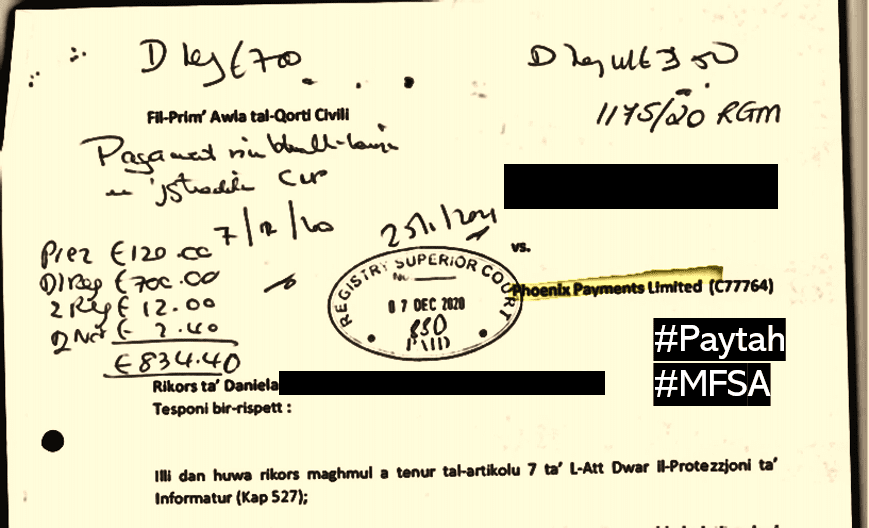

Public court documents obtained by Fintelegram suggest that high-risk payment processor Paytah, operated by Malta-based and MFSA-regulated Phoenix Payments Ltd, was into shabby business. Marco Lavanna, the company’s beneficial owner and director, dismissed the former Money-Laundering Reporting Officer (MLRO) and compliance officer who raised serious issues with the company’s management. The dismissed MLRO has now sued her former employer on the grounds of unfair dismissal and, under oath, reveals the payment processor’s incompliant business approach.

The Paytah Case

Fintelegram has reported about Paytah Case already several times. Reports filed with Phoenix Payments Ltd remained unanswered. The NGO European Fund Recovery Initiative (EFRI) has filed a complaint with the MFSA. Paytah, as a high-risk processor broker, has apparently knowingly and willfully facilitated scams. Many victims of various scams have made their deposits to the scams through Paytah. The payment processor is, therefore, liable to these victims as a co-conspirator. Besides, Paytah must have the scammers’ identity from their AML/KYC audits and thus can (must) assist EFRI and EU law enforcement authorities in apprehending them.

The MFSA, as the competent supervisory authority for Paytah, is obliged to investigate these complaints and take the appropriate measures. Otherwise, the regulator is also liable to the victims. Recent articles have shown the difficult situation and compliance mess at MFSA.

The Maltese Compliance Mess

Public documents filed in Malta courts show that the former Chief Legal and Compliance of Paytah has filed sensitive information with the Financial Intelligence Agency Unit of Malta (FIAU). The Authority’s Director is Kenneth Farrugia (picture left). Moneyval criticized his agency for its failure to take necessary actions against Pilatus Bank. The FIAU has been heavily criticized in Malta for being strong with the weak and weak with the strong. The agency’s Assistant Director Alfred Zammit evidently doesn’t like whistleblowers. He has described a whistleblower as a “terrible manager” during a court testimony of an inquiry about the murdered Maltese journalist, Daphne Caruana Galizia. Other officials of the FIAU, including Kristina Arbociute, made the headlines for the wrong reasons.

Despite these public court documents, to date, both MFSA and FIAU have not published and/or signaled any regulatory action in the Paytah Case. This is indeed telling for a country that is currently under the limelight of Moneyval. Michelle Mizzi Buontempo and Christopher P Buttigieg, former colleagues of disgraced Joe Cushieri, might be too busy to work on the dodgy business of Paytah.

Well, Marco Lavanna of Paytah is still considered fit and proper by MFSA, despite the fact-based revelations about his conduct. The court documents clearly show that MFSA and FIAU have been aware of this unprofessional action in September 2020. Malta has a real issue with its regulatory bodies and supervising agencies, it seems.

Fintelegram will continue to follow the Paytah Case and expose more facts. Stay tuned!