The Maltese Arbiter for Financial Services ruled that Calamatta Cuschieri Investment Services Ltd (www.cc.com.mt) d/b/a Calamatta Cuschieri is guilty of not meeting the relevant regulatory obligations. The detailed decision describes how an investor lost more than €100,000 through investments, which were suggested to him by Calamatta Cuschieri. The MFSA-regulated company is part of the CC Finance Group PLC and one of the largest financial services firms in Malta and is also the distributor of UBS funds in Malta.

The Arbiter Case

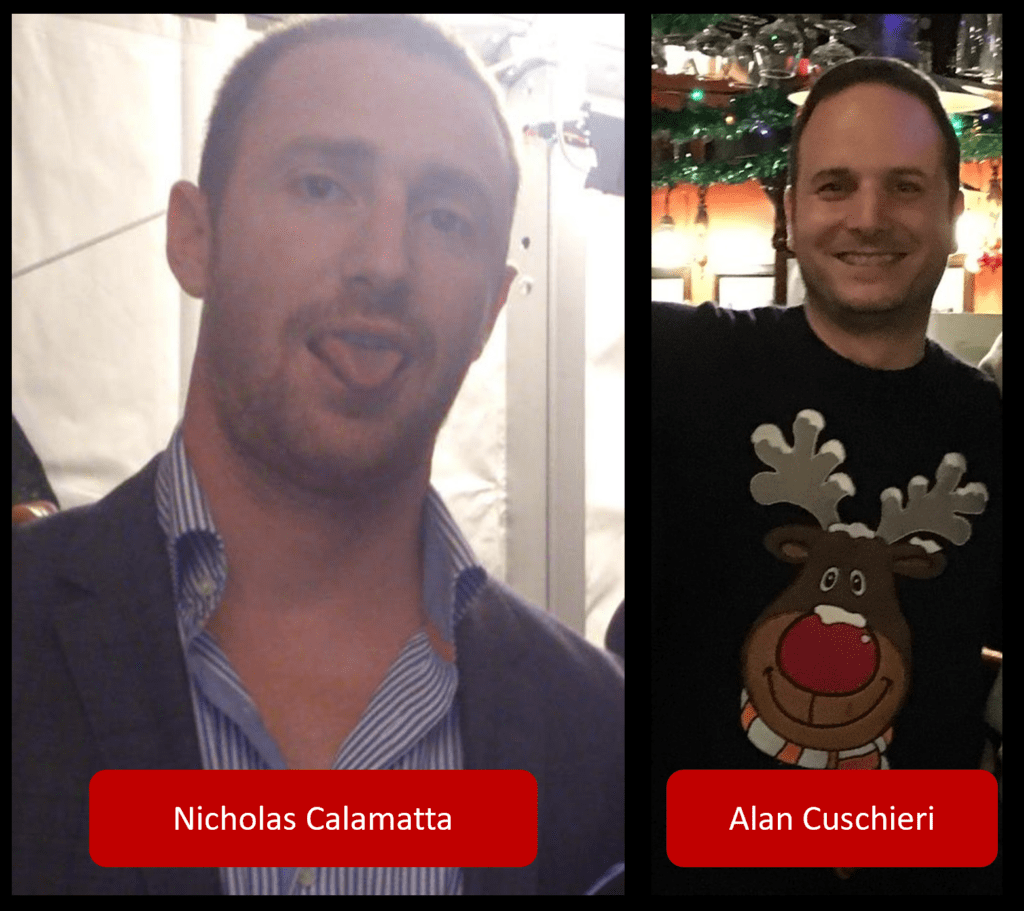

The directors of Calamatta Cuschieri (LinkedIn) include Alan Cuschieri (LinkedIn), Nicholas Calamatta (LinkedIn), and Michael Galea (LinkedIn). The company’s secretary is Kari Pisani, who previously worked at Sparkasse Bank Malta. The bank was fined hundreds of thousands of euros for serious AML issues.

The Maltese Arbiter considered that collective exposure to non-investment grade instruments was suggested by Calamatta Cuschieri. There are onerous obligations on an investment service provider to properly assess and document inter alia the risk a client is willing to take and his investment objective. The onus on the investment service provider is quite high in this regard and such a provider should be able to clearly and unequivocally demonstrate that such obligations have been properly undertaken. The Arbiter considered that the MFSA-regulated investment firm did not meet the relevant obligations. This is particularly so with respect to the aspects involving the Complainant’s ‘investment objectives including risk tolerance’.

The client lost over €100,000 which the company invested for him in a bond of 6.5% Lecta, a Spanish paper company. This defaulted bond was also advised to other clients of Calamatta Cuschieri, either directly as in this case, or via its CCFunds. It is not yet known whether other victims sued the investment firm for their losses.

The Maltese Compliance Issues

Malta has hit the headlines for the wrong reasons over the past months and years. Maltese media have revealed the shocking news about MFSA being that the regulator pays local media houses by direct orders. FIAU’s Director Kenneth Farrugia and his deputy Alfred Zammit have been highly criticized in Malta for not taking action on well-known cases involving high profile Maltese PEPs and led Malta to be greylisted by the FATF.

Calamatta Cuschieri was previously fined by the FIAU for not establishing the source of funds and assets.

MFSA’s outgoing CEO disgraced Joe Cuschieri resigned following the shocking news that he accompanied the alleged mastermind of the assassination of a Maltese journalist, Yorgen Fenech, to Las Vegas on a business and leisure trip. They were accompanied by Edwina Licari, General Counsel of the Malta Financial Services Authority. Other employees of the Authority of the greylisted jurisdiction are Michelle Mizzi Buontempo and Christopher Buttigieg. These officials, who for the past decade have supervised Calamatta Cuschieri, never took any disciplinary action against this firm. However, the company has been ruled to have misled an investor who lost more than €100,000 from his hard-earned savings. MFSA and FIAU officials do not declare their conflicts of interest to the public.

MFSA’s Michelle Mizzi Buontempo and Christopher Buttigieg have been harshly criticized for reaching secret settlements with selected regulated firms.