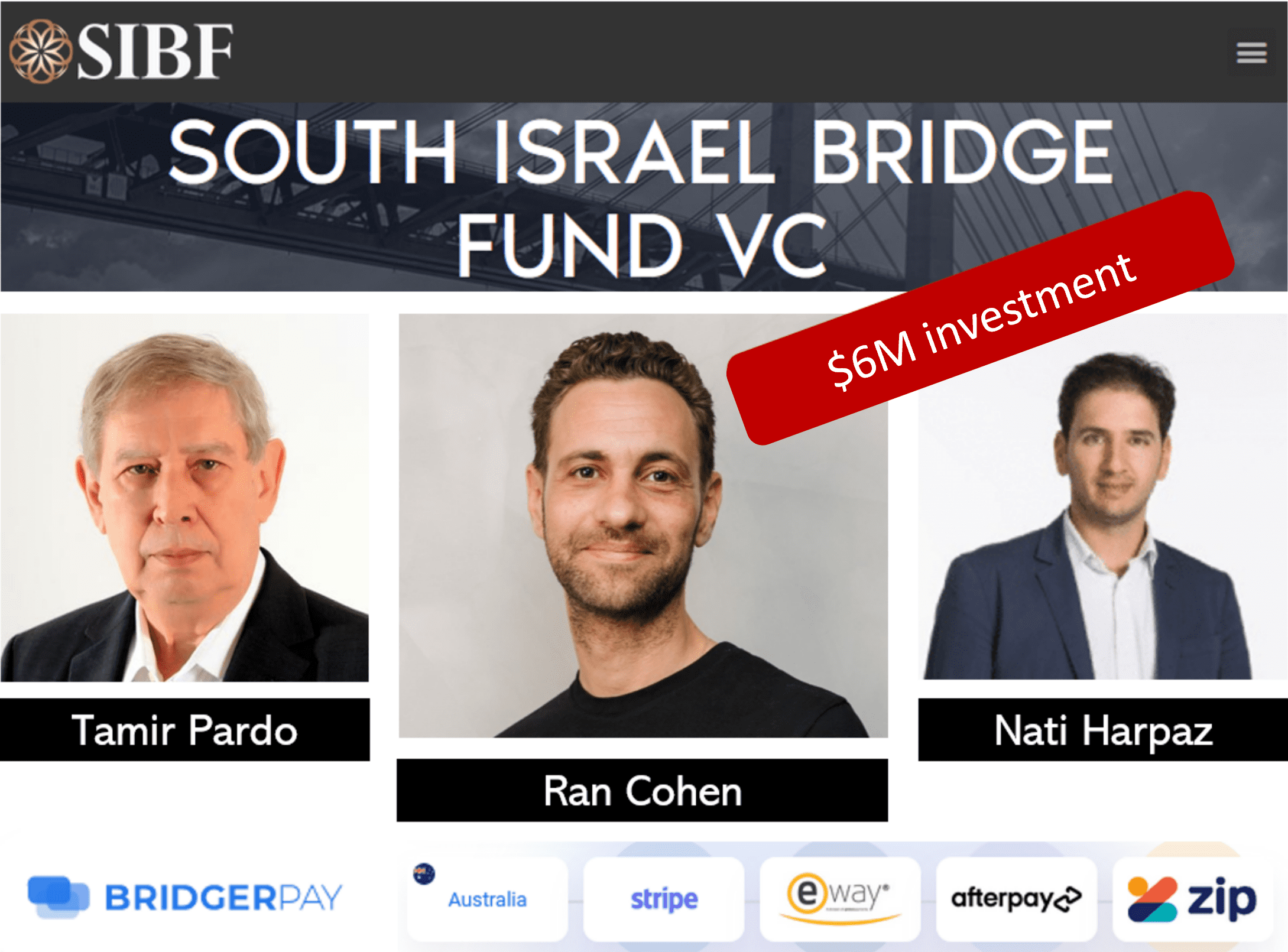

The Cyprus-based Israeli payment processor BridgerPay of Ran Cohen successfully raised 6 million in a seed finance round led by the Nati Harpaz and the Southern Israel Bridging Fund (SIBF). According to Calcalista, the round included $2 million in secondary deals. In 2019, the former forex entrepreneur Ran Cohen teamed up with veteran systems architect and payments expert Yaron Hersh to set up BridgerPay. In 2020, Nati Harpaz joined the company. Since then, the company grew organically, and only now it has decided to raise funds to develop its business.

Key data

| Trading name | BridgerPay |

| Business activities | Payment Processor VISA Merchant Servicer |

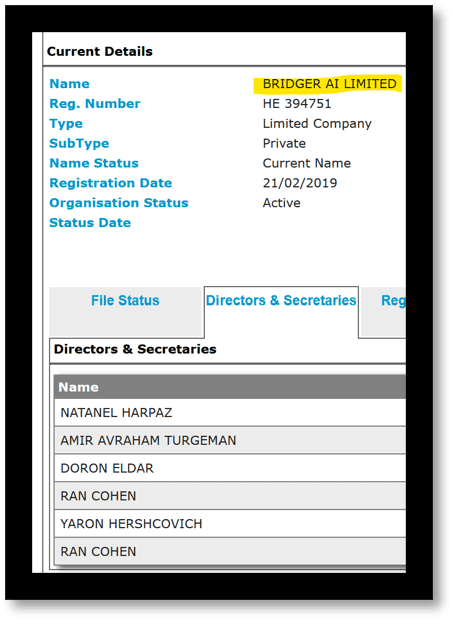

| Legal entity | Bridger AI Limited (Cyprus) |

| Jurisdiction | Cyprus |

| Domain | www.bridgerpay.com |

| Related individuals | Ran Cohen (Israel) Yaron Hersh a/k/a Yaron Hershcovich (Israel) Nati Harpaz (Israel) Doron Eldar |

| Investors | Southern Israel Bridging Fund (SIBF) Amir Avraham Turgeman |

Ran Cohen And Nati Harpaz

Ran Cohen‘s past lies in forex. In particular, he ran Traders Group and partnership with some guys considered by the OCCRP the masterminds of the giant scam machine. The identity of the people is known to FinTelegram, and they confirmed this report. In 2018, Cohen sold his shares in Traders Group to a Cyprus investment firm and established BridgerPay.

Read the report about Traders Group here.

Natanel “Nati” Harpaz joined BridgerPay in 2020 as an executive director. He seems to be important to the company as the now-closed funding round demonstrates. Press reports suggest that Nati Harpaz now invested in BridgerPay alongside SIBF.

In addition to his executive role at BridgerPay, Nati Harpaz also serves as a Director at Trade Square in Australia, which he co-founded. He is Chairman of the Board at Octomedia, and Director at his own investment firm and start-up incubator, Harpaz Group.

No Surprise

At SIBF, former Mossad boss Tamir Pardo is co-founder and president. Also, David Aviv and Eyal Danino are listed as co-founders and managing partners. Tamir Pardo was the 11th director of Mossad from 2011 to 2016 (see Wikipedia). In March 2021, FinTelegram informed that SIBF (www.sibf.vc) was in negotiations to take a 10% stake in Bridger AI Limited based on a valuation of more than $20 million. Specifically, the SIBF allegedly was prepared to invest $2M into the company for a 10% stake. We do not have details on how and if the 2021 transaction and the now announced funding round with BridgerPay and SIBF are connected.

Meanwhile, SIBF partner Doron Eldar (LinkedIn) has also been installed as a director at BridgerPay.

A Self-Onboarding Platform?

BridgerPay allows any business to connect their website to their payment operations platform with 500+ ready-made connections. Ran Cohan said that BridgerPay used the capital to build the world’s first self-onboarding payment operations platform making BridgerPay a full SaaS product and scaling its “go-to-market strategy.“

The automated signup makes available to everyone a technology that is used to reduce the card payments declination rate. BridgerPay find its Bridger Retry would save merchants up to 30 percent of declined card transactions. This is a great story in an honest business environment but a lethal threat in scam environments.

Since BridgerPay‘s inception in 2019, FinTelegram has exposed dozens of huge broker scams that BridgerPay has facilitated with its payment services. Even in the face of warnings from regulators, BridgerPay supports these illegally operating brokers as a payment facilitator and apparently also ensures that victims’ deposits are not rejected by the credit card networks.

Share Information

If you have any information about BridgerPay, its partners, or customers, please let us know through our whistleblower system, Whistle42.