The melody of the song always remains the same only the lyrics change. We repeatedly find that ever-changing scams would not be possible without European payment facilitators who knowingly and willingly or grossly negligently participate in saying it in less metaphorical terms. The international shadow banking system around the collapsed Danish Kobenhavn Andelskasse (a/k/a KBH Andelskasse) dominated by Jesper Bak and Wael Almarree was one of the worst payment facilitators for (legal and illegal) gambling and scams between 2016 and 2018.

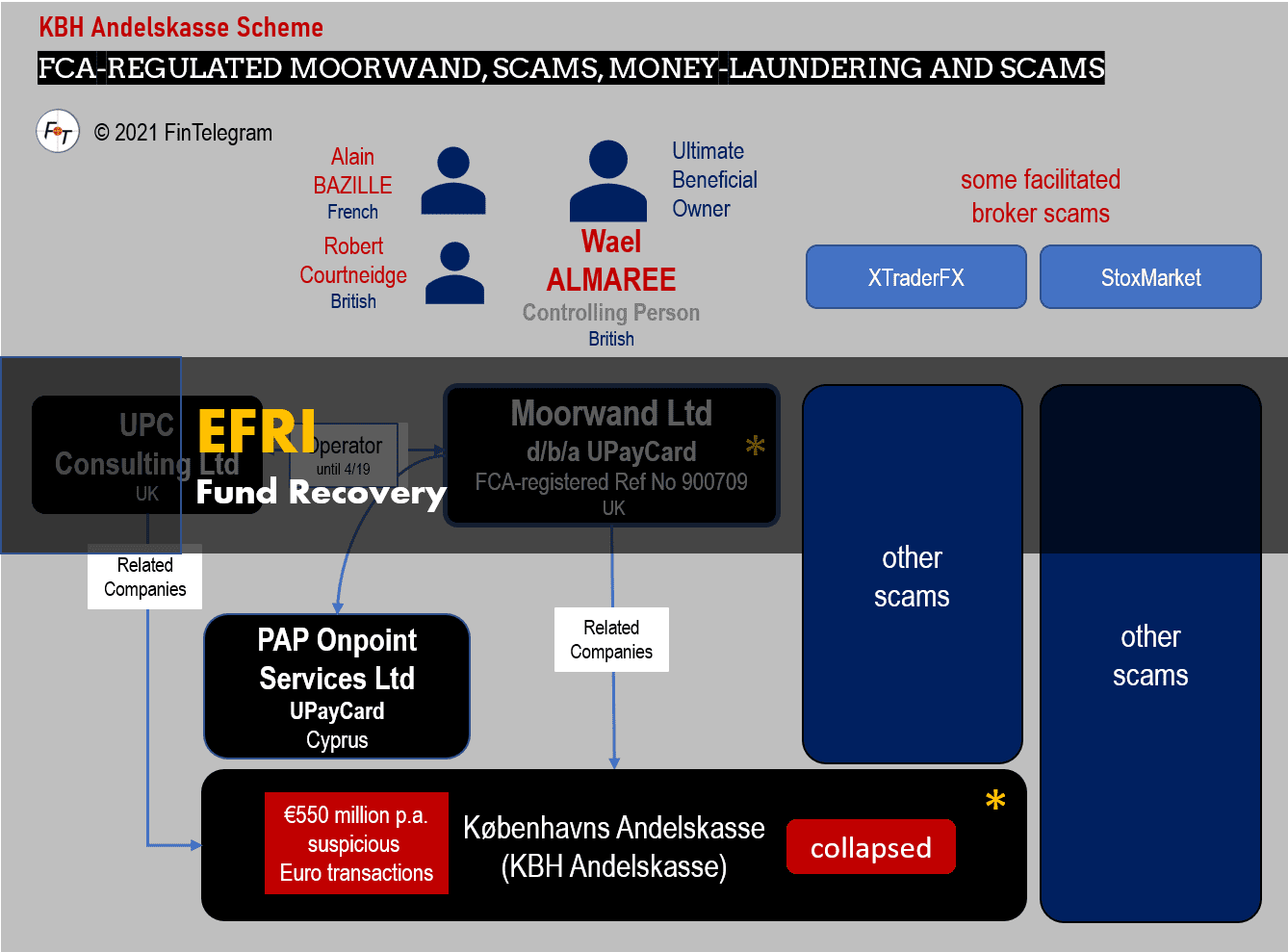

Also involved during this time were Danish FinTech Clearhaus and FCA-regulated Moorwand (formerly UPayCard). The European Fund Recovery Initiative (EFRI) filed the fund recovery claims with the Danish FSA and filed a criminal complaint with the Danish prosecutor’s office.

The hijacked bank

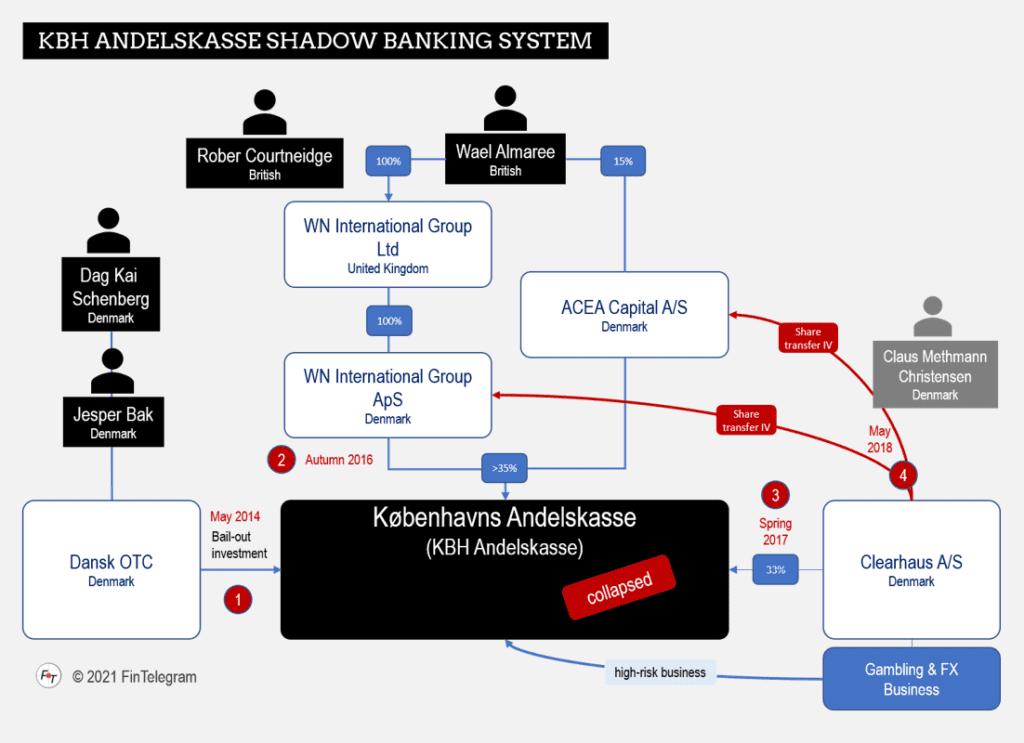

The small Danish cooperative bank Kobenhavn Andelskasse was threatened by insolvency in 2014. Danish investor Jesper Bak and his partner Dag Kai Schenberg rescued the bank through their Dansk OTC. In the process, they also took control of the bank, and Bak was appointed chairman. Now Jesper Bak was perhaps not really “fit and proper” in the definition of financial market laws and regulatory frameworks. He had already been sentenced to prison in 1998 for manipulating the capital market.

Anyway, Bak had to resign as Chairman in April 2016 after an FSA audit apparently did not produce good results. In parallel, the Danish Public Prosecutor’s Office investigated him for another market manipulation case.

Gamblification & Scammification

Jesper Bak was replaced by Moldovian-born British gambling and FinTech investor Wael Almaree. He acquired KHBs shares in the bank in the fall of 2016 through his Danish WN International Group. We do not know the exact amount of the stake. With the entry of Almaree, the bank was apparently repositioned in the direction of high-risk and international customers.

In spring 2017, it was announced that the Danish FinTech Clearhaus had acquired 33% of the shares in Kobenhavn Andelskasse. This company is closely related to Jesper Bak, who brokered a multi-million investment to Clearhaus via his Dansk OTC in September 2015. We do not know whether and what role Bak played in this investment.

According to the available information, Almaree and Clearhaus implemented a sort of gamification and scammification strategy in the bank. Payments from (legal and illegal) gambling ventures, also binary options, and broker scams were happily processed. Many of these high-risk and dark-side payment volumes were acquired through Clearhaus. Some of the new clients and partners like Moorwand, UPC Consulting, and others were conveniently under the economic control of Almaree. The British FinTech expert and Almaree confident Robert Courtneidge was appointed as a director of the bank. Courtneidge was also appointed as a director of FCA-regulated Moorwand, one of KBH Andelskasse‘s largest clients.

Responsibility & Fund Recovery

The European Fund Recovery Initiative (EFRI) has received the Power of Attorney (POA) from numerous victims who made deposits to scams KayaFX, StoxMarkets, Blue Trading, XTraderFX, BrokersOption, 10Markets, and others via KBH Andelskasse.

Meanwhile, the Israeli Gal Barak was sentenced to four years in prison and millions in restitution payments for investment fraud and money laundering in the so-called Vienna Cybercrime Trials. He was with his cybercrime organization operator of scams like XTraderFX. More indictments and convictions are expected. The extensive files of the Vienna Cybercrime Trials show the extent to which Barak laundered stolen money through Moorwand and KBH Andelskasse.

The board members and owners of KBH Andelskasse and its partners are to be considered as co-conspirators and thus responsible for the damages of the scam victims. Thus, they are also liable to pay damages. EFRI is pursuing these claims together with its lawyers in close discussions with the FSA.