Spread financial intelligence

In our European edition of

FinTelegram News, today

published a further analysis of the results of the KPMG special audit report. It is currently no longer a secret in the Fintech and financial scene that

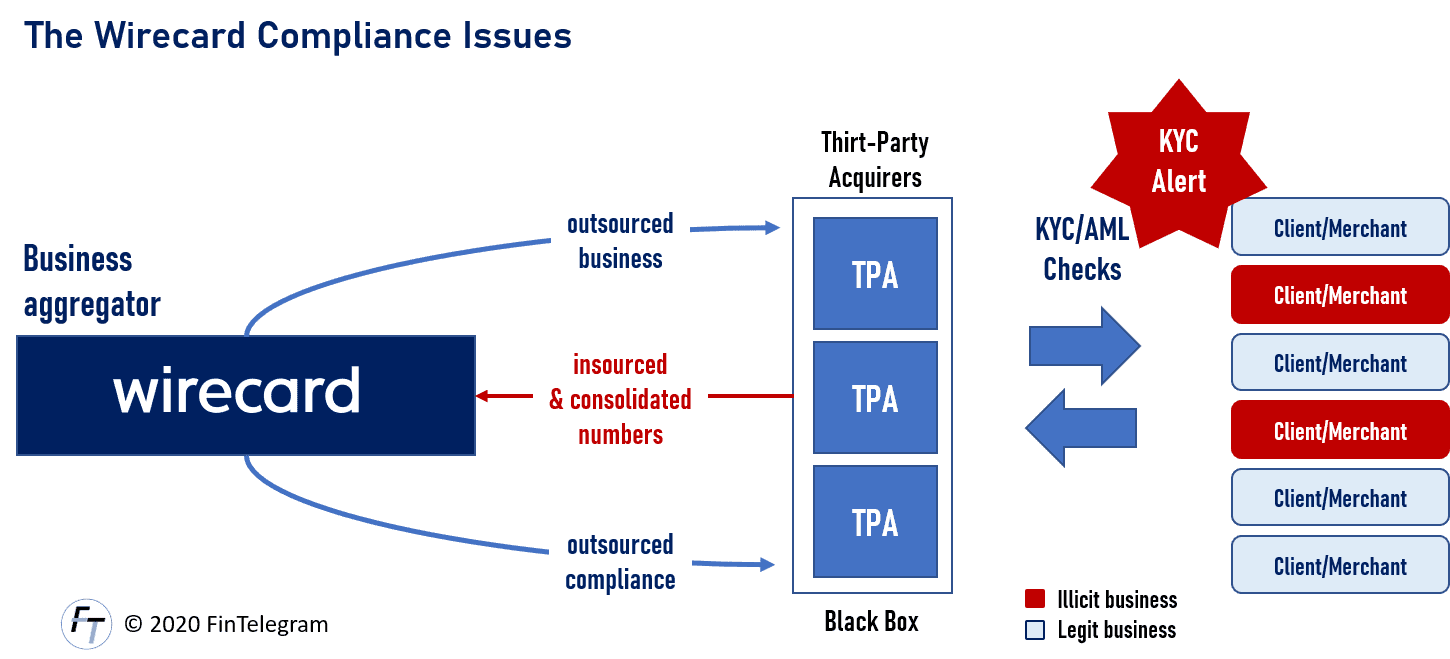

Wirecard, which is listed on the German DAX, has a serious problem with the not even very critical KPMG report. From the point of view of our FinTelegram Research Team as well as from the point of view of the investor protectors of the

European Funds Recovery Initiative (EFRI), it is clear on the basis of the findings of the KPMG report that Wirecard has not properly fulfilled its KYC/AML obligations.

Therefore, it seems logical that

Wirecard is liable for the fraud of its clients or merchants as a vicarious agent. A bank like

Wirecard, which processes payments for illegal and/or fraudulent transactions, is money laundering.

A few weeks ago we already filed a money-laundering complaint against Wirecard with the responsible authorities. For this, we were massively attacked by Wirecard and its aggressive PR machine. The KPMG audit report confirms our own findings and our accusations against Wirecard. In our opinion, Wirecard is liable to the aggrieved retail investors of its fraudulently acting clients for the evidently inappropriately performed or omitted KYC/AML checks. Wirecard is a bank and has to adhere to regulatory rules and financial laws.

Elfriede Sixt, EFRI Principal